Fill Out a Valid Tennessee Ss 4247 Form

Navigating the landscape of corporate amendments in Tennessee demands a clear understanding of the essential documents required by the state, among which the Tennessee SS 4247 form plays a pivotal role. Serving as the designated Articles of Amendment for Limited Liability Companies (LLCs) within Tennessee, this form facilitates the process of officially recording any changes to an LLC's original Articles of Organization. Positioned under the oversight of the Corporate Filings section of the Tennessee Secretary of State, located in Nashville's William R. Snodgrass Tower, the SS 4247 is enshrined within specific statutes - §48-209-104 of the Tennessee Limited Liability Company Act or §48-249-204 of the Revised Tennessee Limited Liability Company Act, respectively. The form lays out a structured approach for LLCs to declare amendments, including but not limited to, a change of company name, alterations in the principal business address, modifications of the registered agent or address, alongside any other pertinent modifications. Importantly, it allows for specifying the effective date of such amendments, whether immediate upon filing or designated for a future time, not exceeding the 90th day following submission. The document mandates the inclusion of the LLC's name as currently recorded, the detailed alterations being made, and the date of the amendment's adoption, ensuring a formal record of all changes is established. Additionally, it addresses the governance under which the amendment was adopted, indicating whether member approval was required or bypassed in favor of a Board of Governors' decision. With a modest filing fee and procedural clarity, the Tennessee SS 4247 form is a testament to the state's commitment to streamlining corporate governance while ensuring legal compliance and operational transparency for LLCs.

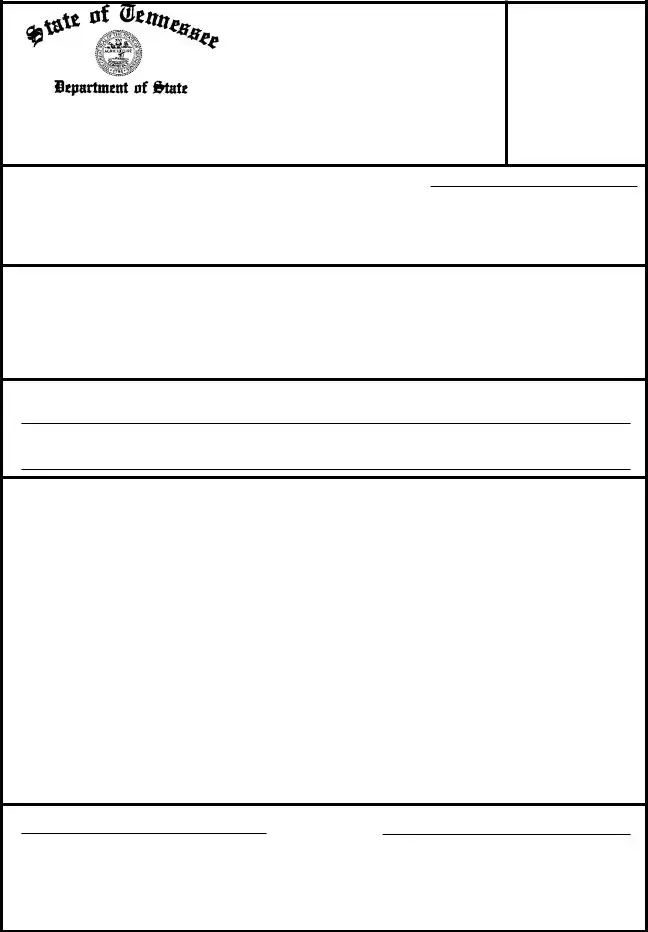

Example - Tennessee Ss 4247 Form

For Office Use Only

ARTICLES OF AMENDMENT

TO ARTICLES OF ORGANIZATION

Corporate Filings

(LLC)

312 Eighth Avenue North

6th Floor, William R. Snodgrass Tower

Nashville, TN 37243

LIMITED LIABILITY COMPANY CONTROL NUMBER (IF KNOWN)

PURSUANT TO THE PROVISIONS OF

PLEASE MARK THE BLOCK THAT APPLIES:

AMENDMENT IS TO BE EFFECTIVE WHEN FILED BY THE SECRETARY OF STATE.

