Fill Out a Valid Tennessee 183 Form

The Tennessee 183 form, pivotal for various entities looking to gain or renew exemption from franchise and excise taxes, encompasses a detailed array of qualifications across diverse sectors. This comprehensive document, issued by the Tennessee Department of Revenue, delineates specific criteria for an array of organizations, including but not limited to venture capital funds, farming or personal residences, affordable housing projects, obligated member entities, family-owned non-corporate entities, diversified investment funds, asset-backed securitizations, and facilities owned by the armed forces, among others. Each category outlined within the form carries a specific set of requirements, aiming to ensure entities are rightly classified for tax exemptions based on their operational domain, ownership structure, and economic objectives. Crucially, the form also mandates detailed disclosures for certain entities, reinforcing the transparency and accountability expected from organizations benefiting from state tax exemptions. Moreover, entities looking to apply or renew their exemption must keenly observe stipulated deadlines and provide the necessary documentation as proof of their eligibility, underscoring the form's role in the broader oversight and regulation of tax exemptions within Tennessee.

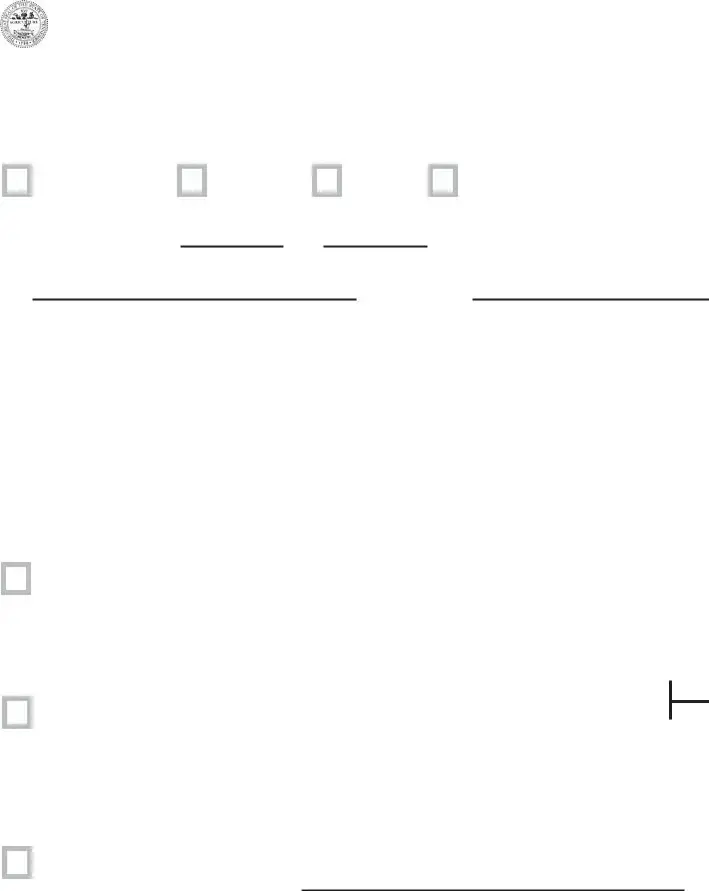

Example - Tennessee 183 Form

TEN N ES S EE D EP AR TMEN T OF R EVEN U E

F r a n c h i s e a n d Ex c is e Ta x

Ap p lic a tio n fo r Ex e m p tio n / An n u a l Ex e m p tio n R e n e w a l

FAE 18 3

Check all that apply: |

|

|

|

|

New Exemption |

Renewal |

Final |

Taxpayer has filed for federal extension |

|

Tax Period Covered: |

Start |

|

End |

|

FEIN:AccountNumber:

Effective Date of Registration with the Secretary of State: |

SOS Control Number: |

|

|

|

||||||||

Legal Name: |

|

|

|

|

|

|

|

|

|

|||

Physical Location (No P.O.Box): |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Street |

|

|

City |

State |

Zip |

|||

Entity Mailing Address: |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Street |

