Fill Out a Valid Tennessee Inh 300 Form

The Tennessee Gift Tax Return, known as the INH 300 form, serves as a crucial document for individuals making gift transfers that exceed certain exemption levels as outlined by the Tennessee Department of Revenue. Grasping the nuances of this form is integral for residents and non-residents alike who plan to transfer real property within Tennessee, tangible personal property, or intangible personal property, depending on their residency status. The form details not only the methodology for reporting such gifts but also the specific exemptions available for gifts to Class A and Class B donees, allowing for a strategic approach to gift-giving that can minimize the tax burden. Furthermore, it clarifies the computation of taxes owed based on the classification of the recipient and the value of the gifts, highlighting the differences between gifts to spouse (which may qualify for marital deductions under specific conditions) and those to other relatives or organizations. Additional intricacies, such as the qualification criteria for gift splitting, the tax implications of gifts of future interest in property, and the procedure for electing deductions for qualified terminable interest property (QTIP), are also addressed, underscoring the form's comprehensive coverage. Importantly, it mandates the inclusion of detailed descriptions and valuations for a broad array of gifts, from real estate to stocks and beyond, ensuring that the full and true value of each gift is accurately reported. With penalties in place for late filings and specific dates and rates specified for computing both penalty and interest, timely and accurate completion of the Tennessee Gift Tax Return is essential for all who navigate this aspect of tax planning.

Example - Tennessee Inh 300 Form

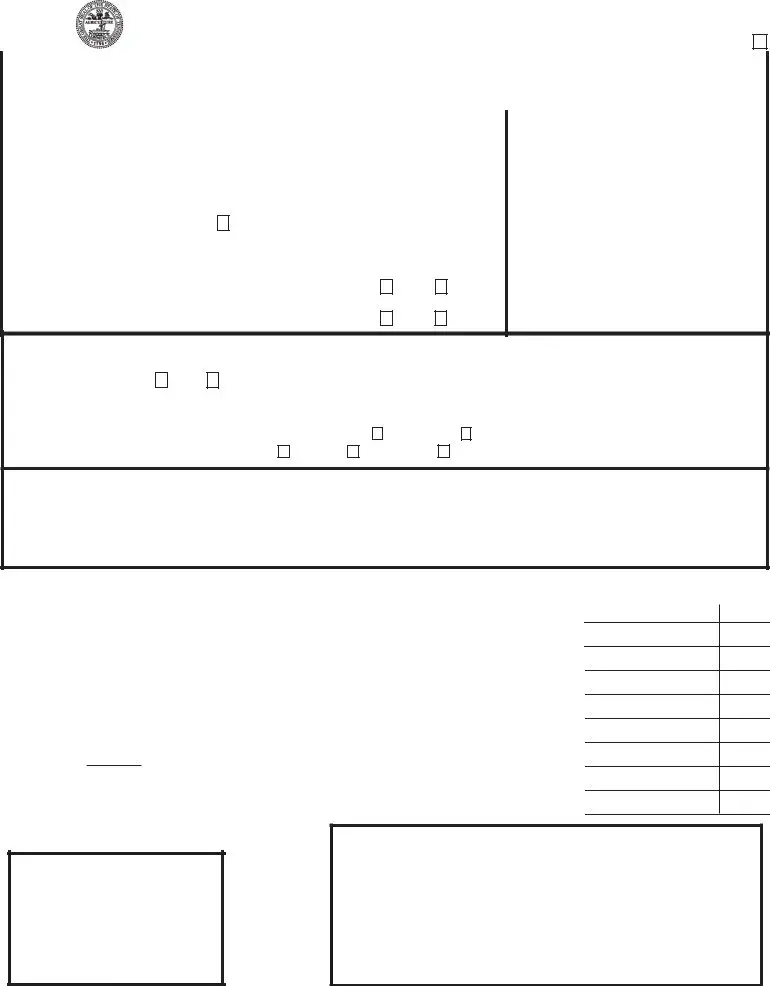

INH 300

TENNESSEE DEPARTMENT OF REVENUE STATE GIFT TAX RETURN

AMENDED RETURN

|

|

____ ____ ____ - ____ ____ - ____ ____ ____ ____ |

CALENDAR YEAR OF GIFT |

COUNTY |

DONOR'S SOCIAL SECURITY NUMBER |

|

|

|

NAME OF DONOR _______________________________________________________ |

The Tennessee Gift Tax is due April 15 of |

||||||||||

the year following the calendar year in |

|||||||||||

|

|

|

|

|

|

|

|

|

|

||

STREET ADDRESS ______________________________________________________ |

which gifts were made. |

||||||||||

|

|

|

|

|

|

|

|

|

|

Make your check payable to the Tennes- |

|

CITY, STATE AND ZIP CODE ______________________________________________ |

see Department of Revenue for the amount |

||||||||||

|

|

|

|

|

|

|

|

|

|

shown on Line 8 and mail to: |

|

If Donor is deceased, check here |

|

and enter date of death |

________________ |

||||||||

|

Tennessee Department of Revenue |

||||||||||

|

|

|

|

|

|

|

|

|

|

Andrew Jackson State Office Building |

|

TERMINABLE INTEREST MARITAL DEDUCTION |

|||||||||||

500 Deaderick Street |

|||||||||||

1.Do you elect, under the rules of 2523(f) I.R.C., to claim a marital deduction for |

