Fill Out a Valid Tennessee Uniform Certification Form

Embarking on the path toward becoming a Disadvantaged Business Enterprise (DBE) or an Airport Concession Disadvantaged Business Enterprise (ACDBE) within Tennessee signals the beginning of an advantageous journey for businesses aiming to level the playing field. The Tennessee Uniform Certification Program (TNUCP) plays a pivotal role in this mission by ensuring that disadvantaged firms gain maximum exposure to participate in contracts assisted by the Department of Transportation (DOT). This comprehensive initiative is carried out in harmony with the Final Rule 49 Code of Federal Regulations (CFR) Part 26, mandating a unified certification process across the state. For firms eager to dive into this opportunity, the TNUCP doesn't only simplify the process by requiring a single application for certification through any of its member agencies but also lays out a clear, detailed path towards certification. This encompasses a meticulous checklist and the necessity for notarization of crucial documents, demonstrating the program’s rigor in maintaining the integrity and fairness of the certification process. Moreover, it emphasizes the requirement for the applicant's principal place of business to be within Tennessee unless already certified in another state, reflecting the program's commitment to fostering local business growth and ensuring that businesses are rightly positioned to leverage the benefits of the DBE program. Ultimately, being listed in the TNUCP database opens doors for certified firms, allowing them to participate more fully in the economic mainstream and contribute to the state’s vibrant transportation infrastructure.

Example - Tennessee Uniform Certification Form

Tennessee

Uniform

Certification

Program

Member Agencies

Tennessee Department of Transportation

Metropolitan Knoxville Airport Authority

Chattanooga

Metropolitan

Airport Authority

Memphis Shelby County Airport Authority

Metropolitan Nashville Airport Authority

Chattanooga Area

Regional

Transportation Authority

Memphis Area

Transit Authority

Nashville Metropolitan Transit Authority

Jackson Transit

Authority

Smyrna Airport

Authority

Commission

Clarksville Transit

System

Regional Transportation Authority [Middle TN]

Knoxville Area Transit

Jackson Airport

TENNESSEE UNIFORM CERTIFICATION PROGRAM

(TNUCP)

Thank you for your interest in participating in the Tennessee Uniform Certification Program (TNUCP) to become a Disadvantaged Business Enterprise (DBE)/Airport Concession Disadvantaged Business Enterprise (ACDBE). Our DBE objective is to ensure that disadvantaged business firms have the maximum opportunity to participate in DOT assisted contracts.

The TNUCP is charged with the responsibility of certifying firms for the purpose of maintaining a database of certified DBEs for the United States Department of Transportation (U.S. DOT) grantees in the state of Tennessee. This is pursuant to the Final Rule 49 Code of Federal Regulations (CFR) Part 26 that requires U.S. DOT recipients to take part in a statewide uniform certification process.

Please complete the attached application if you wish to be considered for DBE certification. In order to avoid unnecessary delays, please complete all portions of the Uniform Certification Application and include all copies of documents requested on the application. In addition, the Affidavit of Certification and the Personal Financial Statement must both be notarized.

Additional documentation may be requested if it is considered necessary to make a certification determination. Incomplete applications will not be evaluated until all requested documentation has been submitted for review. We highly recommend that you keep a copy of all submitted documents for your records.

It is no longer necessary to apply for DBE certification at more than one of the member agencies. If your firm meets the criteria for certification, it will be entered in the TNUCP database. Only firms currently certified as eligible DBEs for the TNUCP may participate in the DBE program of U.S.

DOT grantees within the state of Tennessee. The TNUCP is not required to process an application for certification from a firm having its principal place of business outside the state of Tennessee if the firm is not certified in its home state. If the firm has its principal place of business in another state and is currently certified in that state, please contact the Tennessee Department of Transportation.

To participate in the TNUCP DBE/ACDBE program, please send the completed application and all supporting documentation to the appropriate member agency listed on the following page.

Page 1 of 18

Rev.

The following member agency processes ACDBE/ DBE applications. Please forward your completed certification packet to MMBC Uniform Certification Agency serving the area where your firm has its principal place of business:

Uniform Certification Agency P.O. Box 3060

158 Madison Avenue, Suite 300 Memphis, TN 38173

Tennessee Uniform Certification Program (TNUCP)

Application for Certification as a Disadvantaged Business Enterprise

(DBE)

INSTRUCTIONS AND INFORMATION

Please read these instructions completely and thoroughly!!!

