Fill Out a Valid Tennessee Fae 172 Form

The Tennessee FAE 172 form serves as a critical tool for businesses operating within the state, facilitating the quarterly declaration and payment of franchise and excise taxes to the Tennessee Department of Revenue. Aimed primarily at taxpayers expecting a combined liability of $5,000 or more in the current tax year, this mandate underscores the state's approach to regularizing tax contributions in manageable portions. By specifying submission deadlines as the 15th day of the fourth, sixth, ninth months of the taxable year, and the first month of the following year, the form also outlines the necessity for enterprises to make these payments timely to avoid penalties and interest for late or underpaid installments. Detailed within the form are instructions for calculation, payment methods, and the requirement for using prenumbered vouchers and envelopes provided by the Department of Revenue for submissions. Moreover, it highlights the consequences of non-compliance, including a penalty rate of 5% per month up to a maximum of 25%, alongside accruing interest on unpaid amounts. Designed not just for tax compliance but also to aid in financial planning, the FAE 172 form exemplifies the state's commitment to fostering a structured tax environment.

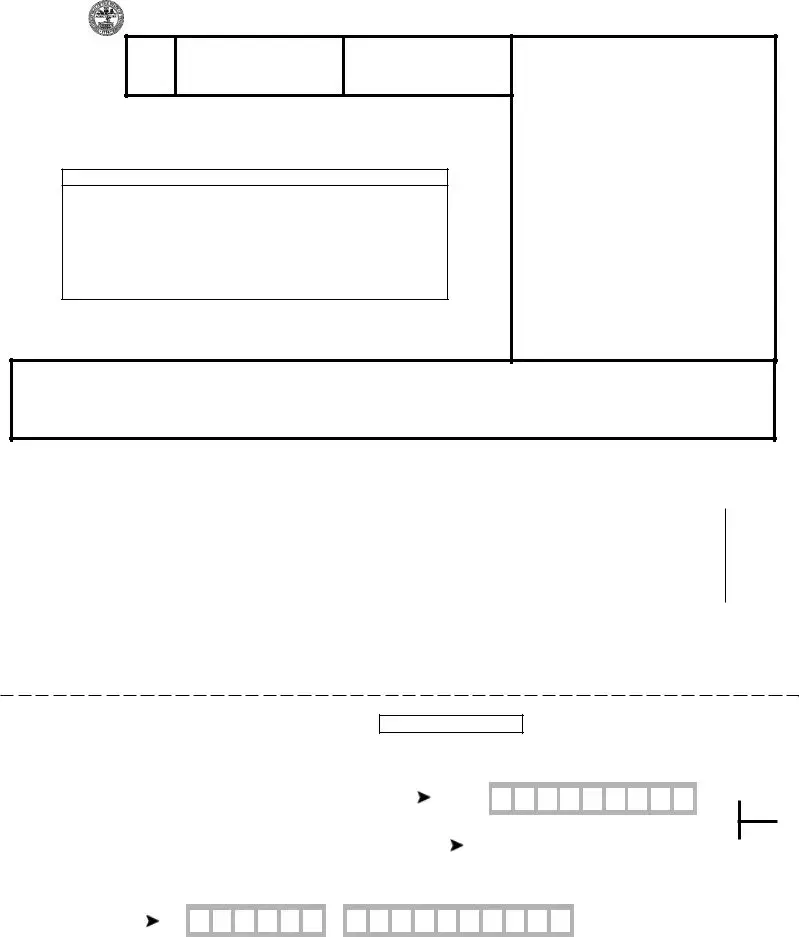

Example - Tennessee Fae 172 Form

R0011301 |

TENNESSEE DEPARTMENT OF REVENUE |

|

QUARTERLY FRANCHISE, EXCISE TAX DECLARATION |

FAE |

|

|

ACCOUNT NO. |

Taxable Beginning |

|||

172 |

Year |

Ending |

|

|

|

||

TAXPAYER NAME AND MAILING ADDRESS |

|

NAME ___________________________________________________________________ |

|

BOX(STREET) ____________________________________________________________ |

|

CITY ____________________________________________________________________ |

|

STATE ________________ |

ZIP __________________________ |

Each taxpayer having a combined franchise and excise tax liability of $5,000 or more for the current tax year must make four quarterly es- timated tax payments. The payments are due on the 15th day of the fourth, sixth, and ninth months of the current year and the first month of the succeeding year.