Nashville, Tennessee 37242 |

||||||||||

gifts of qualified terminable interest property (QTIP)? YES |

|

|

NO |

|

|

|

|

||||

2.Is the gift a disposition of qualified terminable interest property (QTIP) under T.C.A. |

For assistance, you may call |

||||||||||

|

YES |

|

|

NO |

|

|

free |

||||

CONSENT OF SPOUSE - GIFTS BY HUSBAND OR WIFE TO THIRD PARTIES

Do you consent to have the gifts by you and by your spouse to third parties during the calendar year considered as made

each of you? |

YES |

|

NO |

|

If yes, consenting spouse must file return. |

|

||||||||||||

If the answer is "yes," complete Lines 1 through 3 and sign the consent line below: |

|

|||||||||||||||||

1. |

Name of spouse __________________________________ Spouse's social security number ________________________ |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

2. |

Were you married during the entire calendar year? YES |

|

|

NO |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

If the answer to 2 is "NO," check whether |

|

married, |

|

divorced, or |

|

|

widowed, and give date |

___________________ |

|||||||||

Consent of spouse - I consent to have the gifts made by me and my spouse to third parties during the calendar year considered as made

Spouse's signature ___________________________________________________ Date ___________________________ |

||||

|

|

|

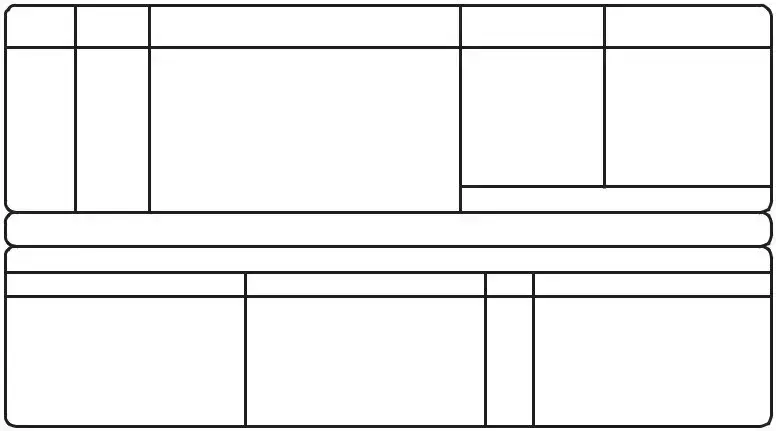

Round to Nearest Whole Dollar |

|

|

|

COMPUTATION OF TAX |

Dollars |

Cents |

1. |

Total Class A Tax |

|

00 |

|

2. |

Total Class B Tax |

|

00 |

|

3. |

Total Tax (Add Lines 1 and 2) |

|

00 |

|

4. |

Deduct: Extension payment |

|

00 |

|

5. |

Net Tax Due (Line 3 minus Line 4) |

|

00 |

|

6. |

Penalty (5% for each |

|

00 |

|

7. |

Interest ( |

% per annum on any taxes unpaid by the due date) |

|

00 |

8. |

Total Amount Due (Add Lines 5, 6, and 7) |

|

00 |

|

9. |

Refund Due (Must complete and attach Report of Debts if claiming refund of $200 or more) |

|

00 |

|

FOR OFFICE USE ONLY Acct. # ____________________

Date Rec'd ________________

Amt. Rec'd $ _______________

Under the penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is

true, correct and complete.

Donor's

signature __________________________________________ Date ______________

Preparer's

signature __________________________________________ Date ______________

Address __________________________________________ Phone _____________

City/State _________________________________________ ZIP _______________

INTERNET

INSTRUCTIONS

WHO MUST FILE A RETURN:

Provided that the total value of all gifts during the calendar year exceeds the applicable exemption levels, the State Gift Tax Return must be filed upon transfer by gift by any person of the following property or any interest therein:

(a)When the transfer is from a resident of this state:

(1)Real property situated in Tennessee.

(2)Tangible personal property, except that which is actually situated outside of Tennessee.

(3)All intangible personal property.

(b)When the transfer is from a nonresident of this state:

(1)Real property situated in Tennessee.

(2)Tangible personal property which is actually situated in Tennessee.

(c)Property in which a person holds a qualifying income interest for life, which is included for taxation pursuant to

CLASSIFICATION OF DONEES:

CLASS A - Husband, wife, son, daughter, lineal ancestor, lineal descendant, brother, sister,

CLASS B - Any other relative, person, association, or corporation not specifically designated in Class A.

EXEMPTIONS:

(a)There shall be allowed against the net gifts made during any calendar year a maximum single exemption of ten thousand dollars ($10,000) against that portion of the net gifts going to donees of class A, and maximum single exemption of five thousand dollars ($5,000) against that portion of the net gifts going to the donees of Class B.

(b)In the event the aggregate net gifts for any calendar year exceed the allowable maximum single exemptions, the tax shall be applicable only to the extent that the gifts, (other than gifts of future interest in property) to each donee exceed the following amounts:

CLASS A - Gifts made before 2002 - The sum of $10,000

CLASS A - Gifts made in 2002 through 2005 - The sum of $11,000 CLASS A - Gifts made in 2006 through 2008 - The sum of $12,000 CLASS A - Gifts made in 2009 and after - The sum of $13,000 CLASS B - The sum of $3,000

"Net gifts" mean that total amount of gifts made during any calendar year less allowable deductions.