1.All questions must be answered. Questions that do not apply to your firm should be marked “N/A.”

2.All documents requested on the Certification Checklist must be provided. Mark “N/A” for any items that do not pertain to your company.

3.The Personal Financial Statement enclosed must be filled out in its entirety leaving no line blank. This form

must be completed for each DBE applicant and this form must be signed by each DBE applicant in the presence of a Notary Public.

4.The Affidavit of Certification must be signed by the principal owner(s) in the presence of a Notary Public.

Please note that failure to complete the application as instructed above will delay processing and may result in a denial of certification as a Disadvantaged Business Enterprise.

For Your Information

1.An

2.Additional information may be required during the processing period. Delays in submitting requested information will cause a delay in processing the application.

3.Changes in ownership, control, or operation of the business should be reported within 30 days of the occurrence. Any changes in ownership or transfer of ownership two (2) years prior to submission of an application with the Tennessee Uniform Certification Program will not be acceptable and will be seriously scrutinized for timing and reasons for ownership change.

4.An applicant has the right to protest a Denial of Certification by filing an appeal with the U.S. Department of Transportation.

5.All certified businesses will be listed in the Directory of Disadvantaged Business Enterprises for the Tennessee Uniform Certification Program.

Page 2 of 18

Rev.

Tennessee Uniform Certification Program

(TNUCP)

Disadvantaged Business Enterprise

(DBE)

Renewal Application

→This document and its attachment must be completed in their entirety for each DBE owner←

PRINT NAME AND TITLE OF MAJORITY DISADVANTAGED OWNER(S):

___________________________________________________________________________________________________

BUSINESS NAME: ___________________________________________________________________________________________

MAILING ADDRESS: ________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

BUSINESS PHONE NUMBER: ___________________________ |

FAX NUMBER: ______________________________ |

EMAIL ADDRESS: _____________________________________ |

|

→DBE FIRM’S GROSS RECEIPTS (attach a copy of the firm’s most recent corporate tax return and all attachments, if applicable)

→DBE OWNER’S PERSONAL TAX RETURN (attach a copy of the most recent personal tax return and all attachments for each individual applying for disadvantaged status)

→PERSONAL FINANCIAL STATEMENT (This attached document must be filled out in its entirety, signed, dated and notarized by the applicant)

→HAS THERE BEEN A CHANGE IN OWNERSHIP/MANAGEMENT THIS PAST YEAR? YES____ NO ____

(If “YES,” you must submit all pertinent information to show changes in ownership)

I agree that the TNUCP will be notified in writing within 30 days of any changes in ownership and/or control, personal net worth and/or size standard that would impact the firm’s eligibility to remain in the program.

I, _____________________________________(NAME OF DBE FIRM OWNER{S}), swear (or affirm) that there have been no changes in

____________________________(NAME OF DBE FIRM) circumstances affecting its ability to meet the size, disadvantaged status, ownership

or control requirements of 49 CFR Part 26 and 13 CFR Part 121. I swear (or affirm) there have been no material changes in the information provided with __________________________________(NAME OF DBE FIRM) application for certification, except for any

changes about which I have provided written notice to_____________________________________(name of DOT recipient) pursuant to

49 CFR 26.83(i).

I swear (or affirm) that I am socially disadvantaged because I have been subjected to racial or ethnic prejudice or cultural bias, or have suffered the effects of discrimination, because of my identity as a member of one or more of the groups identified in 49 CFR 26.5, without regard to my individual qualities. I further swear (or affirm) that my personal net worth does not exceed $750,000, and that I am economically disadvantaged because my ability to compete in the free enterprise system has been impaired due to diminished capital and credit opportunities as compared to others in the same or similar line of business who are not socially and economically disadvantaged.

I specifically swear (or affirm) _____________________________(NAME OF DBE FIRM) continues to meet the Small Business

Administration (SBA) business size criteria and the overall gross receipts cap of 49 CFR Part 26 and _________________________(NAME

OF DBE FIRM) average annual gross receipts (as defined by SBA rules) over the previous three fiscal years do not exceed

_______________(dollar amount). I provide the attached size and gross receipts documentation to support this affidavit.

I certify that the above information is true and complete to the best of my knowledge and understand that knowingly and willfully providing false information to the Federal government is a violation of 18 U.S.C. 1001 (False Statements) which could result in fines, imprisonment or both.

