Fill Out a Valid Tennessee Articles Organization Form

When forming a Limited Liability Company (LLC) in Tennessee, completing the Articles of Organization is a critical step that founders must undertake with precision and a thorough understanding of the requirements. The State of Tennessee provides various avenues for filing, including e-file, print and mail, paper submission, and walk-in options, catering to the diverse needs of applicants. This formality not only demands accuracy and completeness but also an adherence to specific guidelines, such as the inclusion of the LLC's name that meets state legislative criteria and the appointment of a registered agent with a physical address within the state. Entities have the discretion to select their LLC's management structure, fiscal year close, and, if necessary, apply for additional designations such as non-profit or professional LLCs. Furthermore, the option for a delayed effective date allows entities to time their establishment precisely. Applicable filing fees are determined by the number of members the LLC has at the time of filing, ensuring that the cost of filing is proportional to the size of the entity. Rigorous adherence to these stipulations ensures smooth processing and establishes a firm legal foundation for the newly formed LLC.

Example - Tennessee Articles Organization Form

Business Services Division

Tre Hargett, Secretary of State

State of Tennessee

INSTRUCTIONS

ARTICLES OF ORGANIZATION

LIMITED LIABILITY COMPANY

LLC articles of organization may be filed using one of the following methods:

•

•Print and Mail: Go to http://tnbear.tn.gov/NewBiz. Use the online tool to complete the application. Print and mail the application along with the required filing fee to the Secretary of State’s office at 6th FL – Snodgrass Tower ATTN: Corporate Filing, 312 Rosa L. Parks AVE, Nashville, TN 37243.

•Paper submission: A blank application may be obtained by going to https://sos.tn.gov/sites/default/files/forms/ss- 4270.pdf, by emailing the Secretary of State at Business.Services@tn.gov, or by calling (615)

•

LLC Articles of Organization must be accurately completed in their entirety. Forms that are inaccurate, incomplete or illegible will be rejected.

Limited Liability Company Articles of Organization set forth the items required under T.C.A. §

ARTICLES OF ORGANIZATION

1.The name of the Limited Liability Company is – Enter the proposed name of the Limited Liability Company. The name of a new LLC must meet the requirements of T.C.A. §

2.Name Consent: (Written Consent for Use of Indistinguishable Name) – An applicant LLC can request to use a name that is not distinguishable from the name used by an existing business under certain circumstances detailed in T.C.A. §

3.This company has the additional designation of – If applicable to the specific nature of the LLC, enter any additional designation, including:

Page 1 of 3

•Bank

•Captive Insurance Company

•Insurance Company

•Litigation Financier

•

•Professional Limited Liability Company

•Series LLC

•Trust Company

If the LLC’s name contains the word “bank”, “banks”, “banking”, “credit union” or “trust”, written approval must first be obtained from the Tennessee Department of Financial Institutions before documents can be accepted for filing with the Division of Business Services. You may contact the Tennessee Department of Financial Institutions as (615)

If the LLC’s name contains the phrase “insurance company”, written approval must first be obtained from the Tennessee Department of Commerce & Insurance before documents can be accepted for filing with the Division of Business Services. You may reach the Tennessee Department of Commerce & Insurance at (615)

4.The name and complete address of the Limited Liability Company’s initial registered agent and office located in the state of Tennessee is – Enter the name of the LLC’s initial registered agent, the street address, city, state and zip code of the LLC’s initial registered office located in Tennessee and the county in which the office is located. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services. A post office box is not acceptable for the registered agent/office address.

5.Fiscal Year Close Month – Enter the month of the year that concludes the LLC’s fiscal year. If a fiscal year close month is not indicated, the Division of Business Services will list the fiscal year close month as December by default. Please note that T.C.A. §

6.If the document is not to be effective upon filing by the Secretary of State, the delayed effective date and time is – If the existence of the LLC is to begin upon a future date, enter the future date. In no event can the future date or the actual occurrence of the specific event be more than ninety calendar days from the filing of the articles of organization.

7.The Limited Liability Company will be – Indicate whether the LLC will be Member Managed, Manager Managed or Director Managed by checking the appropriate box.