IF THE TOTAL VALUE OF ALL GIFTS MADE BY A PERSON DURING ANY CALENDAR YEAR DOES NOT EXCEED THE EXEMPTION LEVELS, NO GIFT TAX RETURN IS REQUIRED OF SUCH PERSON, UNLESS CONSENTING TO SPLIT GIFTS.

Item

Date of

Gift

SCHEDULE A

Description of Gift - See Instructions

(Include Name of Each Donee)

Value of Gift

Commissioner

Appraisal

TOTAL

NOTE: To facilitate the Class A and B computations, the items listed above should be segregated into the following categories: (1) gifts to spouse, (2) gifts to Class A donees other than the spouse, (3) gifts to Class B donees, and (4) gifts to charity, public, and similar uses.

DONEES

Name

Address

Age

Relationship

INTERNET

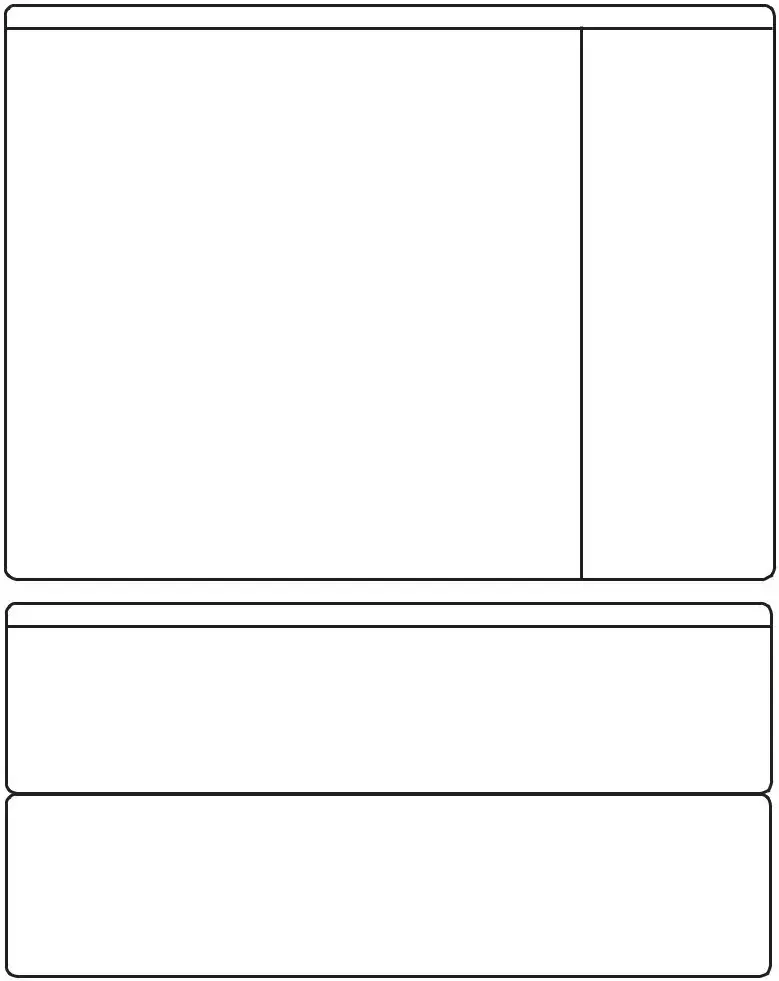

SCHEDULE B

COMPUTATION OF TAXABLE GIFTS

(1)Total gifts of donor (from Schedule A) ..................................................................................................

(2)

(3)Balance (Line 1 minus Line 2) .............................................................................................................

(4)Gifts of spouse to be included (from Line 2, Schedule B of spouse’s return) ....................................

(5)Total gifts (Line 3 plus Line 4) .............................................................................................................

(6)Deductions

(a)Total of items______ to ______ given to spouse .........................................................................

(b)Charitable, public and similar gifts .................................................................................................

(7)Total deductions [Line 6(a) plus Line 6(b)] ..........................................................................................

(8)Total gifts after deductions (Line 5 minus Line 7) ...............................................................................

(9)Total gifts to Class A donees ...............................................................................................................

(10)Total exclusions for the calendar year for each

Class A donee (except gifts of future interest) .....................................................................................

(11)Exemption: $10,000 less amount on Line 10 (if Line 10 is $10,000 or greater,

enter zero) Do not enter more than $10,000 on this line ..................................................................

(12)Total Class A exemptions (Line 10 plus Line 11) ...............................................................................

(13)Total taxable Class A gifts (Line 9 minus Line 12) ..............................................................................

(14)Total gifts to Class B donees (Line 8 minus Line 9) ...........................................................................

(15)Total exclusions not exceeding $3,000 for the calendar year

for each Class B donee (except gifts of future interest) .......................................................................

(16)Exemption: $5,000 less amount on Line 15 (if Line 15 is $5,000 or greater,

enter zero) Do not enter more than $5,000 on this line ....................................................................

(17)Total Class B exemptions (Line 15 plus Line 16) ...............................................................................

(18)Total taxable Class B gifts (Line 14 minus Line 17) ...........................................................................

(19)Total taxable gifts (Line 13 plus Line 18) .............................................................................................