Signature_____________________________________________ Date____________________________________________________

NOTARY CERTIFICATE:

|

PERSONAL FINANCIAL STATEMENT |

|

As of _________________ ,__________________ |

Name |

Business Phone |

|

|

Residence Address |

Residence Phone |

|

|

City, State, & Zip Code

Business Name of Applicant

|

ASSETS |

(Omit Cents) |

|

LIABILITIES |

(Omit Cents) |

|

|

Cash on hand & in Banks………… |

$_______________ |

|

Accounts Payable…………………………... |

$________________ |

|

|

Savings Accounts………………….. |

$_______________ |

|

Notes Payable to Banks and Others……… |

$________________ |

|

|

|

|

|

|

||

|

IRA or Other Retirement Account... |

$_______________ |

|

(Describe in Section 2) |

|

|

|

|

|

|

Installment Account (Auto)………………… |

$________________ |

|

|

Accounts & Notes Receivable……. |

$_______________ |

|

Mo. Payments $_______ |

|

|

|

Life |

|

|

Installment Account (Other)……………….. |

$________________ |

|

|

|

|

Mo. Payments $_______ |

|

|

|

|

Value Only …………………………. |

|

|

|

|

|

|

$_______________ |

|

Loan on Life Insurance…………………….. |

$________________ |

|

|

|

(Complete Section 8) |

|

|

|||

|

|

|

|

|

|

|

|

Stocks and Bonds………………….. |

$_______________ |

|

Mortgages on Real Estate…………………. |

$________________ |

|

|

(Describe in Section 3) |

|

(Describe in Section 4) |

|

|

|

|

|

|

|

|

||

|

Real Estate…………………………. |

$_______________ |

|

Unpaid Taxes……………………………….. |

$________________ |

|

|

(Describe in Section 4) |

|

(Describe in Section 6) |

|

|

|

|

|

|

|

|

||

|

$_______________ |

|

Other Liabilities……………………………… |

$________________ |

|

|

|

|

|

|

|||

|

Personal Property………………….. |

|

|

(Describe in Section 7) |

|

|

|

$_______________ |

|

|

|

|

|

|

(Describe in Section 5) |

|

|

|

|

|

|

|

|

Total Liabilities |

$________________ |

|

|

|

Other Assets……………………... |

|

|

|

||

|

$_______________ |

|

|

|

|

|

|

(Describe in Section 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$_______________ |

|

Total Assets – Total Liabilities= |

|

|

|

|

|

Net Worth |

$________________ |

|

|

|

|

|

|

|

|

Section 1. |

Source of Income |

|

|

Contingent Liabilities |

|

|

|

|

Salary……………………………… |

$_______________ |

|

|

As Endorser or |

$_______________ |

|

|

|

Net Investment Income……………. |

$_______________ |

|

|

Legal Claims & Judgments………………… |

$_______________ |

|

|

|

Real Estate Income………………... |

$_______________ |

|

|

Provision for Federal Income Tax…………. |

$_______________ |

|

|

|

Other Income……………………….. |

$_______________ |

|

|

Other Special Debt………………………….. |

$_______________ |

|

|

|

(Describe in section 1 below) |

|

|

|

|

|

|

|

Description of Other Income in Section 1.

*Alimony or child support payments need not be disclosed in “Other Income” unless it is desired to have such payments counted toward total income.

