Fill Out a Valid Tn New Hire Form

Since October 1, 1997, Tennessee has mandated that all employers in the state report specific details about employees who are newly hired, rehired, or return to work after a significant break. This initiative aims to uphold accurate employment records and support the Department of Labor and Workforce Development's efforts in monitoring and managing the workforce. Employers hold the responsibility to either fill out a designated Tennessee New Hire Reporting form or submit equivalent documentation, such as the employee's IRS W-4 form, that contains the required employee information. Additionally, the digital age allows for reporting through the internet, magnetic tape, or diskette, offering flexibility in how these details are communicated. Critical to its success is the demand for timely submission—within 20 days of the employee's start date, though a more accelerated timeline of 5 days is encouraged to further assist the department's efficiency. The form gathers comprehensive data, including social security numbers, names, addresses, and employment details, alongside the employer's information, which is equally crucial. Furthermore, it explores specifics such as the availability of medical insurance by the employer and the employee's eligibility for earned income tax credit, painting a fuller picture of the employment landscape. It is a straightforward yet vital tool for regulatory compliance, supporting not just the administrative needs but also contributing to a broader understanding of employment trends within Tennessee.

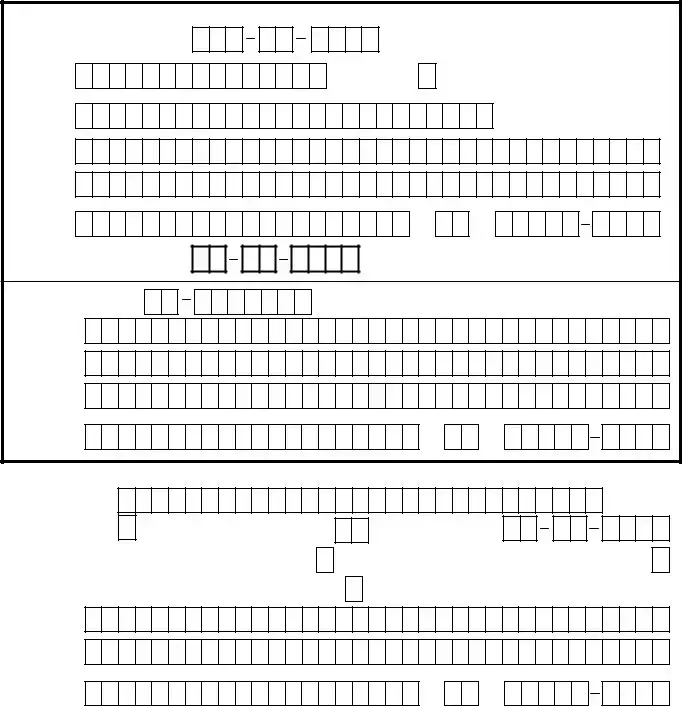

Example - Tn New Hire Form

STATE OF TENNESSEE

NEW HIRE REPORTING

Effective October 1, 1997, all Tennessee employers are required to report certain information about employees who have been newly hired, rehired, or have returned to work. Employers must either (1) complete this form, or (2) submit a copy of the employee’s IRS

TO ENSURE ACCURACY, PLEASE PRINT (or TYPE) NEATLY IN

LETTERS AND NUMBERS, USING A DARK,

REQUIRED INFORMATION: |

|

EMPLOYEE DATA |

||

Social Security Number: |

|

|

||

|

First |

M.I. |

|

|

Name: |

|

|

|

|

|

Last |

|

|

|

Home |

|

|

|

|

Address: |

|

|

|

|

(Do not use |

|

|

|

|

Employer |

|

|

|

|

Address, Do |

City |

State |

Zip Code |

|

not leave |

||||

|

|

|

||

blank) |

|

|

|

|

Employee Date of

Hire:

Federal EIN:

Employer

Name:

Address:

EMPLOYER DATA

City |

State |

Zip Code |

ADDITIONAL INFORMATION:

Store or

Outlet Number:

Gender (M/F): |

Employee State of Hire: |

Earned Income Tax Credit Available? (Y/N):

(if unknown, leave blank)

Does your company offer Medical Insurance? (Y/N):

Corporate or Payroll Address:

Date of Birth:

Employee Left Your Employment? (Y/N):

(Has this employee left your employment before you filed this report?)