Make your check payable to the Tennessee Department of Revenue and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Building

500 Deaderick Street

Nashville, TN 37242

For assistance, you may call

REMINDERS

1.Please read instructions on reverse side before preparing worksheet.

2.UsetheprenumberedvouchersandenvelopesprovidedbytheDepartmentofRevenue.

3.Enter the amount from Line 4 of the worksheet to the "Amount of Payment" field on the voucher.

4.If Line 4 of the worksheet is zero, please do not file the voucher.

|

|

ROUND TO NEAREST DOLLAR |

|

|

00 |

1. |

Estimated Franchise, Excise tax liability |

______________________ |

|

|

00 |

2. |

Less: Franchise, Excise Tax Credits and prior year overpayments |

______________________ |

|

|

00 |

3. |

Net Estimated Franchise, Excise tax liability |

______________________ |

|

|

00 |

4. |

Estimated payment (one fourth of Line 3) |

______________________ |

KEEP UPPER PORTION FOR YOUR

KEEP UPPER PORTION FOR YOUR

FAE 172

TENNESSEE DEPARTMENT OF REVENUE |

1 |

||

QUARTERLY FRANCHISE, EXCISE TAX DECLARATION |

|

||

|

|

|

|

Taxable |

BEGINNING |

ENDING |

|

Year |

|

|

|

|

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

Due Date:

If your account number is not preprinted or unknown, enter federal identification or social security number.

(FEIN/

SSN)

AMOUNT OF |

|

|

|

|

|

|

|

|

00 |

PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR OFFICE

USE ONLY

|

INSTRUCTIONS

1.WHO MUST MAKE ESTIMATED TAX PAYMENTS: Taxpayers who expect a franchise, excise tax liability of $5,000 or more for the current tax year must file a declaration of their franchise, excise tax for the taxable year and make quarterly payments.

2.WHEN TO MAKE PAYMENTS: Quarterly payments of the estimated franchise, excise tax are to be made as follows:

1st payment - The 15th day of the 4th month of the current taxable year. 2nd payment - The 15th day of the 6th month of the current taxable year. 3rd payment - The 15th day of the 9th month of the current taxable year.

4th payment - The 15th day of the 1st month of the subsequent taxable year.

3.REQUIREDPAYMENT: Theminimumamountofeachquarterlypaymentshallbethelesserof:(a)25%ofthecombinedfranchise, excise tax shown on the tax return for the preceding tax year, annualized if the preceding tax year was for less than twelve (12) months; or (b) 25% of 100% of the combined franchise, excise tax liability for the current tax year.

4.PENALTYANDINTEREST: Penaltyattherateof5%permonth,upto25%,andinterestatthecurrentrateperannumareimposed upon any quarterly installment which is late or underpaid. Penalty and interest are computed from the due date of the installment to the date paid or until the fifteenth day of the fourth month following the close of the taxable year.

5.WHICH FORM TO USE: All franchise, excise tax payments must be accompanied by the Tennessee Estimated Franchise, ExciseTaxDeclarationform.Ifyoureceivedapreaddressedpacket,pleaseusetheprenumberedvouchersandenvelopessupplied with the packet. This will help expedite the processing of your estimated payments.

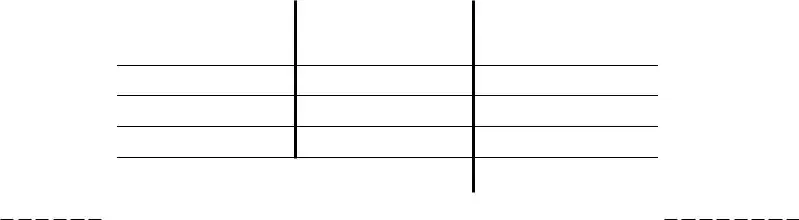

RECORD OF ESTIMATED TAX PAYMENTS

|

|

DUE DATE OF PAYMENT |

|

|

|

|

|

|

|

DATE PAID |

|

|

|

|

AMOUNT PAID |

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

_____________________________________________________________ |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Total payments to be taken on completed return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