|

|

City |

State |

Zip |

|||

Business Telephone Number: |

Email: |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

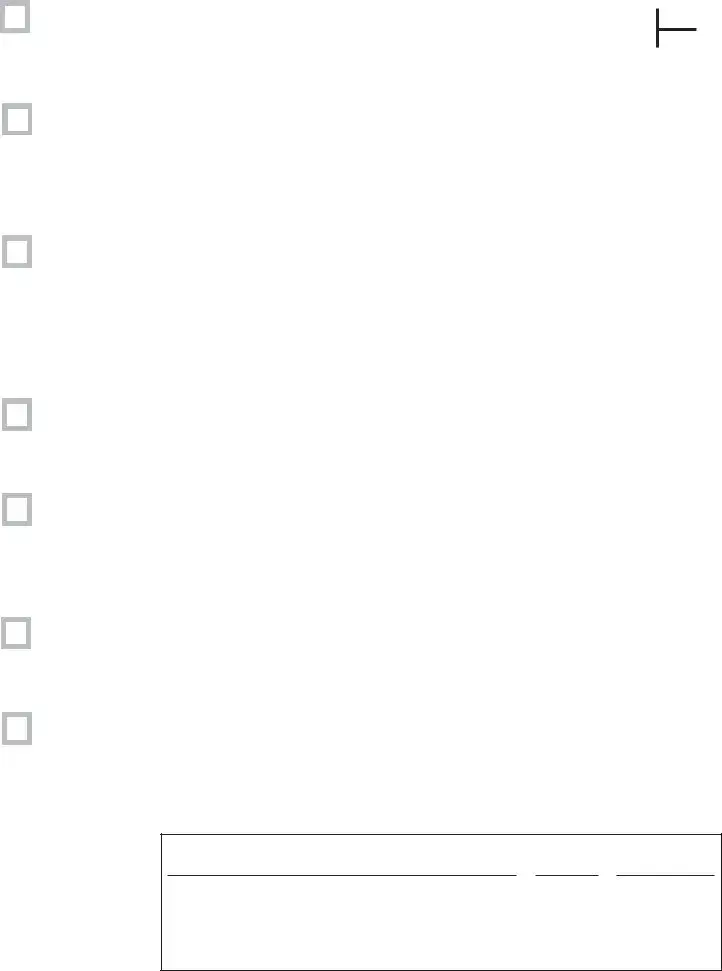

Please check one. All requirements for the selected exemption must be met.

Venture Capital Fund

•Entity is an LLC, LP, LLP, or business trust.

•Entity is operated for the exclusive purpose of buying, holding and/or selling securities, and more than 50% of securities are in

•More than 50% of capital is from investments neither related to nor affiliated with the fund.

Farming/Personal Residence

•Entity is an LLC, LP, or LLP.

•1) At least 66.67% of the activity is in farming and 66.67% of assets are used by the owner or the owner’s lessee for farming; or 2) at least 66.67% of the activity is the holding of one or more personal residences where one or more of the members/partners reside.

•At least 95% of the voting rights, capital interest or profits are owned by natural persons who are relatives or by trusts for their benefit.

•Must complete Disclosure of Activity section.

Affordable Housing

THDA Project Identification Number(s):

•Entity is an LLC or LP.

•Entity was formed exclusively to provide affordable housing.

•Entity has received an allocation of

•Each residential building has an

Obligated Member Entity

•Entity is an LLC, LP, or LLP.

•All members or partners are fully liable for the debts, obligations, and liabilities of the entity.

•Required documentation has been filed with the Tennessee Secretary of State.

•Must attach required documentation that has been filed with the Tennessee Secretary of State.

•Entity is an LLC, LP, or LLP.

•At least 95% of the ownership units of the entity are owned by members of the family or the estate or trust of a deceased individual who,while living,was a member of the family.

•At least 66.67% of the entity’s activity is either 1) the production of passive investment income; or 2) the combination of passive investment income and farming.

•Must complete Disclosure of Activity section.

Diversified Investment Fund

•Entity is an LLC, LP, LLP,or business trust.

•At least 90% of the cost of the entity’s total assets consists of qualifying investment securities, bank deposits, and office space and equipment.

•At least 90% of the entity’s gross income consists of interest, dividends, and gains from the sale or exchange of qualifyinginvestmentsecurities.

•The entity’s primarypurpose is buying, holding, and selling qualified securities on its own behalf and not as a broker.

•Capital is primarily derived from investments byentities or individuals not affiliated with the fund.

•Entity is classified as one of the following: 1) a partnership or trust for federal tax purposes; 2) a REMIC; 3) a FASIT; 4) a business trust; or 5) a trust that is disregarded for federal tax purposes and whose trustee is domiciled outside Tennessee.

•The entity’s sole purpose, except for foreclosures, is the

Security 3rd Party Indebtedness

•Entity is an LLC, LP,LLP or business trust existing on May 1, 1999.

•Entity is at least 98% owned by corporate members of an affiliated group and was formed exclusively to acquire notes from affiliated group members.

•Assets serve as security for

•At least 80% of the entity’s income from assets is included in the income of a corporation doing business in Tennessee and subject to applicable allocation and apportionment rules.

Facilities Owned by the Armed Forces

•Entity is owned, in whole or in part, directly by a branch of the armed forces of the United States.

•Entity derives more than 50% of its gross income from the operation of facilities that are located on property owned or leased by the federal government and operated primarily for the benefit of members of the armed forces of the United States.