________________________ |

1 |

________________________ |

2 |

________________________ |

3 |

________________________ |

4 |

________________________ |

5 |

________________________ |

6a |

________________________ |

6b |

________________________ |

7 |

________________________ |

8 |

________________________ |

9 |

________________________ |

10 |

________________________ |

11 |

________________________ |

12 |

________________________ |

13 |

________________________ |

14 |

________________________ |

15 |

________________________ |

16 |

________________________ |

17 |

________________________ |

18 |

________________________ |

19 |

SCHEDULE C

COMPUTATION OF TAX (For Gifts made after 1983)

(1) Class A taxable gifts from Schedule B, Line 13 |

|

|

AMOUNT |

RATE |

TAX |

(a)First $40,000, or part thereof = _______________________________ X 5.5% = _________________________________

(b)Next $200,000, or part thereof = ______________________________ X 6.5% = _________________________________

(c)Next $200,000, or part thereof = ______________________________ X 7.5% = _________________________________

(d)Amount over $440,000 .. ____________________________________ X 9.5% = _________________________________

(e) Total Class A tax (Add lines a through d and transfer to Page 1, Line 1) |

............... = |

_________________________________ |

(2) Class B taxable gifts from Schedule B, Line 18 |

|

|

AMOUNT |

RATE |

TAX |

(a)First $50,000, or part thereof = _______________________________ X 6.5% = _________________________________

(b)Next $50,000, or part thereof = _______________________________ X 9.5% = _________________________________

(c)Next $50,000, or part thereof = _______________________________ X 12.0% = _________________________________

(d)Next $50,000, or part thereof = _______________________________ X 13.5% = _________________________________

(e)Amount over $200,000 .. ____________________________________ X 16.0% = _________________________________

(f) Total Class B tax (Add lines a through e and transfer to Page 1, Line 2) |

= _________________________________ |

INTERNET

INSTRUCTIONS

DEDUCTION:

(a)Marital Deductions - There shall be allowed as a deduction in computing taxable gifts for a calendar year an amount equal to the gift(s) made by a donor to his/her spouse, provided they were married to each other at the time such gift(s) were made, and further provided that the property so transferred is not either of the following:

(1)Characterized as being a terminable interest; however, see (QTIP) election below.

(2)An interest in unidentified assets.

(b)Election to Deduct Qualified Terminable Interests - You may elect to claim a marital deduction for qualified terminable property or property interests. The election is irrevocable. The effect of the election is that the property (interest) will be treated as passing to the spouse and will not be treated as a nondeductible terminable interest. All of the other martial deduction requirements must still be satisfied before you may make this election.

Qualified terminable interest property is property that: (1 ) passes from the donor; and

(2) in which the spouse has qualifying income interest for life.

The spouse has a qualifying income interest for life if the spouse is entitled to all of the income for the property payable annually or at more frequent intervals, and during the spouse’s lifetime no person has a power to appoint any part of the property to any person other than the spouse.

In order to claim this election, you must check “yes” in the appropriate box on the face of the return. On Schedule A, you should group the property interests for which you made the election separately and mark them “Qualified Terminable Interest Property.” (QTIP)

(c)Charitable Deduction - There shall be allowed as a deduction in computing taxable gifts for a calendar year those gifts transferred to the United States, the State of Tennessee, or to any political subdivision thereof, any public institution herein for exclusively public purpose, or any corporation, society, association or trust therein, or in a state which grants a like exemption to such institutions in Tennessee formed for charitable, educational, scientific, or religious purposes.

DATES AND VALUATION:

The valuation of all property, real and personal, shall be appraised at its full and true value as of the date of the making of the gift.

INFORMATION REQUIRED:

1.REAL ESTATE - describe and identify each parcel so that it may be readily located for inspection and valuation. If formal appraisals are accomplished, attach a copy of the appraisal to the tax return. For city properties, state the street and number, ward, subdivision, block and lot identification numbers or letters. For rural properties, state the township, range, landmarks, number of acres and the road or street name upon which the property is located. For all improved properties, include a short statement of the type and description of the improvement(s). State the gross monthly rental for all parcels of real estate that are rented. Attach a copy of the lease for all leased parcels.

2.STOCKS AND BONDS - the description of stocks should indicate the number of shares, whether common or preferred price per share, exact name of corporation and, if not listed on a stock exchange, the address of the principal business office. If stock is listed, state the principal stock exchange upon which sold. The description of bonds should include quantity and denomination, name of the obligor, kind of bond, date of maturity, interest rate, and interest due dates. State the exchange upon which the bonds are listed, or if unlisted, the principal business office address of the company or municipality.

3.

4.NOTES AND MORTGAGES RECEIVABLE - indicate the face value, unpaid balance, date of the note or mortgage, date of maturity, name of maker, interest rate, interest dates, and a brief description of the property mortgaged.

5.ARTISTIC OR INTRINSICALLY VALUABLE GIFTS - attach a copy of the expert appraisal of the gift items.

6.GIFTS TO A TRUST - attach a copy of the trust agreement or governing instrument.

7.PARTIAL CONSIDERATION

8.POWERS OF APPOINTMENT - the exercise or release of a power of appointment may constitute a gift by the individual possessing such a power. In any case where such action has been taken, see

9.ACTUARIAL VALUATION OF FUTURE AND LlMITED ESTATES - computation of the values of any future, contingent or limited estate, income interest, or annuity must be attached to the tax return. Under

10.OTHER GIFTS - all other gifts should be fully described so that the value placed on the gift can be verified.

11.CONSENT OF SPOUSE - gifts made during the calendar year by the donor and spouse to third parties may be considered as being made

entirety, to perfect the election for gift splitting.