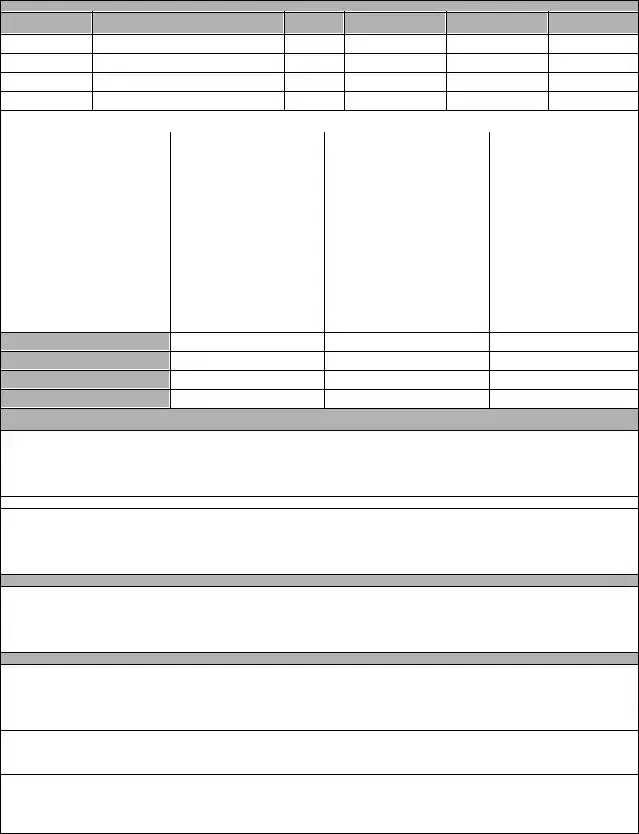

Section 2. Notes Payable to Banks and Other. (Use attachments if necessary. Each attachment must be identified as part of this statement and signed.)

|

|

|

|

Original |

|

|

Current |

|

Payment |

|

|

Frequency |

|

|

How Secured or Endorsed Type of |

|

|

Name and Address of Noteholder(s) |

|

||||||||||||||

|

|

|

Balance |

|

|

Balance |

|

Amount |

|

|

(monthly, etc.) |

|

|

Collateral |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 3. Stocks and Bonds. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed.)

Number of Shares

Name of Securities

Cost

Market Value

Quotation/Exchange

Date of

Quotation/Exchange

Total Value

Section 4. Real Estate Owned |

(List each parcel separately. Use attachment if necessary. Each attachment must be identified as a |

||

|

part of this statement and signed.) |

|

|

|

Primary Residence |

Property B |

Property C |

Type of Property |

|

|

|

Address |

|

|

|

|

|

|

|

Date Purchased |

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

Present Market Value |

|

|

|

|

|

|

|

Name & |

|

|

|

Address of Mortgage Holder |

|

|

|

|

|

|

|

Mortgage Account Number

Mortgage Balance

Amount of Payment per Month/Year

Status of Mortgage

Section 5. Personal Property and Other Assets. (Describe, and if any is pledged as security, state name and address of lien holder, amount of lien, terms of payment and if delinquent, describe delinquency)

Section 6. |

Unpaid Taxes (Describe in detail, as to type, to whom payable, when due, amount, and to what property, if any, a tax lien attaches.) |

Section 7. Other Liabilities (Describe in detail.)

Section 8. Life Insurance Held. (Give face amount and cash surrender value of policies – name of insurance company and beneficiaries.)

I authorize the Tennessee Uniform Certification Program to make inquiries as necessary to verify the accuracy of the statements made and to determine my eligibility. I certify the above and the statements contained in the attachments are true and accurate as of the stated date(s). These statements are made for the purpose of determining Disadvantaged Business Enterprise eligibility. I understand FALSE statements may result in forfeiture of benefits and possible prosecution by the U.S. Attorney General (Reference 18 U.S.C. 1001)

Signature: |

Date: Social Security Number |

|

|

Signature: |

Date: Social Security Number |

NOTARY

Subscribed and sworn to before me this ____day of _________20__

Signed_____________________________, Notary Public in and for the

County of __________________, State_________________

My Commission Expires____________________________

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of TNUCP | The Tennessee Uniform Certification Program (TNUCP) aims to ensure disadvantaged business entities have maximum opportunities in U.S. Department of Transportation assisted contracts. |

| Governing Law | The program operates under the Final Rule 49 Code of Federal Regulations (CFR) Part 26, requiring statewide uniform certification for DBE programs. |

| Application Requirement | Applicants seeking DBE certification must complete and submit a Uniform Certification Application along with required documents. |

| Notarization Requirement | The Affidavit of Certification and the Personal Financial Statement included in the application packet must be notarized. |

| On-site Visit | An on-site interview is mandated for all in-state applicants as part of the certification process, usually within 90 business days of receiving the complete certification package. |

| Report of Changes | Certified businesses must report changes in ownership, control, or business operation within 30 days of such change. |

| Denial of Certification | Firms have the right to appeal against a denial of certification by filing an appeal with the U.S. Department of Transportation. |

| DBE Directory Inclusion | All certified businesses are listed in the Directory of Disadvantaged Business Enterprises of the Tennessee Uniform Certification Program. |

| Eligibility for Out-of-State Firms | Out-of-state firms must be certified in their home state before applying for certification through TNUCP, except under specific conditions where the firm's principal place of business is in Tennessee. |