8.Number of Members at the date of filing – Enter the number of members of the LLC at the date of filing. If the number of members is not indicated, the Division of Business Services will list the number of members as one (1) by default.

9.Period of Duration if not perpetual – Indicate if the duration of the LLC is perpetual or has a specific end date by checking the appropriate box. If “other” is checked, indicate the specific date on which the duration of the LLC’s existence will end.

10.The complete address of the Limited Liability Company’s principal executive office is – Enter the street address, city, state and zip code of the principal executive office of the LLC and the county in which the office is located. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services unless a deliverable mailing address is also provided. A post office box address is not acceptable for the principal office address. Please provide a business email address. All reminders and notifications will be sent via email.

11.The complete mailing address of the entity (if different from the principal office) is – If notifications from the Division of Business Services should be sent to an address other than the principal office address, enter that address. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services. A post office box address is acceptable for a mailing address.

Page 2 of 3

12.

13.Professional LLC (required only if the Additional Designation of “Professional LLC” is entered in section 3) – If “Professional Limited Liability Company” is indicated in section 3 of the articles of organization, check the box certifying that the statement in this section is true. Indicate the licensed profession in the space provided.

14.Series LLC (required only if the Additional Designation of “Series LLC” is entered in section 3.) – If “Series LLC” is indicated in section 3 of the articles of organization, check the box certifying that the statement in this section is true.

15.Obligated Member Entity (list of obligated members and signatures must be attached) – If the LLC elects to be registered as an Obligated Member Entity pursuant to T.C.A. §

If the box indicating registration as an Obligated Member Entity is checked, the articles of organization must be accompanied by a duly executed Obligated member Entity Addendum (Form

16.This entity is prohibited from doing business in Tennessee – Check the box if the LLC, while being formed under Tennessee law, is prohibited from engaging in business in Tennessee.

17.Other Provisions – Including any further information in this space is strictly optional. Use this section to set forth other details of the LLC that are not required to be included in the articles of organization. Such items could include the names of the LLC members, the purpose of the LLC, the names of the LLC management, and provisions regulating the affairs of the LLC. If the form does not allow enough space, enter “see attached” and include the desired details in an attachment.

Signature

•The person executing the document must sign it and indicate the date of signature in the appropriate spaces.

Failure to sign and date the application will result in the application being rejected.

•Type or Print Name. Failure to type or print the signature name and title of the signer will result in the application being rejected.

•Type or Print Signer’s Capacity. If other than the person’s individual capacity, the signer must indicate the capacity in which such person signs. Failure to indicate the signer’s capacity will result in the application being rejected.

FILING FEE

•The filing fee for articles of organization is $50.00 per member in existence on the date of the filing, with a minimum fee of $300.00 and a maximum fee of $3,000.00. If its articles of organization prohibit the LLC from doing business in Tennessee, the filing fee is $300.00, regardless of the number of members in existence on the date of the filing.

•Make check, cashier’s check or money order payable to the Tennessee Secretary of State. Cash is only accepted for