Qualified

•Entity owns an interest in or is a lessee of a qualified

•Entity has no business operations or assets other than its investment or lease in the qualified

•Must attach a copy of the approval received under 26 U.S.C. §§ 47 and 45D.

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and complete.

Taxpayer's Signature |

|

|

|

|

|

Date |

|

|

|

Title |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Preparer's Signature |

|

Preparer's PTIN |

|

Date |

|

|

|

Telephone |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's Address |

|

|

|

City |

|

|

|

State |

ZIP Code |

||||

Preparer's Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

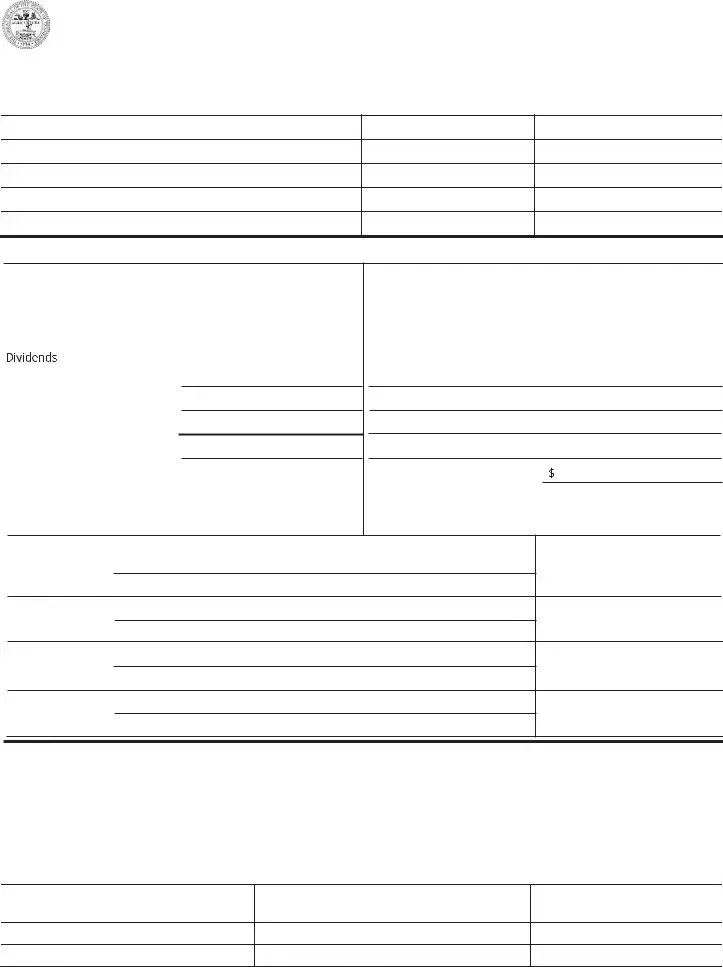

TEN N ES S EE D EP AR TMEN T OF R EVEN U E

F r a n c h i s e a n d Ex c is e Ta x Ex e m p t En tity

D is c lo s u r e o f Ac tivity

Please complete this page if you have indicated that you are applying for or renewing an exemption for a farming/personal residence or a family owned

Organizational Structure

(a) Member/Partner Name |

(b) Ownership Percentage (c) Relationship |

1.

2.

3.

4.

Part I

(a) Passive Investment Income |

|

(b) |

|

|

|||

Source of Income |

Receipts |

Source of Income |

Receipts |

|

|||

|

|

|

Industrial & commercial |

|

|

||

Royalties |

|

|

real estate rental |

|

|

|

|

|

|

|

Other (please describe below): |

|

|

|

|

Annuities

Interest

Gain on sale/exchange of stock

Gain on sale/exchange of securities

Rent from residential property |

|

|

Total |

Rent/income from farming |

|

|

|

Total passive income |

$ |

|

|

Property address:

Property address:

Property address:

Property address:

Part II Farming Activity

County

(a) Type of Income |

(b) Assets at Cost/FMV (see instructions) |

||

|

|

|

|

Farm income |

$ |

Assets used in farming |

$ |

|

|

|

|

Other income |

$ |

Other assets |

$ |

|

|

|

|

Total income |

$ |

Total assets |

$ |

Part III Holding a Personal Residence

(a)Address

(b) Names of Residents

(c)Number of Days Residing at Property

I n s tr u c ti o n s : Ap p lic a tio n fo r Ex e m p tio n

Tenn. Code Ann. §

Each entity is required to make its initial application for exempt status on this form and must also submit a renewal application annually. This annual application is due each year by the 15th day of the fourth month following the end of the

entity’s fiscal year for which the entity is claiming an exemption. The entity should not submit this renewal before the fiscal year end of the exemption year. The Department will not process any early submitted renewals. Any

entity that fails to timely file an application for exemption or renewal may be charged a $200 penalty.