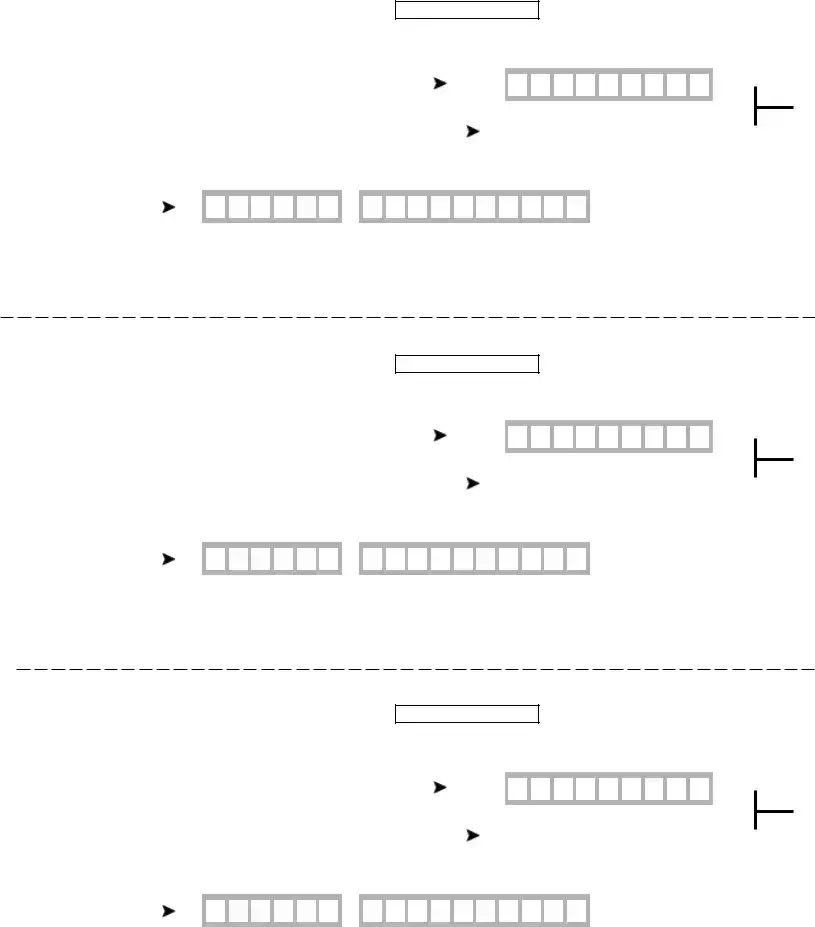

FAE 172

TENNESSEE DEPARTMENT OF REVENUE |

2 |

||

QUARTERLY FRANCHISE, EXCISE TAX DECLARATION |

|

||

|

|

|

|

Taxable |

BEGINNING |

ENDING |

|

Year |

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

FOR OFFICE

USE ONLY

Due Date:

If your account number is not preprinted or unknown, enter federal identification or social security number.

(FEIN/

SSN)

AMOUNT OF |

|

|

|

|

|

|

|

|

00 |

PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FAE 172

TENNESSEE DEPARTMENT OF REVENUE |

3 |

||

QUARTERLY FRANCHISE, EXCISE TAX DECLARATION |

|

||

|

|

|

|

Taxable |

BEGINNING |

ENDING |

|

Year |

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

FOR OFFICE

USE ONLY

Due Date:

If your account number is not preprinted or unknown, enter federal identification or social security number.

(FEIN/

SSN)

AMOUNT OF |

|

|

|

|

|

|

|

|

00 |

PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FAE 172

TENNESSEE DEPARTMENT OF REVENUE |

4 |

||

QUARTERLY FRANCHISE, EXCISE TAX DECLARATION |

|

||

|

|

|

|

Taxable |

BEGINNING |

ENDING |

|

Year |

|

|

|

|

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

FOR OFFICE

USE ONLY

Due Date:

If your account number is not preprinted or unknown, enter federal identification or social security number.

