Fill Out a Valid Tn Ifta 56 Form

Filing tax returns is a critical task for individuals and businesses alike, ensuring compliance with local and federal laws. Among those requirements, for companies operating commercial vehicles across state lines, the Tennessee IFTA Tax Return Form 56 represents a vital aspect of their tax obligations. This form is tailored for reporting fuel taxes under the International Fuel Tax Agreement (IFTA), a cooperative agreement aimed at simplifying the reporting of fuel use by motor carriers operating in several jurisdictions. The form requires detailed information, including the licensee's name from Form 55, the IFTA License Number, the tax period, and comprehensive details about fuel usage across different jurisdictions. Taxpayers must round amounts for gallons and miles to the nearest whole number in specific columns, and calculate the taxable gallons, tax paid on those gallons, net taxable gallons, and the tax rate due or credit. Additionally, the form addresses the need to calculate interest for taxes due. This detailed reporting ensures that businesses pay the correct amount of taxes on fuel, contributing to the maintenance of highways and infrastructure that support national and interstate commerce. If assistance is needed, the provided contact number and the IFTA website offer resources for further guidance.

Example - Tn Ifta 56 Form

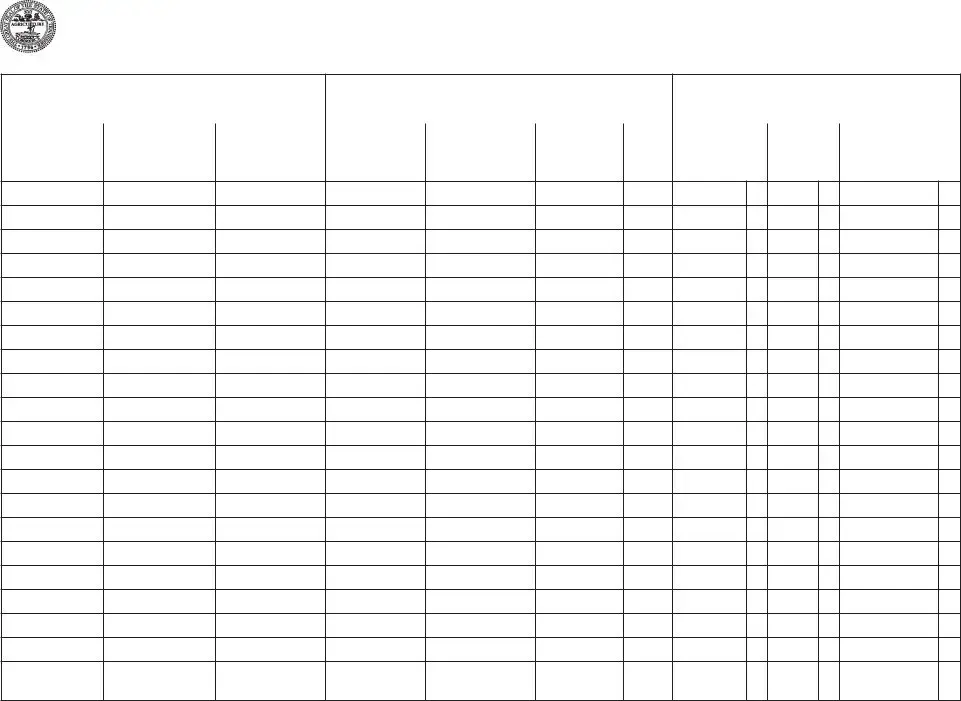

TENNESSEE IFTA TAX RETURN |

FORM 56 |

Round Amounts In Columns B Through F To Nearest Whole Gallon And Mile

The tax rates can be located at www.iftach.org or contact our office at

Name as shown on Form 55 |

|

IFTA License Number |

|

|

Tax Period |

|

|||

|

|

|

|

|

|

|

|

|

|

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

(I) |

(J) |

Jurisdiction |

Total Miles |

Total Taxable Miles |

Taxable Gallons |

Tax Paid Gallons |

Net Taxable |

Tax |

Tax Due/Credit |

Interest |

Total Due/Credit |

and Fuel Type |

In Each Jurisdiction |

In Each Jurisdiction |

(Col. C ÷ MPG) |

In Each Jurisdiction |

Gallons |

Rate |

(Col. F x Col. G) |

at .00417/Month |

(Col. H + Col. I) |

|

for Each Fuel Type |

for Each Fuel Type |

|

for Each Fuel Type |

(Col. D - Col. E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTALS (This Page)