AMENDMENT IS TO BE EFFECTIVE |

|

, |

|

(DATE) |

|

(TIME). |

|

|

|

|

(NOT TO BE LATER THAN THE 90TH DAY AFTER THE DATE THIS DOCUMENT IS FILED.) IF NEITHER BLOCK IS CHECKED, THE AMENDMENT WILL BE EFFECTIVE AT THE TIME OF FILING.

1.PLEASE INSERT THE NAME OF THE LIMITED LIABILITY COMPANY AS IT APPEARS ON RECORD:

IF CHANGING THE NAME, INSERT THE NEW NAME ON THE LINE BELOW:

2. PLEASE INSERT ANY CHANGES THAT APPLY:

|

A. PRINCIPAL ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

CITY |

STATE/COUNTY |

|

ZIP CODE |

||||||

|

B. REGISTERED AGENT: |

|

|

|

|

|

|

|

|

|

|

C. REGISTERED ADDRESS: |

|

|

|

|

|

|

|

||

|

STREET |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

TN |

|

|

|

|

|

|

|

CITY |

STATE |

ZIP CODE |

COUNTY |

|

|||||

|

D. OTHER CHANGES: |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

3. THE AMENDMENT WAS DULY ADOPTED ON |

|

|

|

|

|

|

|||

|

|

|

|

|

MONTH |

DAY |

YEAR |

|||

(If the amendment is filed pursuant to the provision of

BOARD OF GOVERNORS WITHOUT MEMBER APPROVAL AS SUCH WAS NOT REQUIRED MEMBERS

SIGNER’S CAPACITY |

|

SIGNATURE |

|

|

|

|

|

NAME OF SIGNER (TYPED OR PRINTED) |

Filing Fee: $20.00 |

RDA 2458 |

Form Breakdown

| Fact Name | Detail |

|---|---|

| Governing Law | The Tennessee SS-4247 form is governed by the Tennessee Limited Liability Company Act or the Tennessee Revised Limited Liability Company Act, specifically §48-209-104 or §48-249-204. |

| Primary Purpose | This form is used to make amendments to the Articles of Organization of a Limited Liability Company (LLC) in Tennessee. |

| Effective Date Option | Amendments can be made effective when filed or on a specified future date, not later than the 90th day after the document is filed, if indicated on the form. |

| Filing Requirements | Amendments can be adopted either by the board of governors without member approval, if not required, or by the members. The appropriate option must be indicated on the form. |

| Filing Fee | The required filing fee for the SS-424e7 form is $20.00. |

Detailed Instructions for Filling Out Tennessee Ss 4247

Once the decision to amend the Articles of Organization for a Limited Liability Company (LLC) in Tennessee has been made, the next step involves completing and submitting the SS-4247 form to the Secretary of State. This process formally registers any changes such as company name, principal address, or the registered agent. Ensuring accuracy during this process is critical for legal and operational purposes.

- First, if applicable, indicate the control number of the LLC in the space provided. This is for office use but can expedite the process if known.

- Decide when the amendment should take effect. Mark the appropriate block to have the amendment become effective upon filing or specify a different effective date and time, keeping in mind it cannot be later than 90 days after the filing date. If neither option is chosen, the amendment will take effect at the time of filing.

- Insert the name of the Limited Liability Company exactly as it appears on the records. If the amendment includes changing the company’s name, write the new name below the current one.

- Detail any changes to be made to the LLC’s Articles of Organization:

- If changing the principal address, provide the new street address, city, state/county, and ZIP code.

- For updates to the registered agent or registered address, include the new information as required.

- Specify any other changes under “Other Changes,” making sure to include clear and complete details.

- Indicate the date when the amendment was officially adopted by the LLC.

- If the amendment was adopted without member approval as it wasn’t required, check the appropriate box. Otherwise, check the box that member approval was obtained.

- Sign and print the name of the person completing the form, noting their capacity (e.g., LLC member or manager).

- Review the form to ensure all information is accurate and complete. Any incomplete or incorrect submissions can lead to delays.