Page 3 of 3

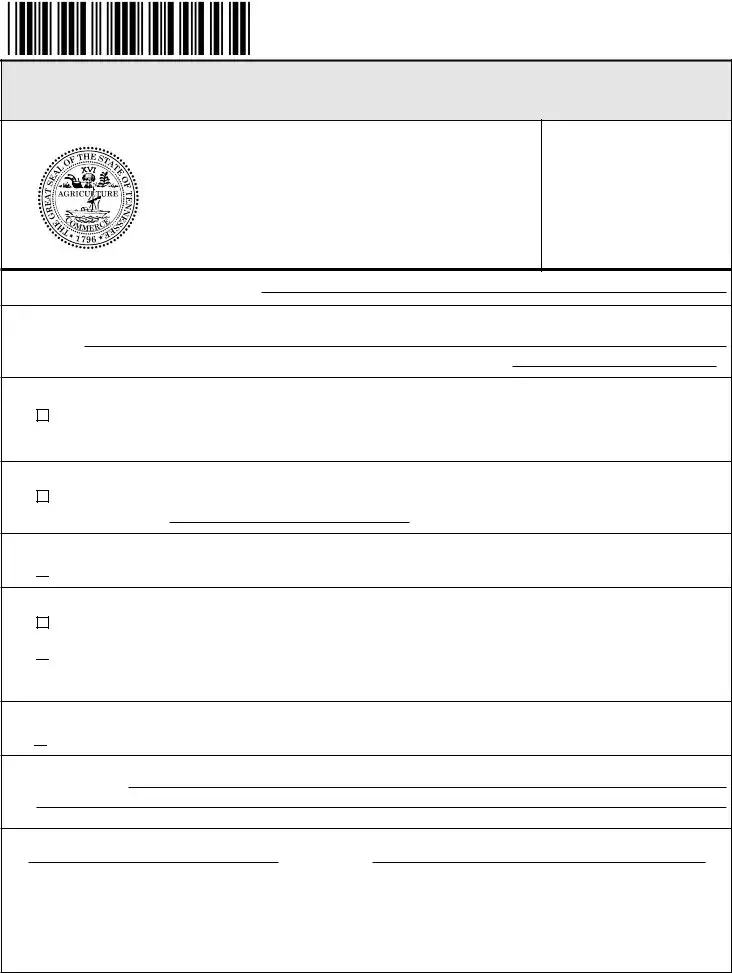

ARTICLES OF ORGANIZATION |

|

LIMITED LIABILITY COMPANY |

Page 1 of 2 |

BUSINESS SERVICES DIVISION

Tre Hargett, Secretary of State

State of Tennessee

312 ROSA L. PARKS AVE, 6TH FL.

NASHVILLE, TN

(615)

Filing Fee: $50.00 per member

(minimum fee = $300, maximum fee = $3,000)

For Office Use Only

The Articles of Organization presented herein are adopted in accordance with the provisions of the Tennessee Revised Limited Liability Company Act.

1.The name of the Limited Liability Company is:

(NOTE: Pursuant to the provisions of T.C.A. §

2.Name Consent: (Written Consent for Use of Indistinguishable Name)

This entity name already exists in Tennessee and has received name consent from the existing entity.

3.This company has the additional designation of:

4.The name and complete address of ithe Limited Liability Company’s initial registered agent and office located in the state of

Tennessee is:

Name:

Address:

City: |

|

State: |

|

Zip Code: |

|

County: |

5.Fiscal Year Close Month:

6.If the document is not to be effective upon filing by the Secretary of State, the delayed effective date and time is: (Not to exceed 90 days)

Effective Date: |

|

/ |

|

/ |

|

|

Time: |

|

Month |

|

Day |

Year |

|||

7. The Limited Liability Company will be:

Member Managed

Manager Managed

Director Managed

8. Number of Members at the date of filing:

9. Period of Duration:

Perpetual

Other / /

Month Day Year

10.The complete address of the Limited Liability Company’s principal executive office is:

Address:

City: |

|

State: |

|

Zip Code: |

|

County: |

Business Email:

Rev. 12/19 |

RDA 2458 |

ARTICLES OF ORGANIZATION |

|

LIMITED LIABILITY COMPANY |

Page 2 of 2 |

BUSINESS SERVICES DIVISION

Tre Hargett, Secretary of State

State of Tennessee

312 ROSA L. PARKS AVE, 6TH FL.

NASHVILLE, TN

(615)

Filing Fee: $50.00 per member

(minimum fee = $300, maximum fee = $3,000)

For Office Use Only

The name of the Limited Liability Company is:

11. The complete mailing address of the entity (If different from the principal office) is:

Address:

City: |

|

State: |

|

Zip Code: |

12.

I certify that this entity is a

13. Professional LLC (required only if the Additional Designation of “Professional LLC” is entered in section 3.)

I certify that this PLLC has one or more qualified persons as members and no disqualified persons as members or holders.

Licensed Profession:

14.Series LLC (required only if the Additional Designation of “Series LLC” is entered in section 3.)