Detailed Instructions for Filling Out Tennessee Uniform Certification

Embarking on the process to become a certified Disadvantaged Business Enterprise (DBE) or Airport Concession Disadvantaged Business Enterprise (ACDBE) in Tennessee is a significant step towards leveraging the opportunities available through the Tennessee Uniform Certification Program (TNUCP). The meticulous completion of the certification application is crucial for a swift and successful review. It is paramount to ensure that each section of the application is filled out thoroughly and accurately, and all requested documentation, including notarized forms, is provided. An oversight or failure to provide complete information can result in delays or potential denial of certification. Hence, keeping a copy of all submitted documents is recommended for future reference. Following these detailed steps will guide you through the process.

- Read all the instructions on the TNUCP certification application carefully before you start filling it out.

- Answer every question on the application. If a question does not apply to your business, write “N/A” (not applicable).

- Review the Certification Checklist provided on the application and gather all the documents listed. If any document is not relevant to your company, mark “N/A” next to that item.

- Complete the Personal Financial Statement included in the application packet. Do not leave any lines blank. If necessary, write “N/A”. This form must be filled out by each DBE applicant and must be signed and dated in the presence of a Notary Public.

- Have the principal owner(s) of your business sign the Affidavit of Certification in the presence of a Notary Public.

- Ensure that all supporting documentation, as per the checklist, is ready and includes all copies as requested in the application.

- Collect recent corporate and personal tax returns. Attach a copy of the firm’s most recent corporate tax return with all attachments, if applicable, and a copy of the most recent personal tax return with all attachments for each individual applying for disadvantaged status.

- Review your application packet to ensure that no required information or documentation is missing.

- If your business has undergone a change in ownership or management within the last year, include detailed information regarding these changes.

- Read the certification statement carefully, sign, and date the application, acknowledging that you understand providing false information is a violation that could result in penalties.

- Have a Notary Public notarize the Affidavit of Certification and the Personal Financial Statement.

- Send the complete application packet, including the application form, notarized documents, and all supporting documentation, to the MMBC Uniform Certification Agency at the address provided on the form. Be sure to keep copies of everything you send for your records.

Upon submission, your application will undergo a detailed review process, which includes an on-site interview if your business is located within the state. It is essential to respond promptly if additional information is requested to avoid delays. Remember, certification is a step towards accessing greater opportunities within Tennessee, and meticulous attention to detail during the application process can significantly expedite your certification.

More About Tennessee Uniform Certification

What is the Tennessee Uniform Certification Program (TNUCP)?

The Tennessee Uniform Certification Program (TNUCP) serves as a platform for businesses to become certified Disadvantaged Business Enterprises (DBE) or Airport Concession Disadvantaged Business Enterprises (ACDBE). It aims to provide disadvantaged businesses with ample opportunities to participate in contracts supported by the Department of Transportation (DOT). The TNUCP is responsible for certifying firms and maintaining a database of such entities for DOT grantees within Tennessee, ensuring a streamlined and uniform certification process as required by federal regulations.

What are the requirements for applying for DBE certification through the TNUCP?

To apply for DBE certification through the TNUCP, applicants must complete the Uniform Certification Application in its entirety, ensuring that all sections are filled and all requested documents are included. The application requires notarization of the Affidavit of Certification and the Personal Financial Statement. It's essential for applicants to provide complete and accurate information to avoid delays. Additionally, keeping a copy of all submitted documentation is recommended for personal records.

Who should I contact to submit my TNUCP DBE/ACDBE application?

Applications for the TNUCP DBE/ACDBE certification should be sent directly to the designated member agency that processes these applications. For businesses with their principal place of business within the specific area, the completed certification packet should be forwarded to the MMBC Uniform Certification Agency. The agency is tasked with processing applications and can be reached at P.O. Box 3060, 158 Madison Avenue, Suite 300, Memphis, TN 38173, with further contact details available for telephone and fax or through their website.