Please mail completed applications and annual renewals to: Tennessee Department of Revenue, 500 Deaderick Street, Nashville, TN 37242. For questions or assistance with this form, please call (615)

Entity Descriptions:

Venture Capital Funds [Tenn. Code Ann. §

Farming/Personal Residence [Tenn. Code Ann. §

Affordable Housing [Tenn. Code Ann. §

Obligated Member [Tenn. Code Ann. §

REMIC or FASIT [Tenn. Code Ann. §

Third Party Indebtedness [Tenn. Code Ann. §

Diversified Investment Fund [Tenn. Code Ann. §

Facilities Owned by the Armed Forces [Tenn. Code Ann. §

Qualified

In s t r u c ti o n s : D is c lo s u re o f Ac ti vi ty

If the entity does not meet the exemption requirements in any given year, it is taxable on all activities for that year. A completed franchise and excise tax return (FAE170) must be filed electronically with payment of any taxes due by the 15th day of the fourth month following the close of the taxable year.

Definitions:

Family Member – To determine who is considered a family member of a

1.Ancestor (mother, grandfather, great grandmother, etc.)

2.Spouse or former spouse

3.Lineal descendent of individual, individual’s spouse or former spouse or individual’s parent (brother, daugh- ter, grandson, niece,

4.Spouse or former spouse of #3 above

5.The estate or trust (testamentary) of a deceased individual who, while living, was one of the above

Relative – To determine who is considered a relative for the farming/personal residence exemption, natural persons shall be considered relatives, if, by blood or adoption, they are descended from a common ancestor and their rela- tionship with each other is that of a first cousin or closer than that of a first cousin, or if they are spouses of one another.

Farming – The growing of crops, nursery products, timber or fibers, such as cotton, for human or animal use or consumption; the keeping of horses, cattle, sheep, goats, chickens or other animals for human or animal use or consumption; the keeping of animals that produce products, such as milk, eggs, wool or hides for human or animal use or consumption; or the leasing of the land to be used for farming.

Filing Requirement:

The following entities must complete the Disclosure of Activity section:

1.FONCEs qualifying for exemption. Complete the Organizational Structure section and Part I.

2.LLCs,LPs, and LLPs qualifying for the farming activity exemption. Complete the Organizational Structure section and Part II.

3.LLCs,LPs, and LLPs qualifying for the holding a personal residence exemption. Complete the Organizational Structure section and Part III.

Organizational Structure:

(a)Provide the full names of all members or partners.

(b)Enter each member’s or partner’s percentage interest in the entity. The total must equal 100%.

(c)Identify the relationship of each partner (e.g., spouse, daughter, etc.). See definition of family member and relative above.

Part I -

Passive Investment Income:

(a)Enter the gross amount received from each source. However, enter the net gain for capital gains on the sale of stock or securities. For a capital loss on the sale of stock or securities, enter $0.

(b)List the source and gross amount of

Note: In order for an entity to qualify for the FONCE exemption: 1) at least 95% of its ownership must be held by members/partners who are family members; and 2) at least 66.67% of its income must be from passive investments and/or farming. If the entity has no income for the year, it meets the passive investment income test.

Part II - Farming Activity:

(a)Enter the amount of gross receipts earned by the entity from farming activities and all other activities. Farm income includes gross receipts derived from the property, including capital gains from the sale of land and other assets.

(b)Enter the original cost of assets owned by the entity. In the event an asset’s original cost cannot be determined, or there is no original cost to the entity, the property should be reported at its fair market value at the time of acquisition by the entity.

Note: In order for an entity to qualify for the Farming Activity exemption: 1) at least 66.67% of its income must be from farming; 2) at least 66.67% of its assets must be used in farming; and 3) at least 95% of the voting rights, capital interest or profits must be owned by family members as defined above.

Part III - Holding a Personal Residence:

(a)Enter the complete address of the property.

(b)If the property listed is residential property, enter the name of the person(s) residing at the property.

(c)Enter the length of time during the year that the person occupied the dwelling.

Note: In order for an entity to qualify for the Holding a Personal Residence exemption: 1) at least 66.67% of its activity must consist of holding one or more personal residences where one or more of the members/partners reside, 2) at least 95% of the voting rights, capital interest or profits must be owned by family members as defined above.