Form Breakdown

| Fact Number | Fact Detail |

|---|---|

| 1 | Governing Law: The Tennessee Gift Tax Return, INH 300, is governed by Tennessee Code Annotated (T.C.A.) §67-8-101 et seq. |

| 2 | Due Date: The Tennessee Gift Tax is due on April 15 of the year following the calendar year in which gifts were made. |

| 3 | Payable to: Payments for the Tennessee Gift Tax should be made to the Tennessee Department of Revenue. |

| 4 | Filing Requirement: A return must be filed if the total value of all gifts during a calendar year exceeds the applicable exemption levels unless consenting to split gifts. |

| 5 | Property Types: The return covers real property in Tennessee, tangible personal property (except out-of-state), and all intangible personal property for residents. For nonresidents, it covers real and tangible personal property situated in Tennessee. |

| 6 | Donee Classification: Donees are classified into Class A (e.g., husband, wife, son) and Class B (any other relative, person, association, or corporation not in Class A). |

| 7 | Exemptions: There's a maximum single exemption of $10,000 for Class A donees and $5,000 for Class B donee net gifts during any calendar year. |

| 8 | Marital Deduction: A marital deduction for gifts made to a spouse is allowed, provided the property transferred is not characterized as having a terminable interest unless it qualifies under QTIP rules. |

| 9 | Penalties and Interest: The tax form includes penalties for late payment (5% for each 30-day period of delinquency up to 25%) and interest on unpaid taxes by the due date. |

| 10 | Split-Gifts Election: Couples can elect to consider gifts to third parties as made one-half by each, provided a "Consent of Spouse" is completed and they are married at the time of the gift without remarrying that year. |

Detailed Instructions for Filling Out Tennessee Inh 300

Ready to conquer the Tennessee INH 300 Form? This peculiar form piques the interest of those navigating the realms of state gift taxes. Don't let the formal name intimidate you—it's essentially your way of communicating with the Tennessee Department of Revenue about any gifts you've given within a calendar year. But before you dive into filling it out, knowing the steps can demystify the process and turn it into a breeze. Let's break it down into manageable parts, ensuring you can confidently complete the form and comply with state requirements.

- Start by marking if you're filing an amended return by checking the appropriate box at the top if applicable.

- Enter the Calendar Year of Gift, ensuring it accurately reflects the year the gifts were made.

- Fill in the County where the gift was given or where the donor resides.

- Provide the Donor's Social Security Number in the designated spaces.

- Under Name of Donor, write the full name of the person who gave the gift.

- Enter the donor's Street Address, including the city, state, and ZIP code below it.

- If the donor has passed away, check the box and enter the Date of Death.

- For questions regarding TERMINABLE INTEREST MARITAL DEDUCTION and CONSENT OF SPOUSE, read each question carefully and check "Yes" or "No" as applicable. If "Yes" is checked for consenting to spouse's gift, ensure to fill in the spouse’s name, social security number, state of marriage, and sign the consent.

- Under COMPUTATION OF TAX, input the appropriate figures in dollars and cents for total Class A Tax, total Class B Tax, and follow through to line 8 where you would list the total amount due, or line 9 for any refund due.

- Sign the form under penalties of perjury, indicating you have reviewed the report and to your best knowledge, it is true, accurate, and complete. Ensure the donor’s signature and date are filled in. If someone prepared the form on your behalf, their signature and date should also be included, along with their address and phone number.

After completing the form with the due diligence it demands, you'll forward it to the Tennessee Department of Revenue. The address is already provided on the form itself. Remember, this isn't just paperwork—it's an essential step in fulfilling your fiscal responsibilities. Ensuring accuracy and timeliness can save a great deal of hassle down the line. Should questions or concerns arise during this process, help is just a call away with both toll-free and direct contact numbers provided for your convenience.

More About Tennessee Inh 300

What is the Tennessee INH 300 form?

The Tennessee INH 300 form is a state gift tax return required by the Tennessee Department of Revenue. Individuals must file this form when they transfer gifts that exceed certain exemption levels within a calendar year. It covers transfers of real property in Tennessee, tangible personal property in or out of Tennessee, and all intangible personal property.

Who needs to file the Tennessee INH 300 form?

This form must be filed by any person who makes gifts during the calendar year that exceed the state’s exemption levels. These gifts could include real and personal property located in Tennessee for residents, and specific property located in Tennessee for non-residents. Additionally, if you are electing to split gifts with your spouse, you will need to file this form regardless of the gift's total value.

When is the Tennessee INH 300 form due?

The due date for filing the Tennessee INH 300 form is April 15 of the year following the calendar year in which the gifts were made. For example, if you made a gift in 2022, your form would be due by April 15, 2023.

Where should the Tennessee INH 300 form be filed?

The completed form along with any payment due should be mailed to the Tennessee Department of Revenue, located in the Andrew Jackson State Office Building, 500 Deaderick Street, Nashville, Tennessee, 37242.

What are the classification of donees and exemptions available?

Donees are classified into two categories:

- Class A: Includes close relatives like spouses, children, lineal ancestors and descendants, and siblings, among others.

- Class B: Includes any other relative, person, association, or corporation not classified as Class A.

How is the gift tax calculated?

Gift tax is calculated based on the net value of gifts made during the calendar year after exemptions and deductions. The net gifts are divided into Class A and Class B gifts, with different rates applied to each class. The form provides a detailed computation schedule to help calculate the tax owed.