(if different from business address)

City |

State |

Zip Code |

REPORTS WILL NOT BE PROCESSED WITHOUT MANDATORY INFORMATION

Send Reports To: Tennessee New Hire Reporting Program

P.O. Box 17367

Nashville, Tennessee 37217

Fax: (877)

Form Breakdown

| Fact | Detail |

|---|---|

| Effective Date | The Tennessee New Hire Reporting program became effective on October 1, 1997. |

| Employer Requirement | All Tennessee employers are mandated to report newly hired, rehired, or returning employees. |

| Reporting Options | Employers can complete the Tennessee New Hire form, submit a copy of the employee’s IRS W-4 form, use another form with the required information, or submit the data via Internet, magnetic tape, or diskette. |

| Reporting Deadline | Employers must report within 20 calendar days of the employee's hire date, though reporting within 5 days is encouraged to assist the Department of Labor and Workforce Development. |

| Required Information | Information required includes employee's social security number, name, address, date of hire, and Federal EIN, along with employer's name and address, and additional information like gender, state of hire, and availability of medical insurance. |

| Reporting Method | Employers are instructed to print or type neatly in uppercase letters and numbers when filling out the form. |

| Contact Information | Reports are to be sent to the Tennessee New Hire Reporting Program in Nashville, either via mail or fax. |

Detailed Instructions for Filling Out Tn New Hire

After hiring a new employee, rehiring a former employee, or welcoming back an employee after a break, Tennessee employers are required to report essential details to the state. This step is mandatory to comply with state laws and helps in the maintenance of accurate employment records. Employers have four options for submitting this information: filling out the Tennessee New Hire Reporting form, using a copy of the employee's IRS W-4 form, submitting another form that contains all the required information, or using electronic means such as the internet or digital storage devices. To guarantee that the process is smooth and error-free, here are the step-by-step instructions for completing the Tennessee New Hire Reporting form.

- Prepare to fill out the form: Before you start, ensure you have all the necessary information about the employee. You'll need details such as their social security number, full name, address, date of hire, and date of birth. For the employer's section, gather your Federal EIN, company name, address, and any additional details like store number.

- Filling in the employee data:

- Enter the employee's social security number in the designated field.

- Write the employee's first name, middle initial, and last name.

- Provide the home address of the employee, ensuring that it is not the employer's address and that no fields are left blank.

- Record the employee's date of hire.

- Filling in the employer data:

- Enter your Federal Employer Identification Number (EIN).

- Write the employer's name as it appears in official documents.

- Provide the full address of the employer’s main office or the location where the employee will work.

- Completing the additional information section:

- Indicate the store or outlet number, if applicable.

- Select the gender of the employee by marking "M" for male or "F" for female.

- State the employee’s state of hire if different from Tennessee.

- Answer whether the Earned Income Tax Credit (EITc) is available, marking "Y" for yes or "N" for no, or leave it blank if unknown.

- Specify whether your company offers medical insurance with a "Y" for yes or an "N" for no.

- If the employee has previously left your employment before this reporting, mark "Y" for yes or "N" for no in the designated field.

- Reviewing the form: Go over the information provided to ensure that it is accurate and all required fields are filled. Pay attention to details like names and addresses, as mistakes here could lead to processing delays.

- Sending the report: Once the form is completed, send it to the Tennessee New Hire Reporting Program at the provided mailing address or fax number. Choose a sending method based on convenience and the ability to meet the reporting timeline.

Remember, reports must be submitted within 20 calendar days of the employee's start date. However, to assist the Department of Labor and Workforce Development more efficiently, submitting within 5 days is highly encouraged. By following these steps carefully, employers will meet their reporting obligations and ensure a smoother integration of new hires into their systems.

More About Tn New Hire

What is the purpose of the Tennessee New Hire Reporting Program?

The Tennessee New Hire Reporting Program aims to enhance child support collection efforts by requiring employers to report newly hired, rehired, or returning to work employees. Reporting this information helps the Department of Labor and Workforce Development quickly locate individuals to enforce child support obligations. Since its inception on October 1, 1997, this mandate seeks to ensure children receive the financial support they are entitled to, by making it more difficult for non-custodial parents to avoid their responsibilities.

