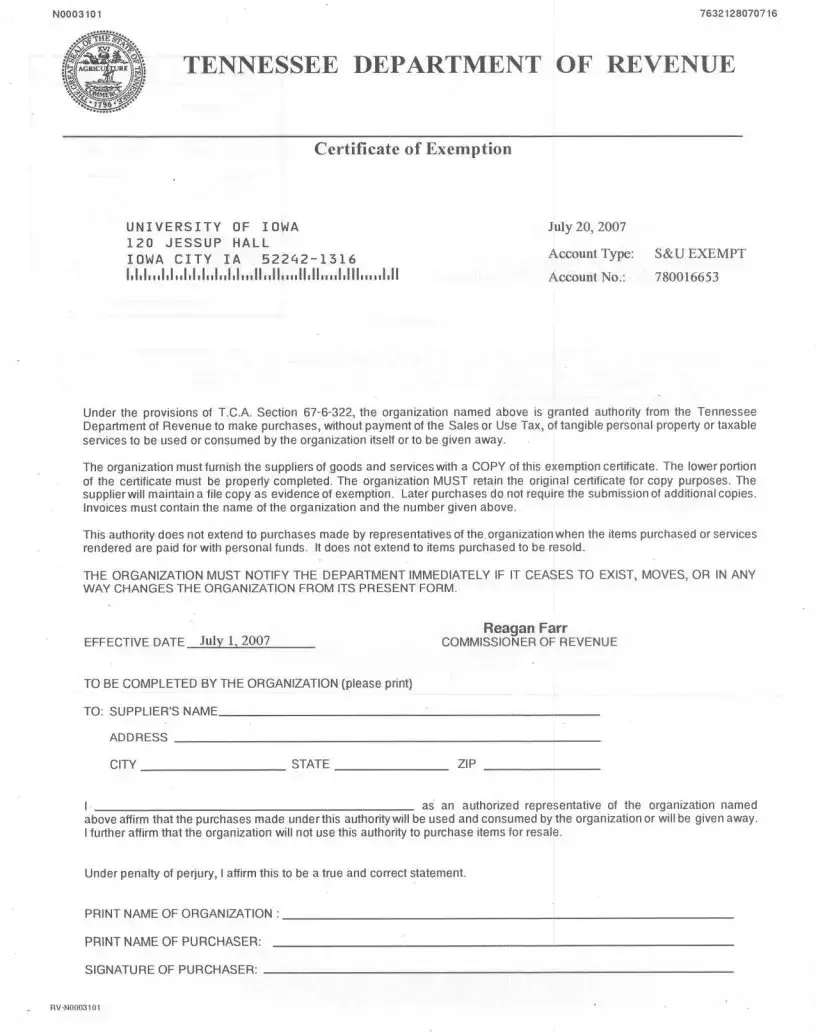

Fill Out a Valid Tennessee Exemption Certificate Form

In navigating the complexities of tax exemptions within Tennessee, organizations find essential utility in the Tennessee Exemption Certificate form, a document that serves as a beacon of tax relief. Authorized by the Tennessee Department of Revenue, this certificate allows eligible entities, like the University of Iowa highlighted in the detailed form instructions from July 20, 2007, to acquire goods or services free from the burden of Sales or Use Tax. The criteria outlined under T.C.A Section 67-6-322 not only specify the qualifications for exemption but also delineate the conditions under which purchases must be made to ensure compliance. The document underscores the importance of providing suppliers with a copy of the exemption certificate for record-keeping, while emphasizing that the organization must retain the original for future transactions. Evidently, the form facilitates a smoother procurement process for exempt organizations, albeit with stringent guidelines to prevent misuse. This includes prohibitions against using the exemption for personal purchases by organization representatives or for items intended for resale. Moreover, the included obligations for organizations to report any changes in their operational status echo the state's commitment to maintaining the integrity of this exemption. Accompanied by instructions for completion and contact information for further assistance, the Tennessee Exemption Certificate embodies a critical tool for eligible organizations seeking to navigate tax exemption processes effectively.