What happens if my application is incomplete?

Incomplete applications will not proceed to the evaluation stage until all required documentation is submitted. It is crucial for applicants to thoroughly review their submission to ensure every part of the application is filled and all necessary documents are included. Delays in certification can be avoided by providing a complete and accurate application package from the onset.

Is it necessary to apply for DBE certification at multiple agencies within Tennessee?

No, it is not necessary to apply for DBE certification at more than one of the member agencies within Tennessee. Once a firm is certified as eligible for the TNUCP, it will be entered into the TNUCP database, making it unnecessary to seek certification through multiple agencies. This process ensures that certified firms can participate in the DBE program across the state without redundant applications.

Common mistakes

When filling out the Tennessee Uniform Certification Program (TNUCP) form, applicants often overlook key details that can significantly impact the success of their Disadvantaged Business Enterprise (DBE) or Airport Concession Disadvantaged Business Enterprise (ACDBE) certification process. Understanding these common mistakes can prevent delays and increase the chances of a successful application.

One primary mistake is not answering all questions on the application. The instructions specify that all questions must be answered, and if a question does not apply, the applicant should mark it as "N/A." This mistake can lead to incomplete applications, which are not processed until fully completed. It is critical to review every question carefully and provide comprehensive answers to avoid unnecessary setbacks.

- Failing to provide all requested documents on the Certification Checklist is another common pitfall. The checklist is an essential part of the application as it outlines all the documents needed for a complete review. Applicants should meticulously cross-reference their submission with the checklist to ensure no document is overlooked.

- Improperly filling out the Personal Financial Statement is a frequent mistake. The form must be filled out entirely, leaving no line blank. Each DBE applicant must complete this form, and it must be signed in the presence of a Notary Public. It's not unusual for applicants to accidentally skip sections or inadequately detail their financial information, leading to delays in the certification process.

- Another mistake revolves around the Affidavit of Certification. This document must be signed by the principal owner(s) in the presence of a Notary Public. Occasionally, applicants submit this affidavit unsigned or not properly notarized, which is a critical error. This affidavit is a testament to the truthfulness and accuracy of the application, making it a fundamental requirement for consideration.

To circumvent these common mistakes, applicants are encouraged to double-check their application package for completeness and accuracy. Keeping a copy of all submitted documents is also advisable for personal records and future reference. By paying close attention to detail and following the instructions meticulously, applicants can enhance their chances of entering the TNUCP database and participating in the DBE program across Tennessee.

Documents used along the form

Along with the Tennessee Uniform Certification Program (TNUCP) Application, several other crucial documents are often needed to ensure a comprehensive evaluation of eligibility for the Disadvantaged Business Enterprise (DBE)/Airport Concession Disadvantaged Business Enterprise (ACDBE) programs. These forms and documents play a significant role in painting a complete picture of the applicant's business and personal financial status, thereby facilitating a thorough and fair certification process.

- Business Tax Returns: Typically includes the most recent federal tax return filed by the business, providing a snapshot of the business's financial health and activities over the previous year.

- Personal Tax Returns: This includes the most recent tax returns filed by the individual applicants, offering insight into their personal financial status which is crucial for determining economic disadvantage.

- Proof of Business Structure: Documents such as Articles of Incorporation, Partnership Agreements, or sole proprietorship documentation, which outline the legal structure and ownership of the business.

- Business Licenses: Any relevant licenses that permit the business to operate legally within its specific industry or sector.

- Proof of Business Insurance: Documents that verify the business is sufficiently insured, covering various liabilities and operational risks.

- Financial Statements: Including balance sheets, income statements, and cash flow statements for the last three fiscal years, detailing the financial performance and position of the business.

- Proof of Disadvantaged Status: Documentation supporting the claim of social and economic disadvantage, which can include narratives of discrimination experienced, evidence of barriers to capital and credit opportunities, etc.

- Ownership and Control Documents: These documents provide evidence that the DBE/ACDBE applicant possesses ownership and control over the enterprise, such as stock certificates, leasing agreements, and loan agreements.