What are the methods available for submitting the New Hire reports?

Employers in Tennessee have several options to submit New Hire reports:

- Completing and submitting the designated New Hire form.

- Submitting a copy of the employee's IRS W-4 form, ensuring it includes the required information.

- Providing other forms that contain at a minimum the mandatory information.

- Submitting the information via the Internet, magnetic tape, or diskette for bulk reporting.

This flexibility ensures that employers of all sizes and capabilities can comply with reporting requirements efficiently.

What information must be included in the New Hire report?

All New Hire reports must contain specific pieces of employee and employer data to be processed:

- Employee Data: Social Security Number, First Name, Middle Initial, Last Name, Home Address, City, State, Zip Code, Date of Hire, and potentially additional information like Date of Birth, Gender, State of Hire, if they left your employment before this report, and if Earned Income Tax Credit is available.

- Employer Data: Federal EIN, Employer Name, Address, City, State, Zip Code, and potentially the Store or Outlet Number, and corporate or payroll address if different from the business address.

Providing complete and accurate information helps in the efficient processing of reports and the effective enforcement of child support obligations.

When are employers required to submit the New Hire report?

Employers are required to submit the New Hire report within 20 calendar days of the employee's hire date. However, to aid the Department of Labor and Workforce Development in timely processing, employers are encouraged to submit reports within 5 days of the hire date if possible. This rapid reporting helps in quicker updating of records and enforcement actions, making the collection of child support both more efficient and effective.

Common mistakes

Filling out the Tennessee New Hire form is a crucial step for employers in complying with state regulations, but mistakes can often be made during this process. Understanding these common errors can help ensure the form is completed accurately, thereby avoiding potential issues.

- Not using uppercase letters and numbers: The instructions specify that information should be printed neatly in uppercase letters and numbers. This mistake can make the form harder to read and process.

- Using an erasable pen or not using a dark, ball-point pen: The form asks for entries to be made with a dark, ball-point pen to ensure the information is permanent and legible.

- Incorrect or missing Social Security Number: Incorrectly entering an employee's Social Security Number, or not entering it at all, can lead to significant processing delays and errors in identification.

- Leaving the employee address blank or using the employer's address: The employee’s home address is required. Using the wrong address or leaving this field blank can cause issues with the accuracy of the state’s employment records.

- Forgetting to indicate if the Earned Income Tax Credit (EITC) is available: While it’s mentioned that it can be left blank if unknown, providing this information when known is helpful for employees.

- Failing to report within the required timeframe: Reports must be made within 20 calendar days of hire, or within 5 days if the employer wishes to assist the Department of Labor and Workforce Development further.

- Omitting the Federal EIN: The employer's Federal Employer Identification Number (EIN) is crucial for processing the form. Failing to include this can lead to the report being unprocessable.

- Not indicating whether the company offers medical insurance: This is an essential piece of information that needs to be reported accurately.

- Leaving the "Employee Left Your Employment?" section blank: This question is critical for the Department to understand the employment status and should be answered even if the employee hasn’t left the employment before filing this report.

It's also worth noting that there are several ways to submit the information, including completing the paper form, submitting a copy of the employee's IRS W-4 form, using another form with the required information, or submitting the information electronically. Employers should choose the method that is most convenient and reliable for them.

Addressing these common mistakes can make the process smoother for both the employer and the state. By making an effort to complete the Tennessee New Hire form accurately, employers can help ensure they are in compliance with state laws and supporting the Department of Labor and Workforce Development in maintaining up-to-date employment records.

Documents used along the form

When onboarding new employees in Tennessee, the State of Tennessee New Hire Reporting Form is crucial but it's just part of the process. Employers often need to complement this submission with several other key documents and forms to ensure compliance with federal and state regulations, and to facilitate a smooth start for the new hire. Understanding these documents helps streamline the hiring process, ensuring that both employer and employee fulfill their obligations and receive their entitlements from day one.

- W-4 Form: This IRS form is essential for determining the federal income tax withholding from an employee's pay. New hires complete this form so employers can withhold the correct federal income tax from their earnings. It includes personal information, filing status, and any additional withholdings.