Example - Tennessee Exemption Certificate Form

N0003101 |

7632128070716 |

TENNESSEE DEPARTMENT OF REVENUE

Certificate of Exemption

UNIVERSITYOF IOWA

120 JESSUP HALL

IOWA CITY IA

1,1,1".1,1"1.1,1,,1,,1,1,,, 11"11",, 11,11" "1,111,,, "I,ll

July 20, 2007

Account Type: S&U EXEMPT

Account No.: 780016653

Under the provisions of T.CA Section

The organization must furnish the suppliers of goods and services with a COPY of this exemption certificate. The lower portion of the certificate must be properly completed. The organization MUST retain the original certificate for copy purposes. The supplier will maintain a file copy as evidence of exemption. Later purchases do not require the submission of additional copies. Invoices must contain the name of the organization and the number given above.

This authority does not extend to purchases made by representatives of the. organization when the items purchased or services rendered are paid for with personal funds. It does not extend to items purchased to be resold.

THE ORGANIZATION MUST NOTIFY THE DEPARTMENT IMMEDIATELY IF IT CEASES TO EXIST, MOVES, OR IN ANY WAY CHANGES THE ORGANIZATION FROM ITS PRESENT FORM.

|

Reagan |

Farr |

EFFECTIVE DATE July 1, 2007 |

COMMISSIONER |

OF REVENUE |

TO BE COMPLETED BY THE ORGANIZATION (please print)

TO: SUPPLIER'S NAME |

|

|

|

_ |

ADDRESS |

|

|

|

_ |

CITY |

STATE |

_ |

ZIP |

_ |

I |

as |

an |

authorized |

representative of the organization named |

above affirm that the purchases made under this authority will be used and consumed by the organization or will be given away. I further affirm that the organization will not use this authority to purchase items for resale.

Under penalty of perjury, I affirm this to be a true and correct statement.

NAME OF ORGANIZATION: |

_ |

|

NAME OF PURCHASER: |

|

|

SIGNATURE OF PURCHASER: |

_ |

|

RV·N0003101

UNIVERSITY OF IOWA 120 JESSUP HALL

IOWA CITY IA

1,1,1"11,1111,1,111111111'11111111'11111,1111111,111111111,11

ASSISTANCE

For additional information, contact the Taxpayer and

Vehicle Services Division in one of our Department of Revenue Offices:

|

Chattanooga |

|

Jackson |

|

(423) |

(731) |

|||

Suite |

350 |

|

Suite |

340 |

State |

Office |

Building |

Lowell |

Thomas Building |

540 |

McCallie |

Avenue |

225 Martin Luther King Blvd. |

|

|

|

|

||

Johnson |

City |

|

Knoxville |

||

(423) |

|

(865) |

|||

204 High |

Point |

Drive |

Room 606 |

|

|

|

|

|

State |

Office |

Building |

|

|

|

531 |

Henley |

Street |

Memphis |

|

Nashville |

||

(901) |

(615) |

|||

3150 |

Appling Road |

3rd |

Floor, AJ |

Building |

Bartlett |

500 |

Deaderick |

Street |

|

www.tennessee.qov/revenue

For additional information or assIstance regarding this notice, you should contact the Department of Revenue. Tennessee residents may use the

number,

written information to the following address: Tennessee Department of Revenue, 500 Deaderick Street, Nashville, TN 37242. Please provide your account number and notice number when inquiring about the notice.

Form Breakdown

| Fact Name | Description |

|---|---|

| Issuing Authority | The Tennessee Department of Revenue is responsible for issuing the Certificate of Exemption. |

| Governing Law | This certificate is governed by T.C.A Section 67-6-322, which allows for tax-exempt purchases by qualified organizations. |

| Effective Date of Certificate | The exemption certificate becomes effective on July 1, 2007. |

| Usage Conditions | Organizations can use this certificate to purchase tangible personal property or taxable services for use or consumption by the organization, or to be given away, without paying Sales or Use Tax. |

| Exclusions | The exemption does not apply to items purchased for resale or purchases made by representatives of the organization with personal funds. |

| Supplier and Organization Responsibilities | Organizations must retain the original certificate and provide a copy to suppliers. Suppliers are required to maintain a file copy as evidence of exemption. Organizations must notify the Department of Revenue if there are any changes to their status. |

Detailed Instructions for Filling Out Tennessee Exemption Certificate

When it comes to making purchases for an organization without having to pay sales or use tax in Tennessee, using the Tennessee Exemption Certificate is the appropriate route. Filling out this form correctly ensures that your organization can buy goods or services without the added tax, provided these purchases are for the organization's use or given away, not for resale. Here's a step-by-step guide to complete the Tennessee Exemption Certificate form:

- Start by identifying the supplier you are purchasing from. Write down the SUPPLIER'S NAME, their ADDRESS, the CITY, STATE, and the ZIP code in the designated areas of the form.