I certify that this entity meets the requirements of T.C.A. §

I certify that this entity meets the requirements of T.C.A. §

15.Obligated Member Entity (list of obligated members and signatures must be attached)

This entity will be registered as an Obligated Member Entity (OME) |

Effective Date: |

/ |

/ |

|||

|

|

Month |

|

Day |

|

Year |

I understand that by statute: THE EXECUTION AND FILING OF THIS DOCUMENT WILL CAUSE THE MEMBER(S) TO BE PERSONALLY LIABLE FOR THE DEBTS, OBLIGATIONS AND LIABILITIES OF THE LIMITED LIABILITY COMPANY TO THE SAME EXTENT AS A GENERAL PARTNER OF A GENERAL PARTNERSHIP. CONSULT AN ATTORNEY.

I understand that by statute: THE EXECUTION AND FILING OF THIS DOCUMENT WILL CAUSE THE MEMBER(S) TO BE PERSONALLY LIABLE FOR THE DEBTS, OBLIGATIONS AND LIABILITIES OF THE LIMITED LIABILITY COMPANY TO THE SAME EXTENT AS A GENERAL PARTNER OF A GENERAL PARTNERSHIP. CONSULT AN ATTORNEY.

16. This entity is prohibited from doing business in Tennessee:

This entity, while being formed under Tennessee law, is prohibited from engaging in business in Tennessee.

This entity, while being formed under Tennessee law, is prohibited from engaging in business in Tennessee.

17. Other Provisions:

Signature Date |

|

Signature |

|

|

|

Signer’s Capacity (if other than individual capacity) |

|

Name (printed or typed) |

Rev. 12/19 |

RDA 2458 |

Form Breakdown

| Fact Name | Description |

|---|---|

| Filing Methods | LLC Articles of Organization in Tennessee can be submitted online, via mail, or in person. |

| Online Submission Convenience Fee | Submitting the Articles of Organization online requires payment of a convenience fee in addition to the filing fee. |

| Governing Law for LLC Names | Tennessee law (T.C.A. § 48-249-106) outlines specific requirements and restrictions for LLC names, including uniqueness and allowable designations. |

| Registered Agent Requirements | The LLC must designate a registered agent with a physical address in Tennessee, and PO Boxes are not acceptable. |

| Fiscal Year Close | The close of the fiscal year for the LLC defaults to December if not otherwise specified, with specific filing deadlines set by T.C.A. § 48-249-1017. |

| Management Structure Options | The Article of Organization allows for the LLC to be Member Managed, Manager Managed, or Director Managed. |

| Filing Fee Structure | The filing fee is based on the number of members at the time of filing, with a minimum of $300 and a maximum of $3,000. A flat fee applies if the LLC is not allowed to do business in Tennessee. |

Detailed Instructions for Filling Out Tennessee Articles Organization

Once the decision to establish a Limited Liability Company (LLC) in Tennessee is made, completing the Articles of Organization is a critical step that sets the legal foundation of your business. Understanding and carefully compiling this document is vital for compliance with state requirements. Here’s a simplified step-by-step guide to help you navigate through the Tennessee Articles of Organization form efficiently and accurately.

- Name of the Limited Liability Company: Start by entering the chosen name for your LLC, ensuring it complies with Tennessee’s naming requirements.

- Name Consent: If seeking to use a name similar to an existing entity’s, check the appropriate box and include the required application and fee for using an indistinguishable name.

- Additional Designation: Specify if your LLC falls under a specific category (e.g., Non-profit LLC, Professional LLC) and ensure compliance with any additional requirements.

- Initial Registered Agent and Office: Enter the full name and Tennessee street address of your LLC’s registered agent. A P.O. Box is not acceptable for this address.

- Fiscal Year Close Month: Indicate which month your fiscal year ends. If not specified, December will be assumed as the default.

- Delayed Effective Date: If you want your LLC’s existence to begin on a date later than the filing date, specify this future date, not exceeding 90 days from filing.

- Management Structure: Indicate whether your LLC will be Member Managed, Manager Managed, or Director Managed.

- Number of Members: Enter the number of members your LLC has at the time of filing.

- Period of Duration: Specify if your LLC’s existence will be perpetual or if it has a specific end date.

- Principal Executive Office Address: Provide the street address of your LLC’s main executive office, not a P.O. Box. Include a business email address for official communications.

- Mailing Address: If different from the principal office address, provide an address where mail should be sent. A P.O. Box is acceptable here.