- Submit the form along with the $20.00 filing fee to the Secretary of State’s office at Corporate Filings, 6th Floor, William R. Snodgrass Tower, 312 Eighth Avenue North, Nashville, TN 37243.

After submitting the form, it’s important to wait for confirmation from the Secretary of State that the amendment has been filed successfully. This confirmation serves as your official record of the amendment. Keep this document safely for future reference, as it may be required for legal or business matters. Remember to update any internal records and notify relevant parties of the changes to your LLC’s Articles of Organization.

More About Tennessee Ss 4247

What is the Tennessee SS-4247 form?

The Tennessee SS-4247 form, also known as Articles of Amendment to Articles of Organization, is a document filed with the Tennessee Secretary of State to make official changes to the articles of organization of a limited liability company (LLC). Changes might include alterations to the company name, principal address, registered agent, or other details originally filed.

When is filing the SS-4247 form necessary?

Filing the SS-4247 form is necessary whenever an LLC operating in Tennessee needs to update or amend any of the information included in its original Articles of Organization. This includes changes such as altering the company name, address, the designation of a new registered agent, or any other modifications to the original filing.

What is the cost to file the SS-4247 form in Tennessee?

The filing fee for the SS-4247 form is $20.00. This fee is required when submitting the form to the Tennessee Secretary of State to process the amendments.

How can the effective date for the amendments be specified?

On the SS-4247 form, there are options to specify the date and time when the amendments will become effective. A filer can either choose for the amendment to be effective upon filing or specify a date and time not to exceed 90 days from the date of filing. If no effective date is specified, the amendment will be effective upon the time of filing.

Who can adopt the amendments indicated on the SS-4247 form?

The amendments can be adopted either by the board of governors without member approval, if not required, or by the members of the LLC. This should be indicated on the form by checking the corresponding box that applies to the method of adoption.

What information is needed to complete the SS-4247 form?

- The name of the Limited Liability Company as it appears on record.

- The new name of the Limited Liability Company, if it is being changed.

- Any changes to the principal address, registered agent, or registered address.

- Details on other changes being made.

- The date the amendment was adopted.

- Signature and printed name of the individual completing the form, along with their capacity (e.g., member, manager).

What is the process for filing the SS-4247 form?

The SS-4247 form must be completed and submitted to the Corporate Filings division of the Secretary of State's office in Nashville, Tennessee, along with the applicable $20.00 filing fee. It can be submitted by mail or in person. Detailed instructions, including the mailing address and any additional requirements, can be found on the Tennessee Secretary of State’s website.

Can the SS-4247 form be filed electronically?

As of the current guidelines, the Tennessee Secretary of State does not provide an option to file the SS-4247 form electronically. The form needs to be either mailed or delivered in person to the Secretary of State's office.

Common mistakes

Filling out the Tennessee SS 4247 form, which serves to amend the Articles of Organization for a Limited Liability Company (LLC), is a crucial process that requires close attention to detail. However, several common missteps can complicate or delay the amendment's acceptance. Understanding these pitfalls can make the filing process smoother and ensure your amendments are processed without unnecessary hurdles.

People often make mistakes related to the timing of the amendment's effectiveness. There are options to have the amendment take effect immediately upon filing or at a specific date and time not later than the 90th day after the filing. Neglecting to choose an option causes the amendment to be effective at the time of filing by default. This oversight may clash with strategic business plans or fiscal considerations.

Another oversight occurs with the LLC's name. If the form is being used to change the LLC's name, it's vital to ensure the new name complies with Tennessee law and is distinct from other registered business entities. Failing to check the availability of the new name before filing can result in the rejection of the amendment due to name duplication or non-compliance with statutory naming conventions.

Adjustments to the principal address, registered agent, or registered office are also common areas of error. These sections require current, accurate information. A frequent mistake is providing a P.O. Box instead of a physical address, where required. Tennessee's regulations necessitate that the registered agent's address must be a physical location as it ensures legal and official documents can be directly delivered.

- Not specifying the effective date of amendment.

- Failure to check the availability of a new LLC name before filing.