- In the section titled "TO BE COMPLETED BY THE ORGANIZATION", clearly print the name of your organization where it says PRINT NAME OF ORGANIZATION.

- Next, print the name of the individual making the purchase on behalf of the organization in the PRINT NAME OF PURCHASER field. This should be the name of the person authorized to act for the organization in these matters.

- Have the purchaser sign the form where indicated to certify that the purchases are for the organization's use or will be given away, and not for resale. The signature space is marked as SIGNATURE OF PURCHASER.

- Remember to check the effective date of the exemption stated in the document, which, in this example, is July 1, 2007. It’s important to ensure that your purchases are made within the validity period of the exemption.

- The last part often overlooked is the notification requirement. If your organization ceases to exist, moves, or significantly changes its operation, you are required to inform the Tennessee Department of Revenue immediately.

Once you have completed these steps, provide a copy of the filled-out certificate to your supplier. Keep the original for your records, as this will be required for any future audits or verifications. Remember, this certificate simplifies the purchasing process for your tax-exempt transactions, so it's essential to fill it out accurately and keep it up to date.

More About Tennessee Exemption Certificate

What is the Tennessee Exemption Certificate?

The Tennessee Exemption Certificate is a document issued by the Tennessee Department of Revenue that authorizes certain organizations, such as the University of Iowa mentioned in the example, to make purchases of tangible personal property or taxable services without paying the sales or use tax. This exemption is granted under the provisions of T.C.A Section 67-6-322 and is specifically intended for purchases that are used or consumed by the organization itself or given away, not for items that are purchased for resale.

Who needs to use the Tennessee Exemption Certificate?

Organizations that are granted authority by the Tennessee Department of Revenue to make tax-exempt purchases must use the Tennessee Exemption Certificate. These include educational institutions, certain nonprofits, and other qualifying entities that use or consume the purchased goods or services within the organization. The certificate must be furnished to suppliers at the time of purchase to ensure that sales or use tax is not charged.

How does an organization use the Tennessee Exemption Certificate?

To use the Tennessee Exemption Certificate, an organization must:

- Provide a copy of the exemption certificate to the supplier of goods or services at the time of purchase.

- Ensure that the certificate is properly completed, including the organization's name, the account number provided by the Tennessee Department of Revenue, and the signature of an authorized representative.

- Retain the original certificate for future copy purposes while suppliers maintain a file copy as evidence of exemption.

- Remember that future purchases don't require submission of additional copies of the certificate, but invoices must contain the organization's name and number.

What purchases are not covered by the Tennessee Exemption Certificate?

The Tennessee Exemption Certificate does not cover all types of purchases. Exclusions include:

- Items purchased for resale.

- Purchases made by representatives of the organization when the items are paid for with personal funds rather than funds from the organization.

It's important for organizations to fully understand these limitations to ensure compliance and avoid improper use of the exemption.

What should an organization do if its status changes after receiving the Tennessee Exemption Certificate?

If an organization ceases to exist, relocates, or undergoes any changes to its status that affect its eligibility for tax exemption, it must immediately notify the Tennessee Department of Revenue. This notification helps maintain accurate records and ensures that the organization remains in compliance with state tax laws.

Common mistakes

Filling out the Tennessee Exemption Certificate form seems straightforward, but there are common missteps that people often make. Understanding these mistakes can save you time, ensure compliance, and facilitate smoother transactions exempt from sales or use tax under the specified conditions. Here's what to watch out for:

- Not providing a complete copy of the certificate to suppliers: It’s mandatory to furnish a complete copy of the exemption certificate to every supplier from whom you make purchases intended for use or donation by the organization. An incomplete copy could lead to misunderstandings or refusal of tax exemptions by the supplier.

- Failure to keep the original certificate: The organization must retain the original document for their records and future copy purposes. Losing the original can create complications when you need to validate your tax-exempt status or when facing audits and verifications.

- Incorrect or incomplete information in the "TO BE COMPLETED BY THE ORGANIZATION" section: Every field in this section needs to be accurately filled out. This includes clearly printing the organization's name, the purchaser's name, and ensuring the purchaser provides a signature. Any incomplete or inaccurate information can invalidate the exemption certificate.