- I-9 Employment Eligibility Verification Form: Required by the U.S. Citizenship and Immigration Services, this form verifies an employee's legal right to work in the United States. Both the employee and the employer must complete their sections of the form, and it includes a requirement for presenting specific documents that verify the employee's identity and legal authorization to work.

- State Tax Withholding Form: Similar to the federal W-4, many states have their own version of a tax withholding form. In Tennessee, this form allows employees to specify their tax withholding preferences for state taxes. This form is critical for employers to withhold the correct amount of state income tax from the employee's pay.

- Direct Deposit Authorization Form: Though not a legal requirement, offering direct deposit is a common practice. This form allows employees to authorize the direct deposit of their paychecks into their bank accounts and typically requires the employee's bank account information, including bank name, account number, and routing number. It streamlines the payment process, ensuring timely and secure access to wages.

Together with the Tennessee New Hire Reporting form, these documents form a comprehensive package, helping employers meet legal requirements and providing employees with the necessary information for tax and identity verification, as well as payment processing. By keeping these forms organized and efficiently handled, employers can foster a positive start to the employer-employee relationship.

Similar forms

The W-4 Form, used by employers in the United States to determine the amount of federal income tax to withhold from an employee's paycheck, shares similarities with the Tennessee New Hire Reporting Form. Both forms require personal and identification details about an employee, such as their social security number and home address. While the W-4 Form focuses more on tax withholding preferences and financial information, the Tennessee New Hire Reporting Form concentrates on the initial reporting of a new or returning employee. Each form plays a crucial role in ensuring accurate financial and employment records from the outset of employment.

The I-9 Employment Eligibility Verification form is another document that resembles the Tennessee New Hire Reporting Form in purpose and necessity. Employers use the I-9 to verify the identity and legal authorization to work of their employees, requiring personal information much like the Tennessee form. However, while the I-9 emphasizes legal work status in the United States and requires documentation such as passports or identification cards, the Tennessee New Hire Reporting Form focuses on the state's need to collect data on newly hired employees for workforce and child support enforcement purposes.

Employment Application forms, often customized by each employer but generally collecting similar types of information, share commonalities with the Tennessee New Hire Reporting Form. These applications gather basic personal and contact information, employment history, and sometimes, educational background, similar to the new hire form's collection of essential employee data. The primary difference lies in their use; employment applications are used to screen potential candidates, while the Tennessee form is for reporting purposes after an individual is hired.

The Employee's Withholding Certificate, another document akin to the Tennessee New Hire Reporting Form, is integral to the payroll process, ensuring employers withhold the correct federal income tax from employees' paychecks. Like the Tennessee form, it collects necessary personal information to accurately report and manage an employee's financial records. Both forms are foundational to establishing an employee's formal work records, though they serve different ends within the spectrum of employment and tax documentation.

Lastly, the Direct Deposit Authorization Form, frequently used by employers to set up electronic wage payments, parallels the Tennessee New Hire Reporting Form in its requirement for accurate employee identification and banking information. While the direct deposit form focuses on bank account details to facilitate the transfer of funds, the Tennessee form aims at gathering employee data for reporting to the state. Despite their different functions, both forms signify the beginning of an official employment relationship and are vital for administrative processes.

Dos and Don'ts

When you're filling out the Tennessee New Hire Reporting Form, it's important to get things right. Doing so helps ensure that your business complies with state laws and that the process runs smoothly. Here are 10 do's and don'ts to consider:

Things You Should Do

- Report accurately: Ensure all the information you provide is accurate, especially the employee's Social Security Number and date of hire.

- Print neatly in uppercase: Fill out the form in uppercase letters to make the information clear and legible.

- Use a dark, ball-point pen: This makes the form easier to read and photocopy, if necessary.

- Provide complete addresses: Don't use your business address for the employee's home address, and make sure to include the full address.

- Choose the right submission method: Whether it's via the internet, magnetic tape, diskette, or the physical form, choose the method that's most reliable for you.

Things You Shouldn't Do

- Don't leave mandatory fields blank: Each required field should be filled in to avoid processing delays.

- Avoid handwriting changes: If you make a mistake, it's better to start with a new form rather than making corrections, which can cause confusion.