What are some important deductions that can be claimed?

Deductions can include gifts made to a spouse (excluding terminable interests unless a QTIP election is made), charitable contributions, and other specific deductions as outlined in the instructions of the form. The calculation section helps determine the taxable gifts after taking these deductions into account.

What kind of documentation is required for filing?

Filers must provide detailed descriptions of the gifts, including valuation appraisals for real estate, stocks, bonds, and other significant gifts. For real estate, descriptions should enable easy location for inspection. Financial statements for non-listed entities and appraisals for intrinsic or high-value gifts may also be necessary.

What if I need to amend a previously filed INH 300 form?

If errors were made or if new information needs to be included after an INH 300 form has been filed, an amended return should be filed. There is a specific box to indicate that the filing is an amendment, and the filer should correct or add the new information as needed.

Where can I get assistance with the Tennessee INH 300 form?

For assistance, individuals can call the Tennessee Department of Revenue. There are toll-free and direct numbers available for in-state and out-of-state inquiries. Additionally, the Department of Revenue’s website offers resources and contact information for further help.

Common mistakes

Filling out the Tennessee INH 300 State Gift Tax Return can be a complex process, and errors can lead to unnecessary audits, penalties, or delays. Here are ten common mistakes people make when completing this form:

- Incorrectly filling out donor information, including the donor's full name, address, and Social Security Number. This basic information is crucial for the Department of Revenue to identify the taxpayer properly.

- Not checking the box "Amended Return" if submitting corrections to an already filed return. This oversight can cause confusion at the Department of Revenue, treating it as a duplicate rather than a correction.

- Failing to accurately report the Calendar Year of the Gift. The tax is due April 15 of the year following the calendar year in which the gifts were made. A common mistake is not aligning the gift year with the tax due year.

- Omitting or incorrectly entering the County. The county information helps in ensuring that any local tax implications are also considered.

- Forgetting to sign and date the consent section in the case where gifts by a husband or wife to third parties are to be considered as made one-half by each. This is critical for joint filings and affects tax calculations.

- Not rounding to the nearest whole dollar on the Computation of Tax section. The form specifies that amounts should be rounded, and failure to comply can lead to miscalculations.

- Incorrect classification of donees into Class A and Class B, affecting exemptions and tax rates. Knowing the classification of your donee is essential for accurate tax computation.

- Missing out on deductions such as marital deductions or charitable deductions. Often taxpayers do not realize they can claim these deductions, leading to overestimation of tax dues.

- Incorrect valuation of gifts in Schedule A, especially real estate or stocks, by not using fair market value or not attaching required documentation like appraisals.

- Not fully completing the “Information Required” section with detailed descriptions of property transferred, which can delay the processing of the return or result in incorrect tax assessments.

Understanding the importance of accurate and complete submissions can significantly minimize errors. Taxpayers are encouraged to review their form carefully or seek professional guidance to ensure compliance with the Tennessee Department of Revenue requirements. Avoiding these common pitfalls not only streamlines the process but also maximizes your eligible deductions, ultimately safeguarding against overpayment and penalties.

Documents used along the form

When dealing with the Tennessee Inh 300 form, a variety of other forms and documents often come into play to ensure a comprehensive approach towards managing one's gifts and inheritance. These forms and documents are critical for a smooth process, as they can provide essential details or support specific claims made on the Tennessee Inh 300 form.

- IRS Form 709 (United States Gift (and Generation-Skipping Transfer) Tax Return): This federal form is used alongside the Tennessee Inh 300 to report gifts that exceed annual exclusion limits. It is essential for reconciling state and federal gift tax obligations.

- Last Will and Testament: This document outlines the decedent's final wishes regarding their estate and beneficiaries. It can provide context for gifts made during the lifetime of the donor.

- Trust Documents: Trusts might be involved in gifting strategies to minimize taxes or manage how gifts are distributed. These documents establish the terms under which the trust operates.

- Appraisal Documents: For gifts of property or items of significant value, professional appraisals support the declared value of these gifts on both Tennessee Inh 300 and IRS Form 709.

- Bank Statements or Financial Records: These can serve as proof of the donor's ownership and transfer of funds or assets, providing a transaction history that supports the reported gifts.

- Deeds and Titles: For gifts involving real estate or vehicles, deeds and titles prove the transfer of ownership. They might be required to ascertain the value and legitimacy of these gifts.

- Marital Deduction Documents: If taking advantage of marital deductions for gift taxes, documentation proving the marriage's validity and any gifts made directly to a spouse will be necessary.

- Receipts of Charitable Contributions: If gifts were made to charity, these receipts are crucial for substantiating deductions and ensuring compliance with both state and federal regulations.

- Gift Splitting Consent Forms: If spouses are splitting gifts to maximize their exclusions, signed consent forms are required to validate this strategy on both their state and federal tax returns.

Each document or form plays a pivotal role in the thorough and accurate reporting of gifts. It's essential for individuals to maintain detailed records not just for tax compliance but also for personal financial planning. The process might seem complex, but each step ensures that every gift, whether small or significant, is accounted for in a manner that respects the legal and fiscal frameworks in place.

Similar forms

The Federal Gift Tax Return (Form 709), used by individuals to report gifts to the IRS, bears a striking resemblance to the Tennessee Inh 300 form in its purpose to disclose gifts exceeding certain thresholds within a year. Both forms necessitate the donor's personal details, the nature and value of the gifts given, and any applicable deductions like marital or charitable ones. Although they serve the same fundamental purpose, the key difference lies in their jurisdiction - one at the federal level and the other specific to Tennessee.