Form Breakdown

| Fact Name | Description |

|---|---|

| Document Title | Tennessee IFTA Tax Return Form 56 |

| Rounding Instructions | Amounts in columns B through F must be rounded to the nearest whole gallon and mile. |

| Tax Rate Information Source | Tax rates can be found at www.iftach.org or by contacting the office at 615-399-4267. |

| Associated License Form | Name as shown on Form 55, which is the reference for the IFTA License Number. |

| Interest Calculation | Interest is calculated at a rate of 0.00417 per month for any due or credit amounts. |

| Governing Law | The form is governed by the laws of Tennessee and follows the International Fuel Tax Agreement (IFTA) regulations. |

Detailed Instructions for Filling Out Tn Ifta 56

Filling out the Tennessee IFTA Tax Return Form 56 requires accurate and thoughtful input of information related to your fuel usage and miles traveled in a specific tax period. To ensure compliance and avoid possible errors, it's important to gather all necessary documents and information beforehand, including your total miles driven, the tax rates for jurisdictions traveled (available online), and your Form 55 IFTA License Number. Following the steps carefully will guide you through the process seamlessly, ensuring your tax responsibilities are met with precision.

- Start by locating the tax rates for each jurisdiction you have traveled in during the tax period. These can be found at www.iftach.org or by contacting the office at 615-399-4267.

- Fill in your Name as shown on Form 55 in the designated space at the top of the form.

- Enter your IFTA License Number next to your name.

- Specify the Tax Period in the space provided. This should reflect the period for which you are reporting.

- For each jurisdiction listed in column (A), enter the Total Miles traveled in that jurisdiction during the tax period in column (B).

- In column (C), input the Total Taxable Miles for each jurisdiction. This reflects the miles that are eligible for IFTA tax.

- Calculate and enter Taxable Gallons for each jurisdiction in column (D) by dividing the Total Taxable Miles (column C) by your miles per gallon (MPG). This should be rounded to the nearest whole gallon.

- Input the Tax Paid Gallons in column (E) for each relevant jurisdiction. These are the gallons for which taxes have already been paid.

- In column (F), determine and fill in the Net Taxable Gallons (column D minus column E) for each jurisdiction.

- The Tax Rate for each jurisdiction needs to be entered in column (G). Use the rates located on the IFTA website or contact the office for assistance.

- Calculate the Tax Due/Credit for each jurisdiction by multiplying the Net Taxable Gallons (column F) by the Tax Rate (column G) and enter this amount in column (H).

- For interest calculations, use the specified rate of .00417 per month and apply it to any late payments. Enter the calculated interest in column (I).

- Add the Tax Due/Credit and Interest amounts together to determine the Total Due/Credit for each jurisdiction, and input this figure in column (J).

- Ensure to calculate and fill in the SUBTOTALS for columns B through J at the bottom of the page.

Once all sections of the form are completed with the required information, perform a thorough review to confirm accuracy. Any inaccuracies can lead to processing delays or incorrect tax liabilities. After the review, submit the form as indicated by the Tennessee Department of Revenue. Timely and accurate submission of Form 56 helps maintain compliance with IFTA requirements and avoids potential penalties. Remember, this form is a crucial component in managing your interstate transportation tax obligations effectively.

More About Tn Ifta 56

What is the TN IFTA 56 form used for?

The TN IFTA 56 form is utilized to report fuel use by motor carriers operating in more than one jurisdiction. It helps calculate and report fuel taxes owed to the state of Tennessee under the International Fuel Tax Agreement (IFTA). Carriers must report the total miles driven, total taxable miles, taxable gallons, and tax-paid gallons in each jurisdiction they operated, allowing the calculation of taxes due or credits owed.