Form Breakdown

| Fact Name | Description | ||

|---|---|---|---|

| Form Purpose | The Tennessee 183 form is utilized for applying for exemption or annual exemption renewal from the Franchise and Excise Tax. | ||

| Relevant Law | Tenn. Code Ann. § 67-4-2008 governs the exemptions from the franchise and excise taxes for which this application form is used. | Publicly Traded Company,"refers to a company registered under or exempt from registration according to specific sections of the Securities Exchange Act of 1934.Definition of "publicly traded company" | The form outlines various exemption categories including venture capital funds, farming/personal residences, affordable housing projects, obligated members, family-owned non-corporate entities, asset-backed securitization, security 3rd party indebtedness, diversified investment funds, facilities owned by the armed forces, and qualified low-income community historic structure owners or lessees. | types of organizations can apply for these exemptions, such as LLCs, LPs, LLPs, and certain trusts or partnerships, depending on the specific exemption category.

| Submission Deadline | Entities must submit their annual exemption renewal by the 15th day of the fourth month following the entity’s fiscal year end. Late submissions can incur a $200 penalty. | ||

| Contact Information | For assistance, entities can contact the Tennessee Department of Revenue at (615) 253-0700 or visit www.tn.gov/revenue. | ||

| Documentation Requirement | Entities must attach relevant documentation, especially for categories like Obligated Member Entities and Affordable Housing projects, which require specific documents filed with the Tennessee Secretary of State or tax credit allocation documentation, respectively. | ||

| Physical Address Requirement | The form specifies that entities must list a physical location for their operation and cannot use a P.O. Box as their physical address. | ||

| Penalty for Late Submission | A $200 penalty is applied to entities that fail to file an application for exemption or renewal in a timely manner. | ||

| Verification Statement | Signatories declare under penalties of perjury that the information provided in the form is, to the best of their knowledge, true, correct, and complete. |

Detailed Instructions for Filling Out Tennessee 183

Filling out the Tennessee 183 form for the Department of Revenue involves a series of steps aimed at applying for or renewing an exemption from franchise and excise taxes. This form is crucial for entities that meet specific requirements outlined for various exemptions. After completing the form, it's necessary to compile any required documentation that supports your application, as this will need to be attached. Remember, the accuracy of this form is paramount, as errors can delay processing or result in penalties. Here’s a step-by-step guide to assist you in filling out the form correctly.

- At the top of the form, check the appropriate box to indicate whether this is a New Exemption, Renewal, or Final. If applicable, also check if the taxpayer has filed for a federal extension.

- Enter the Tax Period Covered, including the Start and End dates.

- Fill in the Entity's Federal Employer Identification Number (FEIN) and your Account Number if known.

- Provide the Effective Date of Registration with the Secretary of State and the SOS Control Number.

- Under Legal Name, enter the full legal name of the entity seeking exemption or renewal.

- For Physical Location, input the street address, city, state, and ZIP code. Remember, P.O. Boxes are not acceptable for this section.

- Provide the Entity Mailing Address if different from the Physical Location, including street, city, state, and ZIP code.

- Enter the Business Telephone Number and Email address for contact purposes.

- From the list provided, please check one box that best describes the exemption category for which you are applying. Be sure that all requirements for the selected exemption are met.

- If applicable, fill in the THDA Project Identification Number(s) under the Affordable Housing section.

- If you are applying for an exemption that requires it, complete the Disclosure of Activity section by providing details on the Organizational Structure, Income Sources, and any Farming or Personal Residence information as relevant.

- At the bottom of the form, the Taxpayer's Signature section must be completed, including the signature of the taxpayer or authorized representative, date, and title. Additionally, the Tax Preparer's Signature section should be completed if prepared by someone other than the taxpayer, including the preparer's PTIN, telephone number, address, and email address.

Upon completion, review the form to ensure all information is accurate and complete. Attach any required documentation to support your exemption application or renewal. Remember, timely submission is important to avoid penalties. Mail the completed form and attachments to the Tennessee Department of Revenue at the address provided on the form. This careful preparation and submission process will ensure your entity's compliance with Tennessee's franchise and excise tax exemption requirements.

More About Tennessee 183

What is the purpose of the Tennessee 183 form?

The Tennessee 183 form is designed for entities seeking exemption from the state’s franchise and excise taxes under specific conditions defined by Tennessee law. It is utilized for both applying for a new exemption and renewing an annual exemption. This form caters to various entities, including venture capital funds, farming or personal residences, affordable housing projects, and more, each with distinct criteria for exemption eligibility.

Who needs to file the Tennessee 183 form?

Entities that believe they qualify for an exemption from Tennessee's franchise and excise taxes based on their activities or structure need to file the Tennessee 183 form. This includes, but is not limited to, venture capital funds, entities engaged in farming or holding personal residences, affordable housing projects, family-owned non-corporate entities, diversified investment funds, and others specified in the form’s instructions. Initial applications, as well as annual renewals for the exemption, are to be filed using this form.

What are the key categories of exemption listed in the Tennessee 183 form?