- Overlooking the limitation on personal purchases: The exemption does not cover items or services purchased by representatives of the organization with personal funds, even if these items or services are intended for the organization's use. Misunderstanding this limitation can lead to unwarranted claims for exemption.

- Purchasing items for resale: The certificate explicitly states that the tax exemption does not apply to items purchased for resale. Attempting to use this certificate for such purchases constitutes misuse and could lead to penalties.

- Failure to notify the Department of Revenue of organizational changes: If an organization ceases to exist, relocates, or undergoes any significant changes to its structure, it must inform the Tennessee Department of Revenue immediately. Neglecting to do so can lead to complications and possibly jeopardize the tax-exempt status.

Employing the tax-exempt privileges granted by the Tennessee Exemption Certificate comes with the responsibility of meticulous compliance with its terms. Avoiding these common mistakes ensures that your organization can fully benefit from the exemption without facing unnecessary hurdles. Always make sure every detail on the certificate is correct, keep the original document safe, and stay informed about the applicable regulations and limitations. When in doubt, contacting the Tennessee Department of Revenue or seeking legal advice is a prudent step to ensure compliance.

Documents used along the form

When dealing with the administration of sales and use tax exemptions in Tennessee, particularly utilizing the Tennessee Exemption Certificate, various other documents and forms often complement the certification process or are required in other related circumstances. These forms and documents play integral roles in ensuring compliance with Tennessee's tax laws and facilitating the transaction process between exempt entities and their suppliers, as well as with the Tennessee Department of Revenue.

- Application for Sales and Use Tax Exemption: Entities must first submit this application to qualify for a Certificate of Exemption, providing detailed information about their organization and the nature of their tax-exempt status.

- Annual Exemption Renewal Form: Most exemptions are not indefinite and require annual renewal. This form ensures that the entity's exemption status is up to date and in compliance with any changes in tax laws.

- Sales and Use Tax Return: Although exempt from some taxes, organizations may be subject to others. This form is used to report and pay any applicable taxes not covered by the exemption.

- Purchaser’s Affidavit of Export Form: If goods purchased tax-exempt are to be exported outside Tennessee, this affidavit may be required to justify the exemption on the basis of the destination of the goods.

- Streamlined Sales and Use Tax Agreement Certificate of Exemption: For transactions involving multiple states, this certificate might be necessary to simplify and standardize the exemption process under the Streamlined Sales and Use Tax Agreement.

- General Affidavit: In situations where additional verification of an organization’s exempt status or of the nature of the purchase is required, a general affidavit may be used to provide such assurances.

- Direct Pay Permit: Certain qualifying entities may obtain a direct pay permit allowing them to pay sales or use tax directly to the state rather than through vendors, necessitating its own application process and documentation.

- Contractor’s Blanket Certificate of Resale: Contractors purchasing materials for use in projects for tax-exempt entities may need to provide this certificate to suppliers to purchase materials without paying sales tax.

- Exempt Organization Declaration of Sales Tax Exemption on Purchased Items: This document serves as a declaration that items purchased by the organization are for its use and qualify under the exemption, detailing the nature of the exempted items.

- Change of Address Form: If an organization with an exemption certificate changes its address, this form must be submitted to update the Department of Revenue records to ensure compliance and proper communication.

In conclusion, the Tennessee Exemption Certificate serves as a foundational element in a broader regulatory environment, where additional documentation supports, defines, and refines the scope of tax-exempt transactions. Understanding the role and requirement of each of these complementary forms and documents is essential for entities seeking to navigate Tennessee's taxation landscape efficiently. These documents collectively ensure that the process from application to renewal of tax-exempt status remains streamlined and transparent, both for the exempt entities and the Tennessee Department of Revenue.

Similar forms

The Uniform Sales & Use Tax Exemption/Resale Certificate – Multijurisdictional form is closely related to the Tennessee Exemption Certificate. Both documents allow organizations to purchase goods or services without paying sales tax, assuming these items will be used for the organization's exempt purposes or for resale. They require the organization to declare their exemption status to the seller, helping both parties maintain compliance with state tax laws.

A Resale Certificate is another document that shares similarities with the Tennessee Exemption Certificate. This certificate permits businesses to buy products without paying sales tax on items that will be resold in their regular business operations. Like the Tennessee Exemption Certificate, it helps businesses avoid the financial burden of double taxation by ensuring that sales tax is applied only at the final point of sale to the consumer.