(FEIN/

SSN)

AMOUNT OF |

|

|

|

|

|

|

|

|

00 |

PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Number | FAE 172 |

| Issuing Body | Tennessee Department of Revenue |

| Purpose | Quarterly Franchise, Excise Tax Declaration |

| Eligibility for Filing | Taxpayers with a combined franchise and excise tax liability of $5,000 or more for the current tax year |

| Payment Schedule | Payments are due on the 15th day of the fourth, sixth, and ninth months of the current year and the first month of the succeeding year. |

| Associated Penalties | Penalties and interest apply for late or underpaid quarterly installments, calculated from the due date of the installment until payment or the fifteenth day of the fourth month following the close of the taxable year. |

Detailed Instructions for Filling Out Tennessee Fae 172

Fulfilling your tax obligations accurately and on time is crucial in managing the financial health of your business. In Tennessee, entities that anticipate a combined franchise and excise tax liability of $5,000 or more for the current tax year are required to make quarterly estimated tax payments. The form facilitating this process is the FAE 172, which serves as the declaration for these quarterly contributions. The following instructions are designed to assist in the correct completion of this form, ensuring that your tax payments are processed efficiently and without delay.

- Identify your taxable year beginning and ending dates, then record them in the designated areas at the top of the form.

- Complete the section titled "TAXPAYER NAME AND MAILING ADDRESS" with accurate details. This includes the legal name of your entity, the address where it receives mail, and corresponding city, state, and ZIP code information.

- Calculate your estimated franchise and excise tax liability for the taxable year and enter this amount in the field provided (1. Estimated Franchise, Excise tax liability).

- Subtract any franchise, excise tax credits, and prior year overpayments from your estimated tax liability and enter the result in the appropriate section (2. Less: Franchise, Excise Tax Credits and prior year overpayments).

- Determine your net estimated franchise and excise tax liability by taking the amount calculated in the previous step and record it accordingly (3. Net Estimated Franchise, Excise tax liability).

- Divide the amount from step 5 by four to find your estimated payment for the quarter. Record this figure in the space provided (4. Estimated payment (one fourth of Line 3)).

- If you have not been assigned an account number or it is not preprinted on the form, ensure to enter your federal identification number or social security number in the designated area.

- Review the form for completeness and accuracy, then sign and date it as required. Ensure that the section of the form to be returned is correctly filled out and includes the calculated amount of payment.

- Use the prenumbered vouchers and the envelope provided by the Department of Revenue to submit your payment. Ensure the "Amount of Payment" field on the voucher reflects the amount from Line 4 of the worksheet.

- Mail the completed form and your payment to the Tennessee Department of Revenue at the address indicated on the form before the due date to avoid penalties and interest.

After submitting your quarterly declaration and payment, keep a record of the transaction for your files. Should questions or concerns arise regarding your payment, the Tennessee Department of Revenue provides in-state toll-free and standard contact numbers for assistance. Adhering to the due dates and accurately completing the FAE 172 form not only complies with Tennessee tax regulations but also contributes to the smooth operational flow of your business initiatives throughout the fiscal year.

More About Tennessee Fae 172

What is the purpose of the Tennessee FAE 172 form?

The Tennessee FAE 172 form is designed for the taxpayer to declare and make quarterly estimated tax payments for franchise and excise taxes. These taxes apply to businesses operating within the state, and this form helps manage the tax liabilities throughout the tax year, ensuring that taxpayers stay compliant and avoid any potential penalties for underpayment or late submission.

Who needs to file the Tennessee FAE 172 form?

Any taxpayer anticipating a combined franchise and excise tax liability of $5,000 or more for the current tax year is required to file the Tennessee FAE 172 form. This includes both in-state and out-of-state businesses with taxable activities in Tennessee. The aim is to facilitate the prepayment of estimated taxes across four quarterly installments.

When are the quarterly payments due?

Quarterly payments for the estimated franchise and excise taxes are due on the following schedule:

- First payment: 15th day of the 4th month of the current taxable year.

- Second payment: 15th day of the 6th month of the current taxable year.

- Third payment: 15th day of the 9th month of the current taxable year.