The form outlines several exemption categories, each with specific requirements:

- Venture Capital Funds

- Farming/Personal Residence

- Affordable Housing

- Obligated Member Entity

- Family-Owned Non-Corporate Entity

- Diversified Investment Fund

- Asset-Backed Securitization (REMIC/FASIT)

- Security 3rd Party Indebtedness

- Facilities Owned by the Armed Forces

- Qualified Low-Income Community Historic Structure Owner or Lessee

When is the Tennessee 183 form due?

Entities must submit the Tennessee 183 form annually by the 15th day of the fourth month following the end of their fiscal year for which they are claiming an exemption. It is important not to submit this renewal before the fiscal year end of the exemption year. Failure to file timely could result in a penalty.

Is there a penalty for failing to timely file the Tennessee 183 form?

Yes, entities that do not file the application for exemption or renewal by the specified deadline may be subject to a $200 penalty. Timely submission is crucial to avoid this charge.

What documents are required to be attached with the Tennessee 183 form?

Depending on the type of exemption being applied for, various documents are required. For example, obligated member entities need to attach documentation filed with the Tennessee Secretary of State. For the affordable housing category, a separate Affordable Housing Certification Form is needed. Each exemption category has its own documentation requirements listed in the form’s instructions.

How can one apply for an exemption using the Tennessee 183 form?

To apply for an exemption, entities must:

- Check the appropriate exemption category or categories on the form.

- Fill out the form with accurate entity details, including legal names, addresses, and specific exemption requirements.

- Attach any required supporting documents for the selected exemption category.

- Sign the form, certifying that the information provided is true, correct, and complete.

- Mail the completed form and attachments to the Tennessee Department of Revenue by the due date.

Where should the Tennessee 183 form be submitted?

The completed Tennessee 183 form, along with any required attachments, should be mailed to the Tennessee Department of Revenue at 500 Deaderick Street, Nashville, TN 37242.

Can an entity apply for multiple exemptions on the same Tennessee 183 form?

Yes, entities can check multiple categories that apply to their situation on a single form. However, they must ensure they meet the requirements for each checked exemption category and provide the necessary documentation for each.

Who can assist with questions regarding the Tennessee 183 form?

For questions or assistance with the Tennessee 183 form, entities can contact the Tennessee Department of Revenue at (615) 253-0700, Monday through Friday, from 8:30 a.m. to 4:30 p.m. CST. Additionally, detailed information and resources can be found on the Tennessee Department of Revenue's official website.

Common mistakes

Filling out the Tennessee 183 form, officially known as the Franchise and Excise Tax Application for Exemption / Annual Exemption Renewal, requires careful attention to detail. Common mistakes can lead to delays or the rejection of the application. Below are eight common errors to avoid to ensure a smoother application process:

- Not checking the appropriate boxes at the top of the form to indicate if the application is for a new exemption, renewal, or final. This simple oversight can lead to confusion and processing delays.

- Incorrectly filling in the Tax Period Covered section. Applicants must ensure the start and end dates are accurately recorded, matching their fiscal year, to avoid discrepancies in their exemption status.

- Failing to provide the correct FEIN (Federal Employer Identification Number) or Account Number. This error can lead to significant delays as it directly ties the application to the entity in the Department of Revenue's records.

- Using a P.O. Box instead of the physical location of the entity. The form explicitly requires a street address to ensure compliance with state regulations.

- Omitting or inaccurately entering the entity's Effective Date of Registration with the Secretary of State and the SOS Control Number. This information is vital for verifying the entity’s legal existence and standing.

- Selecting the wrong exemption type for the entity without meeting all the specified requirements for that exemption. This mistake can result in the rejection of the application because the entity does not qualify for the exemption claimed.

- Not completing the Disclosure of Activity section when applying for exemptions related to Farming/Personal Residence or a Family-Owned Non-Corporate Entity. This oversight can lead to an incomplete application, as this information is crucial for establishing eligibility for these specific exemptions.

- Leaving the taxpayer or tax preparer's signature, title, and date sections at the bottom of the form blank. Unsigned applications are considered incomplete and will not be processed, as these signatures attest to the accuracy of the information provided.

To avoid these common pitfalls, it is crucial to carefully review the application instructions and double-check all entries before submission. Additionally, maintaining updated records and having a clear understanding of the entity’s eligibility for the various exemptions can greatly aid in accurately completing the Tennessee 183 form.

Documents used along the form

When dealing with the Tennessee 183 form, which is crucial for entities seeking franchise and excise tax exemption or annual exemption renewal, several other forms and documents often play integral roles in ensuring a successful application process. These additional forms and documents are designed to complement the information provided on the Tennessee 183 form, offering a comprehensive look at the entity's eligibility and compliance with state regulations.