The Estate Tax Return (Form 706), for instance, is another document that parallels the Tennessee Inh 300 form, particularly in its focus on transfers of wealth. While the Inh 300 concerns gifts made during the donor's lifetime, the Estate Tax Return addresses the transfer of an individual's assets upon their death. Each form necessitates detailed information about the assets transferred, the recipient, and the value, to ensure proper taxation based on the applicable laws.

State-Specific Gift Tax Returns in jurisdictions other than Tennessee share a foundational premise with the Tennessee Inh 300 form. These documents outline the reporting of gifts that fall under state regulation, varying slightly in thresholds and exemptions depending on local law. Such similarities highlight the universal approach to monitoring substantial transfers of wealth to prevent tax avoidance.

The Allocation of Generation-Skipping Transfer Tax (Form 706 GS-T) is developed to address specific gifts that skip a generation. Similarly, the Inh 300 form encompasses the need to report gifts to non-immediate family members, potentially implicating generation-skipping scenarios. Both documents ensure the appropriate taxation of wealth transfers that could otherwise impact governmental revenue across generational lines.

Marital Deduction Forms for gift and estate taxes at the federal level resonate with sections of the Tennessee Inh 300 form that consider spousal transfers. These provisions allow for the strategic planning of asset transfers between spouses, aiming to minimize the tax impact of such gifts. Both documents reflect the tax code's accommodation for marital property transfers, emphasizing their importance within family financial planning.

The Charitable Donation Tax Deduction Form, employed to record donations to non-profit entities, shares its core objective with aspects of the Inh 300 form regarding charitable gifts. Each allows for the deduction of eligible contributions from the total taxable amount, encouraging philanthropic activities while ensuring compliance with tax regulations.

The Real Estate Transfer Declaration forms, required in various jurisdictions for significant property transactions, exhibit parallels with the real estate-related disclosures in the Tennessee Inh 300 form. While the former generally aims at capturing sales or transfers for local tax assessment purposes, both forms require detailed information on the property and the parties involved, underlining the importance of transparency in ownership transfers.

The Annual Exclusion Gift Form, although not a single standardized document, conceptually aligns with the Inh 300 form's approach to exempting certain gifts from taxation based on annual thresholds. This concept allows donors to plan their gift-giving within legal bounds to minimize tax liabilities, demonstrating the tax code's allowances for gift transfers without immediate tax implications.

The Trust Income Tax Return (Form 1041) shares its concern with the Inh 300 form regarding the transfer of assets to or within trusts. Both documents necessitate the declaration of assets placed into trusts and potentially subject to different tax treatments, underscoring the complexity and strategic planning potential within trust and estate planning.

Lastly, the Amended U.S. Gift (and Generation-Skipping Transfer) Tax Return (Form 709-A) is used to correct or update previously filed Form 709s, mirroring the option within the Tennessee Inh 300 form for amending returns. This capability is critical for maintaining accuracy and compliance over time as circumstances or interpretations of tax law change.

The Non-Grantor Trust Gift Reporting Form, a hypothetical document, would share the characteristics of the Tennessee Inh 300 form by requiring detailed disclosures regarding gifts made by trusts. Even though specific forms vary by jurisdiction and trust structure, the principle remains consistent: tracking transfers of wealth to ensure proper taxation and adherence to regulations, similar in essence to the goals of the Tennessee Inh 300 form.

Dos and Don'ts

Filling out the Tennessee INH 300 form, the State Gift Tax Return, requires attention to detail and an understanding of the applicable rules and exemptions. Below are essential dos and don'ts to consider when completing this form.

Do:- Review instructions thoroughly: Before starting, carefully read the form's instructions to ensure a clear understanding of the requirements.

- Gather all necessary documents: Collect all documentation related to the gifts made, including appraisals for real estate and valuable personal property.

- Check the calendar year of the gift: Verify the gift's calendar year to report it accurately on the form.

- Round to the nearest whole dollar: When entering financial information, round your numbers to the nearest whole dollar as instructed on the form.

- Sign and date the form: Ensure the form is signed and dated by the donor and, if applicable, the preparer. This attests to the truthfulness and completeness of the return.

- Consider marital deductions: If applicable, make sure to correctly apply for marital deductions, especially in the case of qualified terminable interest property (QTIP).

- Keep copies for your records: After submitting the form, keep a copy for your records in case of future inquiries or the need for amendments.

- Use the correct mailing address: Confirm the mailing address for the Tennessee Department of Revenue to avoid delays.

- File on time: Be mindful of the April 15 deadline for the year following the calendar year in which gifts were made to avoid penalties.

- Attach required schedules and documentation: Schedule A and Schedule B must be completed accurately. Attach all necessary documents such as appraisals, trust agreements, and copies of balance sheets for non-listed corporations.

- Delay seeking clarification: If any aspect of the form is unclear, don't hesitate to contact the Tennessee Department of Revenue for assistance rather than guessing.

- Forget to check eligibility for exemptions: Not reviewing and claiming applicable exemptions could lead to overpayment of taxes.

- Overlook spousal consent section: If splitting gifts with your spouse, ensure the consent section is completed correctly to avoid tax implications.

- Ignore valuation guidelines: Failing to follow the proper guidelines for valuing property can result in inaccurate tax calculations and potential penalties.