How do I find the tax rates for calculating the taxes on the form?

Tax rates needed for completing the form can be found at the official IFTA website ( www.iftach.org ). Alternatively, for direct assistance or more specific questions, contact the office at 615-399-4267. The rates are essential for accurately calculating taxes owed in each jurisdiction.

What should I round the amounts to on the TN IFTA 56 form?

When filling out the TN IFTA 56 form, you must round all amounts in columns B through F to the nearest whole gallon and mile. This standardization ensures accuracy and consistency in reporting and simplifies the calculation process.

How do I determine the number of taxable gallons and taxable miles?

To determine the number of taxable gallons, divide the total taxable miles by the miles per gallon (MPG) your vehicle achieves, which will give you the gallons used. Taxable miles are the total miles driven in each jurisdiction minus any nontaxable miles, such as those traveled on private roads or miles exempted by specific jurisdictions.

What should I do if I find I have a tax credit?

If the calculations on your form result in a tax credit, you can apply this credit towards future tax liabilities. Detailed instructions on how to apply these credits can be obtained from the Tennessee Department of Revenue or by contacting the office directly. It's important to accurately report and apply these credits to ensure compliance and optimize your tax liabilities.

Is there interest charged on late payments?

Yes, there is an interest charge on late payments. The interest is calculated at a rate of 0.00417 per month on any unpaid tax due. This is indicated on the form and should be carefully calculated to include this interest when making a payment past the due date to avoid further penalties.

Where can I obtain assistance if I have questions while filling out the form?

For assistance with the TN IFTA 56 form, you're encouraged to contact the office directly at 615-399-4267. They can provide guidance, clarifications, and additional instructions to ensure your form is correctly filled out and submitted. Furthermore, visiting the official IFTA website provides resources and FAQs that may address your questions.

Common mistakes

Filing the Tennessee IFTA Tax Return Form 56 requires attention to detail and an understanding of the specific requirements. Mistakes can lead to issues with tax filings, potential audits, and financial penalties. Here are four common errors made when completing this form:

- Not rounding amounts properly: The form instructs to round amounts in columns B through F to the nearest whole gallon and mile. An inaccurate rounding, or not rounding at all, can lead to discrepancies in the tax due or credit. It's critical to adhere strictly to the rounding instructions to ensure the accuracy of your tax calculations.

- Incorrect tax rates: Tax rates are subject to change and may vary by jurisdiction. Using outdated tax rates can result in the incorrect calculation of taxes due. Form 56 notes that tax rates can be located at www.iftach.org or by contacting the office. It is essential to verify the current tax rates from these sources to prevent errors in tax calculation.

- Misreporting fuel types: Each fuel type used across different jurisdictions needs to be accounted for separately. A common mistake is consolidating fuel types or not clearly specifying the fuel type for each jurisdiction. This can lead to inaccurate tax dues or credits since different fuel types may have different tax rates and regulations.

- Failing to accurately calculate net taxable gallons: The form requires taxpayers to subtract tax-paid gallons from taxable gallons to determine the net taxable gallons (Column F). Errors in this calculation can significantly affect the amount of tax due or credit. It is important to ensure that both taxable gallons and tax-paid gallons are accurately reported and that the subtraction is correctly performed to determine the net taxable gallons.

To successfully navigate the complexities of the Tennessee IFTA Tax Return Form 56, individuals should take a meticulous approach to ensure accuracy in every section of the form. Common pitfalls include not adhering to rounding rules, using outdated tax rates, misclassifying fuel types, and improperly calculating net taxable gallons. By understanding these frequent errors and focusing on precise entries, filers can avoid the common issues that may lead to audit triggers or financial penalties. Aligning closely with the form's instructions and seeking clarification when needed can facilitate a smoother, error-free tax return process.