- Disclosure of Activity Attachment: This document is essential for entities applying for exemptions as a farming/personal residence or a family-owned non-corporate entity. It provides detailed information about the entity's activities, ownership percentages, and income sources, which helps establish eligibility for the exemption.

- Affordable Housing Certification Form: Required for entities applying under the affordable housing category, this form verifies the entity's allocation of low-income housing tax credits and compliance with the extended low-income housing commitment as defined in the IRC §42.

- Secretary of State Documentation: For obligated member entities, appropriate documentation filed with the Tennessee Secretary of State, which waives limited liability protection for its members or partners, must be provided. This serves as proof of the entity's formation and its members' or partners' liability status.

- REMIC/FASIT Documentation: Entities classified under the asset-backed securitization exemption must attach documentation proving their classification as a REMIC, FASIT, partnership, trust, or business trust in accordance with federal regulations.

- Proof of Ownership or Lease: Specifically for qualified low-income community historic structure owner or lessee exemptions, entities must provide a copy of the approval received under 26 U.S.C.§§ 47 and 45D, as well as documentation proving ownership or lease of the property.

- Annual Renewal Application: An annual document required for all entities that have previously been granted an exemption. It ensures the continuous review of the entity’s eligibility status and compliance with the specific requirements of their exemption category.

- Third-Party Indebtedness Proof: Entities claiming exemption based on third-party indebtedness need to document that their assets directly or indirectly serve as security for such borrowings. This often includes contracts or agreements that detail the indebtedness structure and the affiliations between parties.

Together, these documents play a critical role in the exemption application process by providing the Tennessee Department of Revenue with the necessary information to assess an entity's eligibility for exemption under specific categories. It's important for applicants to carefully review and prepare these supporting documents to ensure a smooth and efficient review process.

Similar forms

The Tennessee 183 form is akin to federal and state tax exemption applications for nonprofit organizations. Much like the application process nonprofits undergo to gain exemption status under IRS Section 501(c)(3), the Tennessee 183 form allows entities to apply for or renew an exemption from Tennessee's franchise and excise taxes. Both processes require detailed information about the organization's structure, activities, and financials to determine eligibility for tax-exempt status.

Similar to the Uniform Commercial Code (UCC-1) financing statement, the Tennessee 183 form contains information on the entity's legal name, addresses, and the nature of its business. Both documents are integral in defining the relationship between business entities and their financial activities, although the UCC-1 primarily focuses on securing interest in a borrower's collateral.

The document shares common ground with state-issued business licenses and permits applications. These documents are critical for entities to legally operate within a state and outline the nature of the business, ownership details, and operating addresses. While business licenses grant permission to operate, the Tennessee 183 form offers a path to tax exemption based on the entity's specific activities and structure.

It is reminiscent of the Real Estate Mortgage Investment Conduit (REMIC) election form, specifically for entities looking to be treated as a REMIC for federal income tax purposes. Both documents target entities involved with securities and investments, though the Tennessee 183 form is broader, catering to various entities seeking tax exemptions for different reasons.

The form has parallels with Disclosure of Activity statements required by certain financial institutions. These documents detail an entity’s investment activities and asset holdings, essential for regulatory compliance and tax exemption qualification, emphasizing transparency in operations.

Resembling Annual Report filings for corporations, the Tennessee 183 necessitates regular updates through renewal applications. Both document types require entities to report changes in their business structure, activities, and financial status, ensuring ongoing compliance with state regulations.

Like the documentation for forming an LLC or Corporation, this form captures structural and operational details essential for legal and tax purposes. Filing the form, much like filing Articles of Organization or Incorporation, is a foundational step in defining the entity’s legal and operational framework.

It bears similarity to the Low-Income Housing Tax Credit (LIHTC) application, which is specific to entities seeking tax credits for developing affordable housing. Both forms require detailed project information and emphasize the entity’s purpose and activities, catering to specific eligibility criteria for tax benefits.

Comparable to farm tax exemption certificates, the Tennessee 183 form accommodates entities engaged in farming activities seeking tax relief. Both require proof of the entity’s primary activities and asset use to qualify for beneficial tax treatment.

Aligned with applications for Obligated Member Entity (OME) status, it requires detailed ownership and structural information to qualify for specific tax exemptions. Each form serves to limit or exempt entities from certain tax liabilities based on their operational and ownership structure.

It shares characteristics with historic preservation tax credit applications, especially for entities owning or leasing historical structures. Both necessitate in-depth information about the property and the entity’s involvement, aiming to incentivize preservation activities through tax benefits.