- Non-Profit LLC: Required if you indicated “Non-profit LLC” earlier. Check the box to certify compliance with relevant statutes.

- Professional LLC: Indicate if your LLC provides professional services and is in compliance with licensing requirements.

- Series LLC: If applicable, certify that your LLC meets the specific criteria for a Series LLC.

- Obligated Member Entity: For LLCs choosing this designation, acknowledge personal liability and attach required documentation.

- Prohibition of Business in Tennessee: Check if your LLC, while Tennessee-formed, will not conduct business in the state.

- Other Provisions: Include additional details about your LLC not covered elsewhere on the form. Attach extra pages if needed.

- Signature: The document must be signed and dated by the person completing the form, indicating their capacity if not signing as an individual.

After accurately completing the form, ensure the filing fee, calculated based on the number of members (with a minimum of $300 and a maximum of $3,000), is included with your submission. For those opting to mail the form, it's essential to ensure all information is legible and conforming to the guidelines to avoid rejection. Once filed and approved, your LLC will be officially recognized in Tennessee, paving the way for your business endeavors in the state.

More About Tennessee Articles Organization

What are the methods to file the Tennessee Articles of Organization for an LLC?

The Tennessee Articles of Organization for an LLC can be filed through four different methods:

- E-file: This method involves completing the application online and paying the filing fee with a credit or debit card. Note, there is a convenience fee for this service.

- Print and Mail: Users can complete the application online, print it, and then mail it along with the required filing fee to the Secretary of State's office.

- Paper submission: A blank application form can be downloaded, completed by hand or on a computer, and mailed with the filing fee to the Secretary of State's office.

- Walk-in: Applicants can obtain a blank application form in person at the Secretary of State Business Services Division and submit it along with the filing fee.

What are the requirements for the name of a new LLC in Tennessee?

The name of a new LLC in Tennessee must include the words "Limited Liability Company" or the abbreviations "LLC" or "L.L.C." and meet other requirements under T.C.A. § 48-249-106. If an LLC wishes to use a name that is not distinguishable from an existing business, it must obtain written consent and pay an additional fee.

How is the registered agent and office address for an LLC determined in Tennessee?

The registered agent and office address must be a physical address in Tennessee where the LLC's initial registered agent is located. This address cannot be a P.O. Box and must be capable of receiving direct mail. The address is subject to verification and must meet the United States Postal Service address deliverability guidelines.

What is the significance of the fiscal year close month in the Articles of Organization?

The fiscal year close month indicates the end of the LLC's financial year. If not specified, the default is December. It's important for annual reporting purposes as LLCs are required to file a report with the Secretary of State by the first day of the fourth month following the fiscal year end.

Can an LLC in Tennessee have a specified duration?

Yes, an LLC can have a specified duration other than perpetual by indicating a specific end date in the Articles of Organization. This could be relevant for project-specific LLCs or other limited duration ventures.

What are the filing fees associated with the Tennessee Articles of Organization?

The filing fee for the Articles of Organization in Tennessee is $50.00 per member on the date of filing, with a minimum fee of $300.00 and a maximum fee of $3,000.00. For LLCs that do not engage in business in Tennessee, the filing fee is set at $300.00 regardless of the member count. Payments should be made payable to the Tennessee Secretary of State.

Common mistakes

When filling out the Tennessee Articles of Organization form, many individuals seek to establish their Limited Liability Company (LLC) without fully understanding the common pitfalls that can lead to their application being rejected or delayed. To assist individuals in this process, it is crucial to highlight six frequent mistakes made during this important step.

- Incorrect or Incomplete LLC Name: The most fundamental requirement is entering the proposed name of the Limited Liability Company correctly. This name must comply with T.C.A. § 48-249-106, including the mandatory inclusion of "Limited Liability Company," "LLC," or "L.L.C." It is a common oversight to neglect these specifics or to propose a name that is too similar to an existing business name without obtaining the necessary written consent.

- Registered Agent and Office Address Errors: An LLC's initial registered agent and office must have a complete street address located in Tennessee, which is also deliverable by the United States Postal Service. A frequent mistake is providing a post office box instead of a physical address, which leads to the application being rejected.