- Fourth payment: 15th day of the 1st month of the following taxable year.

How is the estimated tax payment calculated?

The estimated tax payment can be calculated in one of two ways, whichever is less:

- 25% of the combined franchise and excise tax shown on the tax return for the preceding tax year, adjusted annually if the previous tax year was less than twelve months.

- 25% of the estimated combined franchise and excise tax liability for the current year.

What are the penalties for underpayment or late payment?

Penalties are imposed for any underpaid or late quarterly installment at the rate of 5% per month, up to a maximum of 25%. Additionally, interest at the current rate per annum is charged. The calculation for penalty and interest starts from the due date of the installment to the date paid or until the fifteenth day of the fourth month following the close of the taxable year. This emphasizes the importance of accurate and timely payments.

Which form should be used for franchise and excise tax payments?

All franchise and excise tax payments must be accompanied by the Tennessee Estimated Franchise, Excise Tax Declaration form (FAE 172). If taxpayers received a pre-addressed packet, it is advised to use the prenumbered vouchers and envelopes provided. Utilizing these prenumbered materials ensures the efficient processing of estimated payments and helps maintain accurate records for both the taxpayer and the Department of Revenue.

Common mistakes

Filling out the Tennessee Form FAE 172, which is used for declaring quarterly franchise and excise taxes, can be a complex process. Mistakes in this process not only could delay filing but may also result in penalties. Here are common mistakes people make:

- Neglecting the Instructions: A common error is not carefully reading the instructions on the reverse side of the form. These instructions are designed to guide taxpayers through each step, helping them to avoid errors that could lead to underpayment or overpayment of taxes. Missing this crucial step can lead to misunderstandings about how to properly fill out the form.

- Incorrect Tax Liability Calculation: Another mistake involves incorrect calculations of estimated franchise and excise tax liabilities. This step is fundamental to determining your quarterly payments. Misinterpretation of your financial data or simple mathematical errors can lead to incorrect amounts being declared – either too much or too little. This can result in unnecessary overpayments or undesired penalties and interest for underpayment.

- Forgetting to Use Pre-numbered Vouchers: The Tennessee Department of Revenue provides pre-numbered vouchers and envelopes for a reason. Using these materials can expedite the processing of your payments. Some taxpayers either overlook or choose not to use these provided materials, instead opting for generic envelopes or their own tracking systems, which can slow down the process and increase the risk of misplacement or processing errors by the Department of Revenue.

- Omitting Account or Identification Numbers: The form requires either a preprinted account number or the taxpayer's federal identification or Social Security number (FEIN/SSN). Failing to provide this information may lead to processing delays or the payment not being credited to the proper account. This oversight is often a simple forgetfulness or misunderstanding about the importance of these identifiers for tax processing.

To ensure a smooth filing process, taxpayers should take their time and carefully review every section of the Form FAE 172. Moreover, reaching out for assistance from the Tennessee Department of Revenue or a tax professional can help clarify any uncertainties and avoid these common pitfalls. Taking these precautionary steps can save time, money, and the hassle of dealing with tax filing corrections down the line.

Documents used along the form

Filing the Tennessee FAE 172 form is an important step for businesses to comply with state tax requirements, specifically for those with a combined franchise and excise tax liability of $5,000 or more during the tax year. Along with this form, there are several other documents and forms that might be needed to ensure full compliance and accurate financial reporting.

- FAE 170 - Franchise and Excise Tax Annual Return: This form is required for reporting the total franchise and excise tax obligation of a business for the entire fiscal year. It includes comprehensive details about the taxpayer's income, deductions, and credits.

- FAE 183 - Application for Extension of Time to File: If a business needs more time to prepare its annual franchise and excise tax return, this application allows for an extension, thereby avoiding penalties for late filing.

- SS-4243 - Business Tax Registration: Before a business can file the FAE 172, it must have completed the Business Tax Registration form. This registers the business with the Tennessee Department of Revenue for tax purposes.

- LB-0456 - Certificate of Registration: Often required alongside tax filings, this document serves as proof that a business is legally registered to operate in the state of Tennessee.