A Nonprofit Organization Exemption Certificate often mirrors the Tennessee Exemption Certificate in its purpose. It specifically provides tax-exempt status to qualifying nonprofit entities, allowing them to make tax-free purchases that directly relate to their charitable activities. Both certificates require the organization to provide proof of their tax-exempt status and to use the purchased goods or services in a manner that aligns with their exempt purpose.

An Agricultural Exemption Certificate also shares traits with the Tennessee Exemption Certificate. This form allows individuals or businesses involved in farming and agricultural activities to make tax-exempt purchases of supplies and equipment used in production. Just like the Tennessee Exemption, the agricultural certificate aims to reduce operational costs by exempting qualifying purchases from sales tax.

The Direct Pay Permit is similar to the Tennessee Exemption Certificate but serves a different purpose. With a direct pay permit, a business pays the sales or use tax directly to the state rather than to the vendor at the time of purchase. This arrangement requires the business to keep detailed records of taxable purchases, similar to the record-keeping requirements for organizations using the Tennessee Exemption Certificate.

The Streamlined Sales and Use Tax Agreement Certificate of Exemption stands in line with the Tennessee Exemption Certificate in its multipurpose nature. This streamlined certificate simplifies the exemption process across member states, allowing businesses and organizations to submit a single form for multiple states, including Tennessee, to claim exemption from sales and use taxes.

The Sellers Permit is somewhat related but different in focus from the Tennessee Exemption Certificate. It authorizes businesses to sell goods and collect sales tax on those sales within a state. While this does not grant an exemption from sales tax, it closely ties with the process by ensuring that businesses are recognized by the state as legitimate collectors of sales tax, which is a complementary process to using tax exemption certificates for qualifying purchases.

The Tax Exempt Purchase Card, often used by government entities, shares a straightforward resemblance with the Tennessee Exemption Certificate. This card allows eligible entities like state governments to make direct purchases without paying sales tax at the point of sale. The presence of such a card simplifies transactions by eliminating the need for paper certificates, yet the objective remains the same: to facilitate tax-free purchases for qualifying organizations and activities.

The Consumer's Certificate of Exemption is another document closely related to the Tennessee Exemption Certificate. It grants individuals or entities the right to make purchases without paying sales tax, provided those purchases are for personal use and meet the state’s criteria for tax-exempt transactions. Similar to organization-based exemptions, this certificate requires qualification and strict adherence to guidelines regarding what constitutes an exempt purchase.

Lastly, the Use Tax Payment form has a relationship with the Tennessee Exemption Certificate from another perspective. While the exemption certificate prevents the upfront payment of sales tax on qualifying purchases, the use tax payment form is used to report and pay tax on items purchased without sales tax—typically from out-of-state vendors—for use, storage, or consumption within the state. This highlights the responsibility of taxpayers to comply with state tax laws, reflecting the compliance aspect embodied by the Tennessee Exemption Certificate.

Dos and Don'ts

When completing the Tennessee Exemption Certificate form, adhering to certain dos and don'ts ensures both compliance and accuracy. The following list outlines key practices to follow and avoid in this process:

Dos:

Ensure the name of the organization is clearly and accurately printed, reflecting its official registration.

Accurately print the name of the purchaser who is authorized to make exempt purchases on behalf of the organization.

Have the form signed by an authorized representative of the organization to validate its authenticity.

Provide a complete and precise address of the organization to avoid any confusion or misdirection of documents.

Include a clear statement of affirmation that the purchases are intended for use or consumption by the organization itself or for giveaway, and not for resale.

Maintain the original exemption certificate with the organization for copy purposes and record-keeping.

Supply a copy of the exemption certificate to the supplier to substantiate the exempt status of the purchases.

Ensure the account number and exempt status are visible on invoices for audit and verification purposes.

Contact the Department of Revenue for any clarification or additional information regarding the exemption certificate.

Notify the Department of Revenue immediately if there are any changes to the organization's structure, location, or existence to maintain accurate records.

Don'ts:

Do not use the exemption for personal purchases; it is strictly for the organization's eligible purchases.

Do not leave the signature field blank, as an unsigned certificate invalidates the tax-exempt status.

Do not provide inaccurate or incomplete information regarding the organization's address or the purchaser's details.

Do not forget to keep the original exemption certificate for your records; losing it complicates future purchases.

Do not attempt to use the exemption for items intended for resale by the organization.