- Providing incomplete or incorrect information about the new principal address.

- Listing a P.O. Box where a physical address is required, particularly for the registered agent or office.

- Omitting or incorrectly completing the section regarding the adoption of the amendment, including whether member approval was necessary.

- Miscalculating the filing fee or submitting the wrong amount, which can delay processing.

- Neglecting to sign the document or print the name of the signer, undermining the document's validity.

- Overlooking the need to complete specific sections based on the type of amendment being made, especially in cases where detailed changes are being documented.

Avoiding these mistakes requires a careful review of the form before submission. It’s also wise to consult with legal counsel or a professional familiar with business filings in Tennessee to ensure compliance with all requirements. Remembering that every detail matters on legal documents can save time, money, and frustration, helping to maintain the company's good standing and operational harmony.

In summary, while the SS 4247 form serves as a tool to amend vital business information, its correct completion is non-negotiable. By understanding and avoiding the common pitfalls outlined above, businesses can ensure a smoother amendment process, keeping their records up to date and in compliance with Tennessee law.

Documents used along the form

When dealing with changes within a Limited Liability Company (LLC) in Tennessee, the SS-4247 form serves as a critical step towards formalizing amendments to the Articles of Organization. However, this document doesn’t stand alone in the process of documenting modifications or compliance within a company's administrative framework. Several other forms and documents are commonly used alongside the SS-4247 to ensure a holistic approach towards maintaining or updating an LLC’s official records. Below is a brief overview of four such forms and documents that might be needed.

- Articles of Organization (SS-4270): This is the foundational document required to form an LLC in Tennessee. It includes basic information about the LLC, such as its name, principal address, and the name and address of its registered agent. Any amendments made through the SS-42412 form would initially reference information provided in the Articles of Organization.

- Change of Registered Agent/Office (SS-4538): If an LLC needs to change its registered agent or the office address, this form must be completed. It's particularly relevant if the amendments filed via SS-4247 involve changes to the registered agent or office locations.

- Annual Report (SS-4233): Tennessee LLCs are required to file an annual report with the Secretary of State. This report updates or confirms the company’s information, including changes to management, address, or the registered agent that might have occurred during the year. Although it's a separate requirement, it complements the maintenance of current and accurate records initiated by amendments through the SS-4247.

- Dissolution Form (SS-4242): If an LLC decides to wind up its affairs, this form is necessary to officially dissolve the company within the state. While it's hoped that filing the SS-4247 contributes to a company’s growth or adaptation, understanding the processes for closing a business is also crucial.

While navigating the regulatory landscape of managing an LLC in Tennessee, understanding each of these documents and their significance can provide clarity and ensure compliance. Whether amending the Articles of Organization or taking other significant administrative steps, knowing what forms accompany the SS-4247 can streamline the process and help maintain the LLC's good standing in the eyes of the law. Working alongside knowledgeable professionals, an LLC can effectively navigate these requirements, keeping focus on thriving in its business endeavors.

Similar forms

The Tennessee SS-4247 form for amending the Articles of Organization for a Limited Liability Company (LLC) bears resemblance to the Articles of Incorporation amendment form used for corporations. Both documents serve the purpose of officially recording changes in the foundational documents of business entities. While the SS-4247 form is specific to LLCs, indicating changes such as the company name, principal address, registered agent, and other amendments, the corporate equivalent also captures similar updates, including changes in corporate name, address, business scope, and officer information. Both forms are vital for ensuring that the public record accurately reflects the current status and structure of the business.

Similar to the SS-4247 form, a Statement of Change of Registered Agent or Registered Office is another document that enables a business to update its registered agent or office address with the state. Though focusing more narrowly on changes to the registered agent or office address rather than a broad array of amendments, this form is crucial for maintaining accurate and current information on where legal notices, and other official communications can be sent, ensuring compliance and preserving the entity's good standing within the state.

The Foreign LLC Application for Registration is akin to the SS-4247 in that it is filed by LLCs, but this form is used by companies organized outside the state seeking authorization to do business within the state. Like the SS-4247, it requires detailed information about the company, including its name, principal and in-state business addresses, and its registered agent. This ensures the state has sufficient information to regulate out-of-state entities operating within its jurisdiction, similar to how amendments via the SS-4247 ensure the state's records are up to date for in-state entities.