- FAE 174 - Quarterly Franchise, Excise Tax Declaration Worksheet: This assists businesses in calculating their quarterly estimated tax payments accurately, ensuring that the amounts entered on the FAE 172 form are correct.

- FAE 147 - Claim for Refund: Should a business believe it has overpaid its taxes, this form is used to request a refund. It requires detailed documentation and justification for the refund claim.

For businesses to remain in good standing, understanding and utilizing these documents in conjunction with the FAE 172 form is critical. Each document serves a unique purpose in the tax preparation and filing process, providing clarity and compliance with Tennessee's tax laws. Proper management of these forms ensures businesses can navigate their tax obligations smoothly and efficiently.

Similar forms

The Form 1040-ES, used for calculating and paying estimated quarterly federal income tax by individuals, is quite similar to the Tennessee FAE 172 form. Both forms are intended for those who expect to owe a certain amount in taxes for the current year, necessitating the need for quarterly payments to avoid penalties. The structure of both forms involves calculating estimated tax liability and making payments at designated times throughout the fiscal year to manage tax obligations progressively, rather than all at once.

Another comparable document is the Form 941, which employers use to report quarterly federal payroll taxes. Like the FAE 172, this form is also filed quarterly and is crucial for reporting taxes withheld from employees' paychecks, as well as the employer's portion of social security and Medicare taxes. Both forms play a vital role in the regular tax administration and compliance process, ensuring entities meet their tax responsibilities timely and accurately.

The State Unemployment Tax Act (SUTA) tax filings, required by individual state governments, also share similarities with the Tennessee FAE 172 form. Businesses must file SUTA reports and contributions on a quarterly basis, similar to how businesses must make estimated franchise and excise tax payments in Tennessee. Both types of filings are essential for compliance with state regulations and involve periodic payments to avoid interest and penalties.

Form 1120-W is the equivalent for corporations needing to calculate and pay their estimated quarterly federal income tax. Just as with the FAE 172 form, corporations use these estimates to manage their tax obligations throughout the year, ensuring they are meeting their tax liabilities in increments. This process helps corporations avoid large year-end tax bills and penalties associated with underpayment.

Lastly, the Quarterly Federal Excise Tax Return, Form 720, has parallels with the Tennessee FAE 172, as it's used by businesses to report and pay federal excise taxes on specific goods, services, and activities. Both require regular, quarterly submissions and address different types of taxes that businesses are obligated to pay. By filing these reports and making payments quarterly, businesses can better manage their cash flow and stay in compliance with tax laws.

Dos and Don'ts

When filling out the Tennessee FAE 172 form, a few key practices can ensure accuracy and compliance. Below are ten points detailing what you should and shouldn't do:

- Do carefully read the instructions provided on the reverse side of the form before beginning. Understanding the instructions can help prevent mistakes.

- Do use the pre-numbered vouchers and envelopes provided by the Tennessee Department of Revenue if they are available to you. This helps expedite the processing of your payments.

- Do enter the amount from Line 4 of the worksheet in the "Amount of Payment" field on the voucher accurately.

- Do ensure that your check is made payable to the Tennessee Department of Revenue when submitting your payment.

- Do round figures to the nearest dollar on the FAE 172 form to comply with the rounding instructions.

- Don’t file the voucher if Line 4 of your worksheet indicates a zero. In this case, submitting the voucher is unnecessary.

- Don’t forget to include either your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) when your account number is not preprinted or known.

- Don’t delay in making your quarterly payments. Late payments can result in penalties and interest charges. Adhere to the due dates specified on the form.

- Don’t underestimate your tax liability. Ensure that you calculate your payments accurately to avoid underpayment penalties.

- Don’t ignore the Record of Estimated Tax Payments section. Keeping accurate records can assist you in managing your tax obligations and can be helpful if any disputes arise.

Filling out the Tennessee FAE 172 form accurately and on time plays a crucial role in managing your franchise and excise tax obligations. By following these do's and don’ts, you can navigate the process more smoothly and avoid common pitfalls.