Do not overlook the necessity to include the organization's name and account number on all invoices.

Do not delay notifying the Department of Revenue about changes that affect the organization's exempt status.

Do not assume that the exemption applies automatically; the proper completion of the certificate is critical.

Do not ignore the need to renew or verify the exemption status as required by the Tennessee Department of Revenue.

Do not hesitate to contact the Department of Revenue for assistance or clarification regarding the exemption process.

Misconceptions

When discussing the intricacies of the Tennessee Exemption Certificate form, several misunderstandings commonly arise. Shedding light on these can help organizations and individuals better navigate their tax exemption privileges and responsibilities.

It's only for educational institutions: The belief that only schools or universities can use the Tennessee Exemption Certificate is incorrect. Various organizations, provided they meet certain criteria set by the Tennessee Department of Revenue, can qualify for this exemption.

Any purchase qualifies for exemption: A common misconception is that holding an exemption certificate allows an organization to exempt from taxes on all purchases. However, the law specifies that purchases must be for the organization's use, consumption, or as giveaways, and not for resale.

Personal purchases are covered: The certificate does not cover purchases made by representatives of the organization with personal funds, even if they intend to donate those purchases to the organization afterward.

One-time application: Some believe that once you obtain the exemption certificate, no further action is required. However, organizations must notify the Department of Revenue if their status changes, such as relocating or ceasing operations.

There's no need to present the certificate for each purchase: While the supplier retains a copy of the certificate for recurring purchases, it’s a good practice to ensure every transaction explicitly states the purchase is exempt to avoid any confusion or tax liability.

It allows for direct exemptions at point of sale: Another misunderstanding is that the exemption is automatically applied at the time of purchase. In reality, the buyer must provide the certificate or account number to the seller to apply the exemption.

Exemption certificates have an indefinite validity: The belief that once obtained, the exemption certificate lasts forever is false. It’s subject to review and renewal by the Tennessee Department of Revenue, ensuring only eligible organizations benefit.

Only tangible goods are exempt: While the certificate explicitly mentions tangible personal property, it also covers taxable services consumed or used by the organization, broadening its applicability.

All nonprofits automatically qualify: A common misconception is that nonprofit status automatically grants exemption under this certificate. Eligibility depends on the organization’s purpose and activities as defined by Tennessee law.

No consequences for misuse: Lastly, there’s an incorrect assumption that misuse of an exemption certificate carries no repercussions. Misuse can result in fines, revocation of the certificate, and possibly criminal charges.

Understanding these points can help organizations correctly use their Tennessee Exemption Certificate, ensuring they remain compliant while enjoying the benefits of tax exemption on qualifying purchases.

Key takeaways

Understanding the Tennessee Exemption Certificate form is crucial for organizations looking to make tax-exempt purchases. Here are key takeaways to ensure compliance and proper use:

- Organizations granted authority by the Tennessee Department of Revenue can purchase tangible personal property or taxable services tax-exempt. This privilege is to be used strictly for items or services consumed by the organization itself or given away.

- A copy of the exemption certificate must be furnished to suppliers as proof of the organization's exempt status. It's the organization's responsibility to distribute these copies for tax-exempt purchases.

- The original exemption certificate is to be retained by the organization for record-keeping and future copy purposes. This safeguards against future disputes or audits.

- Suppliers are required to keep a file copy of the exemption certificate to justify the tax-exempt sale on their end, ensuring both parties comply with state tax laws.

- Purchases made by individual representatives of the organization using personal funds do not qualify for exemption. This distinction is crucial to avoid misuse of the exemption status.

- Items purchased for resale are not covered under this exemption. The certificate strictly limits tax-exempt purchases to those consumed by or given away by the organization, emphasizing the non-commercial intent behind the tax exemption.

- Any change in the organization's status, such as ceasing operations, moving, or any alterations to its form, must be reported to the Tennessee Department of Revenue immediately. This maintains the accuracy and integrity of the exemption status.

Adhering to these guidelines ensures that organizations can effectively utilize their tax-exempt status for their intended purposes without falling afoul of regulatory requirements. It also protects the interests of both the exempt organizations and their suppliers, fostering a compliant and transparent relationship.

Popular PDF Forms

What Documents Do I Need to Get a Tennessee Driver's License - Mandates the signature of both the eye care provider and the person receiving the examination.

Example of Pesticides - Facilitates a smoother registration experience by detailing essential steps and submissions.