- Fiscal Year Close Month Assumptions: Another typical error is leaving the fiscal year close month blank, leading to the default setting of December by the Division of Business Services. This assumption may not always align with the LLC's actual operations or preferences.

- Effective Date Issues: If specifying a future date for the LLC to become effective, it's essential to remember that this date cannot exceed ninety calendar days from the filing. Incorrectly setting this timeframe is a common slip-up.

- Misunderstanding Member Management Structure: Indicating whether the LLC will be Member Managed, Manager Managed, or Director Managed is a critical decision that is often made without proper consideration. This misunderstanding can lead to complications in the LLC's governance structure.

- Insufficient Detail in Other Provisions: Some applicants fail to use the "Other Provisions" section to its full potential, neglecting to include beneficial details about the LLC's purpose, management, or regulations. While optional, this information can be instrumental in clarifying the LLC's operations and intentions.

Awareness and attentiveness to these common mistakes can greatly enhance the process of establishing an LLC in Tennessee. By carefully reviewing each section of the form and adhering to the detailed instructions provided, applicants can avoid these pitfalls. Ensuring accuracy in the completion of the Tennessee Articles of Organization form is a crucial step towards a successful establishment and operation of an LLC.

Documents used along the form

Creating a Limited Liability Company (LLC) in Tennessee requires an understanding of the documents and forms essential to the formation and operation of the business beyond merely the Articles of Organization form. Each document serves a unique purpose, ranging from establishing the company’s legal structure to ensuring compliance with state regulations. This list elucidates additional documents typically used in conjunction with the Tennessee Articles of Organization form to give business owners a comprehensive overview of what to prepare for.

- Operating Agreement: Although not submitted to the state, this internal document outlines the LLC's ownership, operations, and member roles. It's crucial for defining the financial and working relationships among business owners.

- Employer Identification Number (EIN) Application: Businesses must obtain an EIN from the IRS for tax purposes. This number is essential for hiring employees, opening business bank accounts, and filing taxes.

- Business License Application: Depending on the type of business and its location, various local and state licenses may be required to legally operate in Tennessee.

- Annual Report: Tennessee LLCs must file an annual report with the Secretary of State to maintain good standing. This report updates the state on the company’s current contact information and business structure.

- Amendment to the Articles of Organization: If any of the initial information provided in the Articles of Organization changes, such as the business address or member structure, an amendment form must be filed with the state.

- Name Reservation Application: Before filing the Articles of Organization, a business can reserve its name for a period to ensure its availability.

- Registered Agent Consent Form: Since a registered agent must be named in the Articles of Organization, this form documents the agent's consent to act on behalf of the LLC.

- Foreign LLC Application: For businesses originally established in another state but wishing to operate in Tennessee, this application is necessary for obtaining the authority to conduct business within the state.

- Dissolution Form: If an LLC decides to cease operations, this document formally winds up the business under state law, addressing matters like asset distribution and debt resolution.

- Professional LLC Application: For businesses offering professional services, such as legal or medical services, additional information may be required to confirm the owners are licensed professionals.

In summary, founding and managing an LLC in Tennessee involves several key documents and forms beyond the initial Articles of Organization. Each serves a distinct purpose in establishing the legal and operational framework of the business. Staying informed and compliant with these requirements is vital for the smooth running and legal integrity of any LLC operating within the state.

Similar forms

The Articles of Incorporation for a Corporation serve a role parallel to that of the Tennessee Articles of Organization for an LLC, with both documents being foundational legal tools for structuring businesses within their respective categories. Articles of Incorporation set the stage for a corporation by outlining key details like the corporation’s name, purpose, and stock details, similar to how Articles of Organization specify an LLC's name, management structure, and member details. Despite the type of entity differing, both documents formally establish the entity's existence under state law.

Operating Agreements, while not filed with the state like the Articles of Organization, provide an internal framework for the operational aspects of an LLC, somewhat mirroring the role the Articles play in defining the LLC's structural basics. Unlike the Articles, which are public documents, Operating Agreements are private documents that detail the rights, powers, duties, liabilities, and obligations of the members among themselves and with respect to the LLC. This similarity lies in their foundational importance for the management of the entity’s internal affairs.