Annual reports or statements, required by many states for both LLCs and corporations, are somewhat analogous to the SS-4247 form. Although annual reports are primarily for updating the state on the entity's current operational status, including information on addresses, directors, and registered agents, they similarly ensure that the entity's public record remains current, aiding in regulatory compliance and transparency.

The DBA (Doing Business As) registration form, which businesses use to register a trade name, shares a common purpose with aspects of the SS-4247 form in allowing businesses to operate under a name different from their legal name. This parallels the SS-4247's ability to record a change in the name of an LLC, highlighting the importance of accurately reflecting how a business presents itself to the public and ensuring clear and legal identification in business operations.

Similarly, the Articles of Dissolution form, used when a company decides to legally end its existence, is related to the SS-4247 form in its procedural nature and its impact on a company’s legal standing. While the SS-4247 amends an entity's structure or details, dissolution documents formally conclude the entity's legal existence. Both processes require formal filings with the state to reflect significant alterations to the company's status and ensure compliance with state regulations.

The Certificate of Authority is another comparable document for LLCs and corporations seeking to operate in jurisdictions beyond their state of incorporation. Like the SS-4247, which amends information about an LLC within its home state, the Certificate of Authority application requires submission of similar company details to a foreign state, emphasizing the need for accurate representation in all areas of operation.

The LLC Operating Agreement amendment closely aligns with the purpose of the SS-4247 form, even if it isn't always filed with the state. An operating agreement amendment internally records changes within the LLC, such as shifts in membership, management structures, or contributions, which might also necessitate updates to the Articles of Organization through forms like SS-4247, ensuring both internal documents and state records are synchronized.

Lastly, the Biennial Statement for LLCs in some states, similar to annual reports, requires regular submission to update the state on basic company information. While its frequency and specific requirements might differ, its goal mirrors that of the SS-4247 form: keeping the state apprised of current company details to maintain good standing and regulatory compliance.

Dos and Don'ts

When completing the Tennessee SS-4247 form, understanding the do's and don'ts can streamline the process and ensure compliance with the Tennessee Limited Liability Company Act. Below are important guidelines to follow:

Do's:- Review the instructions carefully before starting the form to ensure a clear understanding of the requirements.

- Ensure the name of the Limited Liability Company (LLC) is precisely as it appears on record. If changing the name, the new name must be accurately inserted.

- Clearly state any changes being made to the Articles of Organization, such as changes to the principal address, the registered agent, or the registered address.

- Specify the effective date and time of the amendment if it is not meant to be effective upon filing. Remember, it cannot be later than the 90th day after the document is filed.

- Check the appropriate box to indicate whether the amendment was adopted by the Board of Governors without member approval or by the members.

- Don't leave any required fields blank. All relevant sections must be completed to avoid the form being returned or rejected.

- Do not forget to sign and print the name of the signer in the designated area at the bottom of the form. An unsigned form is not valid.

- Do not disregard the filing fee. Remember, the form must be accompanied by the correct filing fee of $20.00. Incorrect fees can delay processing.

- Do not use outdated information. Ensure that all information, especially contact details and registered addresses, is current and correct.

- Avoid making assumptions about the process or the information required. If in doubt, consulting the Secretary of State’s office or a legal professional can provide clarity.

Following these do's and don'ts can help ensure the amendment process is carried out efficiently and correctly, reflecting the current status and structure of your LLC accurately.

Misconceptions

Understanding the Tennessee SS-4247 form, which pertains to the Articles of Amendment to Articles of Organization for limited liability companies (LLCs), is essential for business owners wishing to update their LLC's records with the state. Several misconceptions about this document can lead to confusion and mistakes in the filing process. It is beneficial to clarify these misunderstandings to ensure a smooth amendment process.

- Misconception #1: Any changes to the LLC can be made using the SS-4247 form.