Documents used along the form

Preparing and filing the Tennessee IFTA Tax Return Form 56 is a comprehensive process that requires various forms and documents. These materials ensure that carriers can accurately report their fuel use and comply with tax regulations across different jurisdictions. To help navigate this process, here is a list of other forms and documents often used alongside the TN IFTA 56 form. Each plays a unique role in ensuring accurate tax reporting and compliance.

- IFTA License Application (Form 55): This form is crucial for obtaining an IFTA license, allowing carriers to operate across state lines under the IFTA agreement. It captures essential information about the carrier seeking licensure.

- Mileage Log: A detailed record of miles traveled in each jurisdiction. It is essential for accurately reporting total and taxable miles on the IFTA Tax Return.

- Fuel Receipts: These provide evidence of fuel purchases in different jurisdictions. Carriers must keep these receipts to accurately report tax-paid gallons purchased.

- Quarterly Fuel Use Report: Summarizes fuel usage and mileage for each vehicle in a fleet for a quarter. This report supports the figures entered on the IFTA Tax Return.

- Vehicle Trip Reports: Document specific trip details, including routes taken and miles traveled in each jurisdiction. This information is vital for filling out the mileage sections of the IFTA Tax Return accurately.

- IFTA Quarterly Tax Rate Chart: Published by IFTA, Inc., this chart lists the current fuel tax rates for each member jurisdiction. It's necessary for calculating the taxes due or the credits owed on the IFTA Tax Return.

- Audit Support Documentation: These documents, including trip sheets, fuel invoices, and mileage logs, must be retained to support the information reported on the IFTA Tax Return in case of an audit.

- Supplementary Schedules: For carriers with operations in multiple jurisdictions, these schedules provide additional space to report mileage and fuel details when the main form lacks sufficient space.

- IFTA Decal Application: While not directly related to tax reporting, carriers must display IFTA decals on their vehicles. This application is for obtaining or renewing these decals.

This list underscores the importance of thorough record-keeping and documentation for interstate carriers. Using these forms and documents in conjunction with the TN IFTA 56 form aids in ensuring accuracy and compliance with tax obligations across jurisdictions. It's not just about filling out a form but about maintaining a comprehensive and compliant record-keeping system that supports your IFTA tax return submissions.

Similar forms

The Form 2290, Heavy Highway Vehicle Use Tax Return, is similar to the Tennessee IFTA Tax Return Form 56 in that it requires detailed vehicle operation information to calculate taxes due. Both forms serve the transportation industry and require filers to report distance (miles) traveled and fuel usage, although for different purposes. While IFTA concerns the reporting of fuel use across different jurisdictions to calculate tax dues or credits, Form 2290 specifically addresses the tax due on the use of heavy highway vehicles weighing 55,000 pounds or more.

The IRS Schedule C (Profit or Loss from Business) bears resemblance to the TN IFTA Form 56 in its requirement for detailed accounting of business operations. In both, accurate records must be maintained and reported to the respective tax authority to calculate the amount of tax owed or due back to the taxpayer. Although Schedule C pertains to a broader spectrum of business income and expenses, and Form 56 is specific to taxable fuel use, both necessitate a meticulous breakdown of operational specifics to determine tax obligations.

The International Fuel Tax Agreement (IFTA) Quarterly Fuel Use Tax Schedule mirrors the Tennessee IFTA Tax Return Form 56 by requiring commercial motor vehicle operators to report fuel usage and miles traveled per jurisdiction. This similarity extends to their shared purpose of allowing truckers and transport companies to report and pay taxes due for fuel usage across states or provinces. Both documents streamline the process of tax payment on fuel for businesses operating across multiple jurisdictions.

Excise Duty Forms, commonly used in various regions to impose taxes on goods like gasoline, alcohol, and tobacco, share common ground with the TN IFTA Tax Return Form 56 regarding the specific focus on taxing fuel consumption. These forms calculate taxes based on the quantity of the product used or sold, necessitating accurate record-keeping and reporting of volumes to ensure proper tax computation, much like the gallon and mile calculations required on the IFTA form.