Partnership Agreements guide the operations and decisions of a partnership and, in that way, are akin to Articles of Organization for LLCs. Both documents outline the governance structure and operational protocols of the business entity. While Partnership Agreements cater to partnerships and are not typically state-filed documents, they share the purpose of setting operational and governance expectations, akin to how Articles of Organization establish the legal structure and operational guidelines for an LLC.

Bylaws for a corporation detail the rules governing the corporation’s operations and are somewhat parallel to the Articles of Organization for an LLC. Bylaws, which cover the corporation's internal management aspects more fully than the Articles of Incorporation, share similarities with Articles of Organization in establishing a firm basis for the entity's operational structure, governance, and procedural rules, albeit serving different types of business entities.

The Certificate of Formation, similar to the Articles of Organization but used in some states instead, is the document filed to legally form an LLC. It typically requires information like the company name, purpose, duration, and management type. This similarity is direct, as both serve the foundational registration requirement for creating an LLC under state law, despite the difference in terminology.

A DBA registration ("Doing Business As") document allows a business to operate under a name different from its legal name, similar to how an LLC's Articles of Organization may specify a professional or trade name under which the company will do business. The connection here is in the naming of the business entity - one document establishes the entity's legal name, while the other allows it to publicly operate under another name for marketing or business purposes.

The Employer Identification Number (EIN) application (Form SS-4 with the IRS) is necessary for tax administration purposes and, while not a one-to-one match, functions similarly to the Articles of Organization in establishing your LLC’s identity, but from a federal perspective. Both are initial steps towards legitimizing the business entity, one at the state level and the other at the federal level, emphasizing their foundational importance to business operations.

Foreign LLC Registration forms, required when an LLC formed in one state wishes to operate in another state, share similarities with the Articles of Organization as they often require equivalent information to register the LLC in the new state. This process resembles the initial formation and registration of an LLC, emphasizing the foundational role such documents play in legal recognition and operational sanction across jurisdictions.

The Annual Report filed by an LLC, while serving a different function than the Articles of Organization, shares the similarity of being a recurring document necessary for maintaining good standing with the state. Unlike the Articles which are filed once at the formation of the LLC, the Annual Report keeps the state updated on essential information such as the LLC’s address and current members, reflecting the business’s ongoing operational status.

Finally, the Dissolution documents for an LLC, which are filed to legally end the existence of an LLC, can be seen as the bookend to the Articles of Organization. While the Articles establish the legal framework for starting the LLC, the Dissolution documents officially terminate it. Both are critical bookends in the lifecycle of an LLC, marking its legal commencement and conclusion within state records.

Dos and Don'ts

When you're filling out the Tennessee Articles of Organization form for a Limited Liability Company (LLC), there are crucial steps to follow and pitfalls to avoid ensuring your filing is successful. Here are 5 dos and 5 don'ts to guide you through the process:

-

Do:

- Check the availability of your LLC name to ensure it meets Tennessee requirements and is distinguishable from names already in use.

- Accurately provide the name and address of your LLC's registered agent in Tennessee. Remember, a P.O. box is not permissible for the registered agent's address.

- Ensure that your LLC's principal office address is deliverable by the United States Postal Service. If using a P.O. box for the mailing address, it must be complemented by a physical location for the principal office.

- Clearly indicate if your LLC will be Member Managed, Manager Managed, or Director Managed.

- Include an obligated member entity addendum if you're registering as an obligated member entity. Understand that this could make members personally liable for the LLC's debts.

-

Don't:

- Forget to sign and date the application. An unsigned form will be straightaway rejected.

- Overlook the filing fee. Make sure your payment is for the correct amount and payable to the Tennessee Secretary of State.

- Assume a post office box is acceptable for the principal office address. A physical address is required for verification purposes.

- Ignore the need for approval if your LLC's name includes certain words like "bank" or "insurance," which require consent from respective Tennessee departments.

- Misjudge the importance of providing a business email address for official notifications and reminders.

Misconceptions

When it comes to filing the Articles of Organization for a Limited Liability Company (LLC) in Tennessee, there are several common misconceptions that can trip up new business owners. Understanding these misconceptions can save time, money, and potential legal headaches down the line.