Dos and Don'ts

When completing the Tennessee 183 form, it's crucial to provide accurate and comprehensive information to ensure your application or renewal for an exemption is processed efficiently. Here are some guidelines to assist you:

Do:- Check all boxes that apply at the top of the form to clarify whether you are applying for a new exemption, renewing an existing one, or filing a final return.

- Provide the exact legal name of your entity as registered. Misinformation can lead to processing delays.

- Include the physical location of your entity. Remember, P.O. Boxes are not acceptable for this field.

- Clearly state the entity’s type and ensure it aligns with the exemption category under which you are applying or renewing.

- For entities requiring it, attach all necessary documentation such as those filed with the Tennessee Secretary of State or specific financial documents supporting your exemption category.

- Avoid leaving the Tax Period Covered section blank. You must specify the start and end dates of the period for which you're requesting exemption.

- Do not submit your application without checking the accuracy of your FEIN and Account Number. Errors in these fields could result in your form being rejected.

- Do not forget to select the correct exemption your entity is applying for based on the detailed descriptions provided in the instructions. Incorrect selection may cause unnecessary delays.

- Avoid signing the document without reviewing all the information for accuracy and completeness. Incomplete forms or those with errors can be denied.

Misconceptions

Misunderstandings about forms, especially tax-related ones, can lead to missteps or missed opportunities. The Tennessee 183 form, associated with exemptions from the franchise and excise tax, is no exception. Clearing up common misconceptions about this document can help ensure it's used effectively.

It's Only for New Entities: Many believe the Tennessee 183 form is solely for businesses recently established. However, this form caters to both new and existing entities - it facilitates not just the application for new exemptions but also the renewal of existing ones. This ensures all qualifying entities can take advantage of the exemptions, regardless of how long they have been in operation.

For Farming and Personal Residence Only: While the form includes sections for farming and personal residences, its scope is significantly broader. It encompasses a range of entities like Venture Capital Funds, Affordable Housing projects, Obligated Member Entities, and more. Understanding the variety of exemptions covered can help a broader group of entities recognize opportunities for tax relief.

Ownership Structure Doesn’t Matter: Another common misconception is that the entity's ownership structure doesn’t impact exemption eligibility. In reality, specific requirements around ownership percentages, types of owners (e.g., natural persons, family members), and the nature of investment income are critical for eligibility under certain exemptions. Detailed attention to these requirements is crucial.

No Documentation is Needed Beyond the Application: Simply submitting the Tennessee 183 form isn't always enough. Depending on the exemption sought, additional documentation – such as detailed disclosures of activity, proof of investment, or ownership verifications – may be required. For some categories, like the Obligated Member Entity, documentation filed with the Tennessee Secretary of State or documentation of federal tax credits is mandatory.

Dispelling these misconceptions about the Tennessee 183 form helps ensure eligible entities correctly apply for and maximize potential exemptions. Accurate information and adherence to the form’s requirements can make a significant difference in navigating the landscape of franchise and excise tax obligations in Tennessee.

Key takeaways

Filling out the Tennessee 183 form correctly is essential for organizations seeking exemption from the state’s Franchise and Excise Taxes. Here are seven key takeaways to guide you through the process:

- Identify the type of exemption your entity is applying for whether it is a new exemption, a renewal, or a final exemption application. Different exemptions have specific requirements and documentation.

- Ensure accurate completion of all sections relevant to your entity’s exemption category. For example, Venture Capital Funds, Farming/Personal Residence, Affordable Housing, etc., each have unique criteria that must be met.

- Provide the exact legal name, physical location, business contact information, and the effective date of registration with the Secretary of State to avoid any processing delays.

- If your organization falls under specific categories like Farming/Personal Residence or a Family-Owned Non-Corporate Entity, remember to complete the Disclosure of Activity section with detailed information about your operations.

- Attach all required documentation, such as proof of your entity's qualification under the selected exemption category, any filings with the Tennessee Secretary of State, and other pertinent supporting documents.

- Submit the application by the due date, which is the 15th day of the fourth month following the end of your entity’s fiscal year for which the exemption is claimed. Timely submission is crucial to avoid penalties.

- For exemptions that require renewal, don’t submit the renewal application before the end of the fiscal year for which the exemption is sought. The Tennessee Department of Revenue will not process renewals submitted early.

By paying close attention to these key points, entities can navigate the exemption application process more smoothly, ensuring compliance with Tennessee’s tax exemption laws and regulations. Accuracy, completeness, and timeliness are the primary factors that will help in the successful processing of your application.

Popular PDF Forms

Tennessee Tax Exempt Form for Non-profit Organizations - Includes penalties and interest section for late or incorrect tax filings, with instructions for calculating amounts owed.

How to Become a Teacher in Tn - Intended to streamline the licensure advancement process by compiling pivotal, out-of-system teaching experiences.