The Uniform Motor Carrier Bodily Injury and Property Damage Liability Certification Form is akin to the Tennessee IFTA Tax Return Form 56 in its function within the transportation industry, albeit serving a different regulatory requirement. While the IFTA form deals with tax payments based on fuel usage, this certification form deals with compliance in insurance coverage, demonstrating the transport industry's multi-faceted regulatory demands, which include both fiscal and safety obligations.

State Sales Tax Return forms, requiring businesses to report and remit taxes collected from customers, parallel the Tennessee IFTA Tax Return Form 56 in their foundational purpose of calculating and reporting taxes. While sales tax forms focus on transactions within a single state and the IFTA form focuses on fuel use across states, both require detailed operational data to accurately tabulate taxes owed to government authorities.

The Motor Vehicle Use Tax Certification form, often required when registering vehicles in a new state, shares characteristics with the TN IFTA Tax Return Form 56 through its focus on vehicle usage and associated taxes. Both forms assess the extent of vehicle use, but for different types of tax—IFTA form for fuel tax across jurisdictions, and the Motor Vehicle Use Tax for tax due on the vehicle's purchase considering its use.

The Environmental Protection Agency (EPA) Fuel Compliance Forms require detailed reporting on the production, importation, and distribution of fuel, similar to how the Tennessee IFTA Tax Return Form 56 demands reporting on fuel consumption. Both forms play roles in regulating environmental and financial responsibilities related to fuel, emphasizing compliance and accurate reporting in their respective fields.

The Commercial Vehicle Safety Alliance (CVSA) Inspection Forms, like the Tennessee IFTA Tax Return Form 56, cater to the transportation industry, focusing on vehicle safety rather than fiscal duties. Their similarity lies in the mandatory, detailed recording of operational details—IFTA for tax purposes and CVSA for safety compliance, both contributing towards responsible and regulated commercial transport operations.

Dos and Don'ts

Filling out the Tennessee IFTA Tax Return Form 56 correctly is crucial for accurately reporting your fuel use taxes. To ensure that this process goes smoothly, here are some dos and don'ts to keep in mind:

Do:

- Round amounts in columns B through F to the nearest whole gallon and mile, as precision in these figures is key to correct tax calculation.

- Locate the current tax rates either by visiting www.iftach.org or contacting the office as advised at 615-399-4267, ensuring you're using the most up-to-date rates for your calculations.

- Clearly write the name as shown on Form 55 and your IFTA License Number, to ensure your return is processed for the correct account.

- Accurately fill out the tax period, to avoid having your return processed for the wrong period.

- Double-check your calculations for Total Miles, Total Taxable Miles, Taxable Gallons, and Tax Paid Gallons in each jurisdiction to minimize errors.

- Calculate Net Taxable Gallons correctly (Column D minus Column E), as errors here can significantly affect your Tax Due/Credit.

- Remember to calculate interest at .00417/Month for any tax that is due or credit, ensuring that your Total Due/Credit reflects any interest applicable.

Don't:

- Estimate or guess amounts—ensure all figures are based on accurate records to prevent discrepancies.

- Omit any jurisdiction where you traveled, as failing to report all jurisdictions can lead to inaccuracies and potential penalties.

- Leave any columns blank without verifying whether the information is not applicable to your situation—a fully complete form helps in timely processing.

- Forget to check your math, especially when rounding figures to the nearest whole number, as small errors can cascade into larger ones in the totals.

- Ignore the instructions for rounding figures in columns B through F, as incorrect rounding can affect your tax liability.

- Use outdated tax rates, which could result in either underpayment or overpayment of taxes.

- Wait until the last minute to submit your form, as this can lead to rushed calculations and errors, or missed deadlines.

Misconceptions

Understanding the Tennessee IFTA (International Fuel Tax Agreement) Tax Return Form 56 can sometimes be tricky, leading to a number of misconceptions. It’s essential for those filing to get the facts straight to ensure the process is completed accurately and efficiently. Below, we will debunk some common misunderstandings about this form.

Misconception 1: You can round amounts in any way you like. The form specifically requires that amounts in columns B through F be rounded to the nearest whole gallon and mile. Precision in these calculations is crucial for the accuracy of your tax return.