Misconceptions

Understanding the complexities of tax compliance involves unravelling common misconceptions. The Tennessee FAE 172 form, a quarterly franchise and excise tax declaration, is no exception. Misinterpretations of this document can lead to confusion and errors in tax filing. Here are 10 such misconceptions and the truths behind them:

- Every business in Tennessee must file the FAE 172 form. In reality, only taxpayers with a combined franchise and excise tax liability of $5,000 or more for the current tax year are required to make these quarterly estimated tax payments.

- The form can be submitted without payment if the calculated quarterly payment is zero. Contrary to this belief, if Line 4 of the worksheet results in zero, taxpayers are instructed not to file the voucher, emphasizing the conditionality of submission based on the payment amount.

- Payments are due monthly. This is inaccurate. The form stipulates that payments are due quarterly, specifically on the 15th day of the fourth, sixth, and ninth months of the current year, and the first month of the succeeding year.

- The form applies to personal taxes as well. The FAE 172 is specifically designed for the declaration of franchise and excise taxes, not personal income taxes, focusing on business entities.

- Penalties and interest don't begin to accrue immediately after a missed payment deadline. In truth, penalties at the rate of 5% per month (up to 25%) and interest at the current rate per annum are imposed from the due date of the installment until paid.

- The Department of Revenue does not provide support for filling out the form. Assistance is readily available through in-state toll-free numbers and a non-toll-free number for calls outside of Tennessee, debunking the myth of inadequate support.

- Tax credits and previous overpayments can't reduce your estimated liability. The form clearly allows for deductions of franchise, excise tax credits, and prior year overpayments from the estimated tax liability, directly impacting the calculation of quarterly payments.

- There is no record-keeping section on the FAE 172 form. The second part of the form is dedicated to the record of estimated tax payments, ensuring taxpayers can track the amount and date of each payment.

- All businesses must annually file the FAE 172. The requirement is quarterly estimated payments for those who meet the specified tax liability threshold, not an annual filing mandate for all businesses.

- Online submission of the FAE 172 form is not available. While the document itself suggests mailing payments, the Tennessee Department of Revenue has made strides in digitalizing tax submissions, including options for online filing which may confuse some taxpayers about their options.

Dispelling these myths is vital for accurate and compliant franchise and excise tax filing in Tennessee. Taxpayers should ensure their understanding is based on reliable resources and, when in doubt, seek assistance directly from the Tennessee Department of Revenue.

Key takeaways

When completing and submitting the Tennessee FAE 172 form, the following key takeaways are crucial for accurately handling your quarterly franchise and excise tax declarations:

- Taxpayers with a combined franchise and excise tax liability of $5,000 or more for the current tax year are required to make four quarterly estimated tax payments.

- Payments are due on specific dates: the 15th day of the fourth, sixth, and ninth months of the current year, and the first month of the following year.

- It is important to use the prenumbered vouchers and envelopes provided by the Tennessee Department of Revenue to expedite the processing of your payments.

- When calculating your estimated payment, enter the amount from Line 4 of the worksheet onto the "Amount of Payment" field on the voucher.

- If Line 4 of your worksheet shows zero, there is no need to file the voucher.

- Make sure all payments are made payable to the Tennessee Department of Revenue and mailed to the correct address.

- For any questions or assistance, the Department of Revenue offers toll-free and local phone support.

- The necessary minimum amount for each quarterly payment is the lesser of 25% of the previous year's combined tax, annualized if less than 12 months, or 25% of the current year's liability.

- Late or insufficient payments are subject to penalties at a rate of 5% per month, up to a maximum of 25%, in addition to interest charged at the current annual rate.

- Keep accurate records of all estimated tax payments, including dates paid and amounts, for your files and future reference.

Adhering to these guidelines will help ensure that your quarterly franchise and excise tax obligations are met in a timely and accurate manner. Failing to do so can result in significant penalties and interest charges. It is always recommended to consult with a professional if you have any uncertainties or unique circumstances.

Popular PDF Forms

Tennessee Dmv Forms - Record of formal pledge by Tennessee CPAs to the state board, showcasing their commitment to not practice while inactive.

How to Become a Teacher in Tn - Urges careful compliance with the documentation requirements for experiences from July 1 to June 30 of each fiscal year.

Class D License Tn - The structured format guides the user through providing essential information without oversights.