- Online filing is the only option: It's a common belief that LLC Articles of Organization can only be filed online in Tennessee. However, Tennessee allows multiple filing methods including online (e-file), print and mail, paper submission, and walk-ins. Each method serves different needs and preferences.

- Any address is acceptable for the registered agent: The Tennessee Articles of Organization require a physical address in Tennessee for the registered agent’s office, not merely any address. P.O. Boxes are not acceptable, and the address must be recognizable as deliverable by the United States Postal Service.

- No need for a fiscal year close month: Some might think specifying a fiscal year close month is optional. However, if this is not indicated, the Division of Business Services will automatically list December as the fiscal year close month by default. This might not align with the LLC’s actual financial practices.

- Delayed effective date has no limits: There’s a limit to how far in the future the effective date of the LLC can be set. It can't exceed ninety calendar *days from the filing of the articles of organization.* This is important for businesses that need to coordinate their official start date with other business activities or legal considerations.

- All LLCs have the same management structure: The assumption that there’s only one type of management structure for LLCs is incorrect. Tennessee LLCs can be Member Managed, Manager Managed, or Director Managed, offering flexibility in how the business is run.

- Only one member is assumed: If the number of members at the date of filing is not specified, the Division of Business Services will list the number of members as one by default. This might not represent the business’s true structure and could impact various aspects of business operations and legal obligations.

- LLCs cannot be non-profit: A notable misunderstanding is that LLCs cannot have a non-profit designation. Tennessee law allows for the creation of Non-Profit LLCs, provided certain conditions are met. This includes having a sole member that is a nonprofit corporation.

- No additional costs for specific designations: Business owners might not realize that requesting to use an indistinguishable name or registering as an Obligated Member Entity involves additional fees. It’s important to account for these potential extra costs when planning the budget for filing the LLC.

Navigating the complexities of forming an LLC in Tennessee requires careful attention to detail and an understanding of state-specific requirements. By debunking these misconceptions, prospective business owners can approach the filing process with greater confidence and clarity.

Key takeaways

Filling out the Articles of Organization for a Limited Liability Company (LLC) in Tennessee involves careful attention to detail and precise completion of required information. Here are five key takeaways to help guide you through this process:

- The name you choose for your LLC must comply with Tennessee’s naming requirements, including the necessity to be distinguishable from existing business names and to include "Limited Liability Company," "LLC," or "L.L.C." in the name. If choosing a name similar to an existing business, written consent and an additional fee are required.

- Identify the LLC’s initial registered agent and registered office accurately. The registered agent acts as the LLC's point of contact for legal documents. Remember, a physical Tennessee address is required for the registered office, and PO boxes are not acceptable.

- Decide on the management structure of your LLC. This can be Member Managed, Manager Managed, or Director Managed. Your choice affects how decisions are made within the company and who has the authority to act on behalf of the LLC.

- Determine the fiscal year close month for your LLC, which informs when your annual reports are due. By default, if not specified, December will be set as the fiscal year end. Compliance with annual reporting requirements is crucial to maintain good standing.

- The filing fee for the Articles of Organization depends on the number of members in the LLC at the time of filing, with a minimum fee of $300 and a maximum of $3,000. If the LLC is prohibited from doing business in Tennessee, a flat fee of $300 applies, regardless of member count.

Moreover, it’s essential to ensure all provided information is complete, accurate, and legible to avoid rejection. Tennessee offers both electronic and paper filing options to accommodate different preferences. Electronic filing provides a quicker response time, while the print and mail option can be chosen to avoid convenience fees. Regardless of the method selected, remember to sign and date the application to validate your submission.

To maintain the LLC's good standing and ensure compliance with Tennessee state law, mark your calendar for annual reporting deadlines based on the fiscal year close month you've chosen. Staying informed and adhering to the stipulated requirements can significantly streamline the process of maintaining your LLC in Tennessee.

Popular PDF Forms

Franchise and Excise Tax - Farming/Personal Residence exemption criteria focus on the percentage of activities and assets used in farming or holding personal residences owned by family members or trusts.

Is It Mandatory to Card Everyone in Tennessee - The Alc 119 form's method for prorating the brand registration tax for distilled spirits provides a fair and equitable financial approach for partial-year registrations.