Misconception 2: Tax rates are fixed and can be assumed. Tax rates vary and must be checked for each filing period. They can be found on the IFTA website or by contacting the office at 615-399-4267. Relying on outdated rates can lead to errors in the tax due or credit.

Misconception 3: The form is only for gasoline fuel types. Form 56 is required for multiple fuel types, not just gasoline. Each fuel type used within the jurisdiction during the tax period must be reported separately to comply with IFTA requirements.

Misconception 4: Total miles are the same as taxable miles. There's a distinction between total miles and taxable miles reported. Taxable miles exclude non-taxable ones such as off-road or private mileage, which must be calculated correctly to determine the net taxable gallons.

Misconception 5: You only need to file if you owe taxes. All IFTA license holders must file Form 56, regardless of whether tax is owed, even if it results in a credit or if no miles were traveled during the period. Regular filing helps keep your IFTA license in good standing.

Misconception 6: The "Tax Due/Credit" and "Total Due/Credit" sections are the same thing. The Tax Due/Credit is calculated by multiplying the net taxable gallons by the tax rate, while the Total Due or Credit includes any additional interest due for late payments, making them distinct figures on the form.

Misconception 7: Interest is applied annually. Interest on late payments is calculated monthly at a rate of .00417, not annually. This detailed calculation ensures any delinquencies are accurately captured over time, affecting the total amount owed.

Misconception 8: Filing Form 56 yearly is sufficient. IFTA taxes must be filed quarterly, not annually. Understanding the specific filing deadlines for each quarter is essential to avoid penalties and interest for late submissions.

Dispelling these misconceptions is fundamental to filing the Tennessee IFTA Tax Return Form 56 correctly. Accurate filing not only keeps you compliant but also helps in managing your fuel tax liabilities efficiently. When in doubt, it's always best to seek clarification from the Tennessee Department of Revenue or a professional knowledgeable in IFTA regulations.

Key takeaways

When completing the Tennessee IFTA Tax Return Form 56, it is crucial to understand and accurately follow all instructions to ensure compliance with tax obligations under the International Fuel Tax Agreement (IFTA). Here are key takeaways to guide you through this process:

- Round all amounts in columns B through F to the nearest whole gallon and mile. This ensures the calculations are consistent with IFTA requirements.

- The tax rates needed for the calculations can be found at the IFTA's official website or by contacting the Tennessee Department of Revenue directly. This is vital for accurate computation of taxes due or credits.

- Enter the name as shown on Form 55 and your IFTA License Number correctly to ensure that your return is processed correctly.

- Specify the tax period for which you are filing, as this will determine the applicable tax rates and any seasonal adjustments that may apply.

- In the jurisdiction section, accurately report total miles traveled and total taxable miles, distinguishing between the two as per IFTA guidelines.

- Calculate taxable gallons in each jurisdiction by dividing total taxable miles by your vehicle's miles per gallon (MPG). This figure must then be compared against tax-paid gallons to determine net taxable gallons.

- Net taxable gallons are determined by subtracting tax-paid gallons from taxable gallons calculated. This forms the basis of your tax due or credit.

- Apply the tax rate for each jurisdiction to the net taxable gallons to calculate the amount of tax due or credit.

- Interest is calculated at a rate of .00417 per month for any overdue payments, which should be added to the tax due to get the total due/credit.

- Ensure to include subtotals for each page if your return encompasses multiple pages. This helps in maintaining accurate records and calculations.

Accurately completing and understanding each component of the IFTA Tax Return is essential in meeting your tax obligations and avoiding potential penalties or audits. Proper documentation and record-keeping facilitate a smoother process when filling out Form 56.

Popular PDF Forms

Franchise and Excise Tax - Includes a directive reminder about the need for entities applying for certain exemptions to complete the Disclosure of Activity section thoroughly.

What Vaccines Are Required for School in Tennessee - The certificate plays a critical role in the public health effort to maintain high immunization rates and prevent outbreaks.