Together, these documents augment the TNUCP application, providing the evaluating committee with a full understanding of the applicant's business operations, financial integrity, and eligibility for certification. The thorough preparation and submission of these forms and supporting documentation are fundamental steps in the certification process, ensuring that all applicants are assessed fairly and equitably.

Similar forms

The Small Business Administration (SBA) 8(a) Business Development Program application shares similarities with the Tennessee Uniform Certification Program (TNUCP) application, particularly in its goal to assist disadvantaged businesses. Both programs require businesses to qualify based on certain disadvantaged criteria, including the owner's ethnic background, social disadvantage, and economic disadvantage. Just like the TNUCP, the SBA 8(a) application necessitates a thorough submission of personal financial information, business financial data, and an affidavit of certification to verify the disadvantaged status of the applicants.

The Disadvantaged Business Enterprise (DBE) Certification application for other states closely resembles the TNUCP in structure and objectives. These applications serve to identify and certify businesses owned by socially and economically disadvantaged individuals so they can participate in federally funded projects. Common requirements include demonstrating ownership and control by disadvantaged individuals, providing personal and business financial statements, and undergoing reviews that may include site visits, similar to the TNUCP's process.

The Minority Business Enterprise (MBE) Certification process, managed by various state agencies or third-party organizations like the National Minority Supplier Development Council, parallels the TNUCD's approach in its effort to offer procurement opportunities to minority-owned businesses. Applicants must submit extensive documentation proving minority ownership, operational control, and independence, alongside detailed financial information to verify their eligibility for the program.

The Women-Owned Small Business (WOS-OB) Federal Contracting program certification requests submission of evidence similar to the TNUCP, aimed at expanding access to federal contracting opportunities for women-owned small businesses. Both certifications demand rigorous proof of eligibility, including business and personal financial documents, to ensure that the enterprise is indeed controlled and owned by women who are economically disadvantaged.

The Airport Concessions Disadvantaged Business Enterprise (ACDBE) Program, which also falls under the umbrella of U.S. Department of Transportation certifications like the TNUCP, requires businesses to undergo a similar certification process to be eligible for concessions opportunities in airports. Businesses must prove their disadvantaged status through detailed financial disclosures, ownership and management structure documents, and an affidavit attesting to their qualifications.

The Local Disadvantaged Business Enterprise (LDBE) Certification available in certain jurisdictions operates with objectives akin to the TNUCP, albeit with a more localized focus. Requirements for certification include proving the disadvantaged status of the business owner(s) through personal net worth limits and business size standards, and submitting comprehensive personal and business financial documentation to confirm the company's eligibility and operational status.

Finally, the certification process for becoming a supplier or contractor for Large Corporations with Supplier Diversity Programs often mirrors the documentation and eligibility criteria seen in the TNUCP. These corporates seek to diversify their supply chains by incorporating businesses owned by minorities, women, veterans, and other disadvantaged categories. Similar to the TNUCP, applicants need to furnish detailed company profiles, financial statements, and proof of certification as disadvantaged businesses from recognized programs or agencies.

Dos and Don'ts

When completing the Tennessee Uniform Certification Program (TNUCP) application form, there are several dos and don'ts that applicants should keep in mind:

- Do read all instructions thoroughly before beginning to fill out the application.

- Do answer all questions on the application. If a question does not apply to your situation, mark it as “N/A” for not applicable.

- Do provide all documents requested on the Certification Checklist. If an item does not pertain to your company, mark it as “N/A.”

- Do ensure the Personal Financial Statement is fully completed, leaving no line blank, and is notarized.

- Do keep a copy of all submitted documents for your records.

- Don’t leave any questions unanswered without marking them as “N/A.” Incomplete answers may result in unnecessary delays.

- Don’t forget to have the Affidavit of Certification signed by the principal owner(s) in the presence of a Notary Public.

- Don’t submit the application without all the required documents. Incomplete applications will not be evaluated until they are fully complete.

- Don’t apply for DBE certification at more than one member agency. It’s no longer necessary.