- Leave sections incomplete: Do not skip sections or leave them blank; this could cause processing delays or result in the return being considered incomplete.

- Misclassify donees: Incorrectly classifying donees as Class A or Class B may affect tax calculations and exemptions.

- Underestimate penalties and interest: Neglecting to calculate or underestimating penalties and interest due for late payments can lead to an inaccurate total amount owed.

- Fail to report all gifts: Omitting gifts made during the calendar year can result in penalties and interest for underreported tax obligations.

- Incorrectly report real estate and tangible personal property: Be precise in reporting gifts of real estate located in Tennessee and tangible personal property, whether situated in Tennessee or outside.

- Rush through the process: Take your time to ensure accuracy and completeness, reducing the likelihood of errors that could lead to an amended return or penalties.

Misconceptions

Understanding the Tennessee INH 300 form, or the State Gift Tax Return, involves navigating through a lot of technical details and specific conditions. This has led to several misconceptions, which are important to clarify for accurate tax reporting and compliance.

- Misconception 1: The Tennessee Gift Tax applies to every gift, regardless of the amount.

- Misconception 2: Non-residents of Tennessee are not subject to the Tennessee Gift Tax.

- Misconception 3: All gifts to family members are exempt from the gift tax.

- Misconception 4: The INH 300 form must be filed shortly after the gift is made.

- Misconception 5: Marital deductions are automatically granted for all gifts between spouses.

- Misconception 6: Consent of spouse for gift splitting is optional and does not impact tax liability.

- Misconception 7: The valuation of gifts is based on the donor's perceived value.

- Misconception 8: Any type of gift, regardless of its nature, should be reported on the INH 300 form.

- Misconception 9: Preparing and filing the INH 300 form is straightforward and does not require detailed financial records.

- Misconception 10: Amendments to the INH 300 form are not permitted after submission.

Clarification: The Tennessee Gift Tax only applies if the total value of all gifts made during the calendar year exceeds the applicable exemption levels.

Clarification: Non-residents may still need to file a return if they transfer real or tangible personal property situated in Tennessee.

Clarification: While there are exemptions, they apply up to certain amounts and dependent on the recipient’s classification (Class A or Class B).

Clarification: The due date for filing the INH 300 and the accompanying tax payment is April 15 of the year following the calendar year in which gifts were made.

Clarification: The marital deduction is allowed under specific conditions and must meet certain criteria, including the treatment of qualifying terminable interest property (QTIP).

Clarification: Electing gift splitting with spouse’s consent can significantly impact tax liability, making both spouses jointly liable for the tax.

Clarification: Property must be appraised at its full and true value as of the date the gift is made, following guidelines for specific types of property.

Clarification: Certain exemptions and exclusions apply, for example, charitable gifts, which may not require reporting under specific conditions.

Clarification: Detailed information and potentially complex calculations are required, especially concerning the valuation of gifts and determining applicable deductions and exemptions.

Clarification: If necessary, an amended return can be filed to correct or update information on previously submitted returns.

Correct understanding of the Tennessee INH 300 form is important to ensure compliance with the state’s gift tax regulations. Individuals considering making significant gifts or who have questions about their gift tax situation should consult with a tax professional or the Tennessee Department of Revenue for guidance.

Key takeaways

When managing the Tennessee INH 300 form, which pertains to the State Gift Tax Return, it's essential to understand the specific requirements and procedures associated with its completion and submission. Here are key takeaways to guide individuals through this process:

- The Tennessee Gift Tax is applicable to gifts made within a calendar year and requires filing by April 15 of the following year.

- Payment of the gift tax should be made to the Tennessee Department of Revenue, and the INH 300 form along with the payment must be sent to their designated address in Nashville.

- Individuals are obligated to file a return if the total value of all gifts during the calendar year surpasses the exemption amounts provided by law, taking into account the nature and class of the donee.

- Classification of donees into Class A (e.g., direct relatives like children, siblings) and Class B (all other recipients) directly impacts the tax computation.

- Exemptions and deductions are available and vary based on the class of the donee, with specific amounts deductible for gifts to Class A and Class B donees.

- The form permits electing a marital deduction for gifts of qualified terminable interest property (QTIP), with the spouse’s consent required for certain gift-splitting approaches.

- Accurate valuation of gifts is crucial, and the form requires detailed descriptions of the gifts including real estate, stocks, bonds, and other types of gifts, potentially needing formal appraisals.

- For non-taxable gifts, the requirement to file might still be present if electing for gift splitting between spouses, necessitating thorough completion of the consent section of the form.

- Penalties and interest may apply for late filing or payment, calculated based on the period of delinquency and the unpaid tax amounts.

Attention to detail and adherence to the laid-out rules and deadlines are essential in ensuring compliance and optimizing the tax implications of gift-giving within Tennessee. Individuals are encouraged to seek assistance directly from the Tennessee Department of Revenue or a qualified tax professional if uncertainties arise during the completion of the INH 300 form.

Popular PDF Forms

Tennessee Workers' Compensation Rules and Regulations - This requirement facilitates a critical aspect of workers' compensation, allowing for an informed and personal choice in medical care following workplace injuries.

Tennessee Uniform Certification - The attached Personal Financial Statement is crucial for assessing the economic disadvantage status of applicants.

What Vaccines Are Required for School in Tennessee - The certificate acts as a concise record for parents, schools, and healthcare providers to manage and verify immunization status.