This is incorrect. The SS-4247 form is specifically designed for amending the Articles of Organization of an LLC. While it does allow for changes such as the company name, principal address, registered agent, and other modifications directly related to the Articles of Organization, it cannot be used for all kinds of changes. For example, updating member information or altering membership percentages would not be covered by this form.

- Misconception #2: The amendment is effective immediately upon submission.

While it is true that an amendment can be made effective upon filing, this is not an automatic process. The filer must expressly indicate this preference by marking the appropriate block on the form. If no box is checked, the amendment will indeed be effective at the time of filing by default. However, the form also provides an option to specify a different effective date and time, not to exceed 90 days after the filing date. If filers overlook this option, they may inadvertently set the wrong effective date for their amendment.

- Misconception #3: Member approval is always required to file an amendment.

This misunderstanding can cause unnecessary delays. The SS-4240 form clearly provides options regarding the adoption of the amendment. An amendment can be adopted by the board of governors without member approval if the Articles of Organization or operating agreement allows for such action. Conversely, if member approval is needed per the company’s governing documents, the appropriate box indicating this requirement must be checked. Understanding when member approval is required or not is critical to correctly completing and filing the form.

- Misconception #4: There is no filing fee for the amendment.

Contrary to what some may believe, there is a filing fee associated with submitting the SS-4247 form. The document states that a $20.00 filing fee must accompany the form. Overlooking or misunderstanding the requirement to include the filing fee can result in a rejection of the amendment filing, leading to delays and potential complications for the LLC.

Correcting these misconceptions and approaching the amendment process with a clear understanding of the form’s requirements and options can help ensure that the necessary changes to an LLC’s Articles of Organization are made efficiently and accurately. It is always advisable to review the form carefully and consult with a professional if there are any uncertainties about the process or how to complete the form correctly.

Key takeaways

When preparing to amend the Articles of Organization for a Limited Liability Company (LLC) in Tennessee, using the SS-4247 form is a fundamental step in the process. Its correct completion is crucial for ensuring the timely and accurate reflection of any changes in the company's official records held by the state. Here are seven key take myaways about completing and using this form effectively:

- Know the fee: A filing fee of $20.00 is required when submitting the SS-4247 form. This fee is essential for the processing of your amendment by the Corporate Filings section of the Tennessee Secretary of State.

- Understand the timing options: The form allows for the amendment to take effect either when it is filed by the Secretary of State or at a specific date and time chosen by you, provided it is no later than the 90th day after the date of filing. If no choice is made, the default is for the amendment to take effect upon filing.

- Clearly identify the LLC: It's important to insert the name of the LLC exactly as it appears on record. If you're changing the name of the LLC, the new name must be entered accurately on the designated line.

- Specify the changes: Any modifications need to be clearly detailed in the form, whether it's a change in the principal address, registered agent, registered address, or other amendments to the LLC's organization or operation.

- Adoption date is crucial: Indicating the date on which the amendment was adopted is a requirement. This confirms that the amendment has been duly executed according to the governing statutes of the Tennessee LLC Act or the Tennessee Revised Limited Liability Company Act.

- Approval method: The form requires specifying whether the amendment was adopted by the Board of Governors without member approval, if such was not required, or by the members themselves. This distinction is important to ensure compliance with the correct procedural requirements for amendments.

- Signature and Capacity: The form must be signed by an individual with the authority to file amendments on behalf of the LLC, and their capacity (e.g., a member or manager of the LLC) should be clearly indicated next to their signature.

Completing the SS-4247 form accurately is fundamental to the process of amending an LLC's Articles of Organization in Tennessee. Understanding these key aspects can help ensure the process is handled smoothly, reflecting the desired changes in the company's official state records without unnecessary delays or complications.

Popular PDF Forms

Notice of Completion Tennessee - A formal notification under Tennessee law by a corporation declaring the end of their property improvement project.

Qualified Income Trust Tennessee - Upon the grantor's death or change in Medicaid need, steps must be taken to appropriately close the QIT account in Tennessee.

How Long Does It Take for a Divorce to Be Final in Tennessee - For residents of Tennessee seeking divorce, this document formalizes the dissolution of marriage, incorporating terms on alimony, custody, and property division.