Misconceptions

When it comes to the Tennessee Uniform Certification Program (TNUCP) and the process of becoming a certified Disadvantaged Business Enterprise (DBE) or Airport Concession Disadvantaged Business Enterprise (ACDBE), several misconceptions can lead to confusion among applicants. Below are four common misunderstandings and the truths behind them:

- Misconception 1: You need to apply for DBE certification at each member agency separately. Many applicants believe that they must submit applications to every member agency listed to increase their chances of becoming certified or to ensure statewide recognition. In reality, the process is much more streamlined. A single application submitted to the TNUCP suffices. Once a firm is certified, it will be entered into the TNUCP database, making it accessible by all member agencies across the state.

- Misconception 2: The certification process is quick and requires minimal documentation. The process of obtaining DBE/ACDBE certification is thorough, requiring a detailed review of numerous documents to verify the eligibility of a business. Applicants must complete all sections of the uniform certification application and supply all requested documentation, including notarized affidavits and personal financial statements. Incomplete applications will not be considered until they are fully complete, potentially delaying the certification process.

- Misconception 3: Once certified, no further action is required to maintain certification. Maintaining DBE certification is not automatic. Certified businesses must notify the TNUCP of any significant changes in ownership, control, or their financial situation. Additionally, firms must undergo periodic reviews and reapply for certification to verify that they continue to meet the eligibility criteria over time. This ensures the integrity and accuracy of the DBE certification process.

- Misconception 4: Only businesses based in Tennessee are eligible for certification. While it's true that the TNUCP prioritizes Tennessee-based businesses, firms located outside the state are not automatically disqualified. If a business is already DBE certified in its home state, it can contact the TNUCP for information on how to be recognized in Tennessee. However, an out-of-state company must first be certified by its home state and meet all the TNUCP’s eligibility criteria to participate.

Understanding these points clearly can streamline the certification process, avoid unnecessary delays, and ensure applicants are well-prepared. It's essential for businesses to thoroughly review the TNUCP guidelines and requirements or reach out directly to the TNUCP for clarification on any aspects of the certification process to ensure compliance and make the most of the opportunities available to disadvantaged businesses.

Key takeaways

The Tennessee Uniform Certification Program (TNUCP) plays a crucial role in promoting the participation of Disadvantaged Business Enterprises (DBE) in Department of Transportation (DOT)-assisted contracts across Tennessee. To navigate the certification and application process efficiently, applicants must pay careful attention to detail and comply with all requirements. The following key takeaways offer guidance to businesses seeking DBE certification through the TNUCP, ensuring a smooth application process.

- Completeness is critical. Applicants must ensure that every part of the Uniform Certification Application is fully completed. Any question that does not apply should be marked with “N/A” for not applicable. This thoroughness avoids delays in the processing of the application.

- Documentation is essential. Alongside the application, specific documents listed on the Certification Checklist must be provided. If certain documents do not pertain to the applicant's company, indicating “N/A” where relevant is important. Additionally, both the Affidavit of Certification and the Personal Financial Statement need notarization, underscoring the importance of providing accurate and comprehensive information.

- Timeliness affects processing. Incomplete applications are put on hold until all requested documentation is submitted. To prevent unnecessary delays, applicants are encouraged to keep a copy of all documents submitted for their records. Responding promptly to requests for additional information can also expedite the review process.

- Maintenance of certification requires vigilance. Certified businesses must report any changes in ownership, control, or operation within 30 days. This requisite ensures the continued accuracy of the TNUCP database, which is instrumental in maintaining the integrity of the certification process.

- Renewal demands accuracy and honesty. The renewal application demands complete transparency and accuracy. Changes in the business that affect its eligibility must be disclosed. Failing to do so not only risks the certification status but also could lead to legal consequences given the serious view of providing false information to the federal government.

Understanding and following these key points can greatly contribute to the successful certification of disadvantaged business enterprises seeking to participate in the TNUCP. By fostering inclusivity and diversity among businesses engaged in DOT-assisted contracts, the TNUCP aims to level the playing field, offering equal opportunities for all businesses across Tennessee.

Popular PDF Forms

Ebt Tennessee - Gain clarity on the types of family assistance available in Tennessee and how to access them through this all-in-one application form.

Franchise Tax Tennessee - It specifies the due dates for estimated tax payments: in the months of the 4th, 6th, 9th of the current year, and the 1st month of the following year.

Workforce Essentials Dickson Tn - The State of Tennessee offers a duplicate diploma request process for public high school graduates. Find out what you need to know.