- Don't delay: Submit the form within 20 calendar days of the hire date, or within 5 days if you wish to aid the Department of Labor and Workforce Development even more efficiently.

- Do not forget to report rehires: Employees who are returning to work or have been rehired also need to be reported.

- Don't ignore the form's requirements: Using a different form? Make sure it includes all the mandatory information the New Hire Reporting Form asks for.

Misconceptions

Many employers and employees in Tennessee have misconceptions about the New Hire Reporting requirements. Understanding these misconceptions can help ensure compliance and reduce errors during the reporting process. Below are nine common misconceptions clarified:

- Only full-time employees need to be reported: All employees, including part-time, seasonal, and temporary employees, are required to be reported.

- The reporting is optional: Reporting new hires is mandatory for all Tennessee employers. Failure to report can result in penalties.

- W-4 forms are the only acceptable document for reporting: While the W-4 form is commonly used, Tennessee employers have the option to submit the information by completing the New Hire Reporting form, through internet submission, magnetic tape, or diskette, as long as the required information is provided.

- Information can be submitted in any format: The required information must be submitted in a specified format. Failure to provide the mandatory information or submitting it in an incorrect format can result in the report being unprocessed.

- There's a 20-day grace period for all reports: While reports are due within 20 calendar days of the employee’s hire date, to assist the Department of Labor and Workforce Development, employers are encouraged to submit this information within 5 days if possible.

- The employer address can be used if the employee's home address is unknown: The instructions explicitly state not to use the employer address for the employee's home address and not to leave it blank, highlighting the importance of having accurate personal data for each employee.

- Medical insurance offerings do not need to be reported: Although not part of the minimum mandatory information, indicating whether the company offers medical insurance is requested as additional information on the form.

- The report is only for the state's use: While the primary purpose is for state use, including child support enforcement, the compiled data can also be used for federal purposes and to detect unemployment insurance fraud.

- It's unnecessary to report rehires or employees returning to work: Employers are required to report not only new hires but also rehires or employees returning to work, as specified in the form's instructions.

Clearing up these misconceptions helps employers in Tennessee comply properly with the New Hire Reporting requirements, ensuring accurate and timely submission of employee data. This not only supports the state's efforts in child support enforcement and job creation but also helps in maintaining accurate employment records.

Key takeaways

When hiring new employees in Tennessee, there are critical steps employers must take regarding the Tennessee New Hire Reporting Program. Here are ten key takeaways that businesses should be aware of when filling out and using the Tennessee New Hire form:

- All employers in Tennessee are obliged to report new hires, rehired employees, or those returning to work, effectively helping in the fight against unemployment insurance fraud and ensuring child support enforcement.

- Employers have a few options for reporting: completing the Tennessee New Hire form, submitting a copy of the employee's IRS W-4 form, using another form that contains the required information, or reporting online, by magnetic tape, or diskette.

- The information must be submitted within 20 calendar days of the employee’s start date. However, submitting the report within 5 days is encouraged to aid the Department of Labor and Workforce Development more efficiently.

- To fill out the form correctly, it's important to print or type neatly in upper-case letters and numbers, using a dark, ball-point pen.

- The required information for the employee includes their social security number, full name, home address (excluding the employer’s address), date of hire, and, if applicable, gender and date of birth.

- The employer must provide their Federal Employer Identification Number (EIN), the name and address of the business, and, if applicable, the store or outlet number, whether medical insurance is offered to employees, and whether the employee has previously left before this report.

- The report will not be processed without all mandatory information being clearly provided, emphasizing the importance of thoroughness and accuracy.

- The Earned Income Tax Credit (EITC) availability question is included but can be left blank if unknown. This information can help employees understand potential tax benefits.

- Reports should be sent to the Tennessee New Hire Reporting Program, with options for delivery via mail or fax, offering flexibility for different business operational styles.

- Ensuring timely and accurate reports not only complies with Tennessee state laws but also supports a larger framework designed to improve child support collection efforts and prevent benefit fraud, underscoring the societal importance of these reports.

The process of reporting new hires in Tennessee is designed to be straightforward, but understanding these key takeaways can help employers ensure they meet their legal obligations and contribute to the wider community and economic well-being.

Popular PDF Forms

Tennessee Ag 0675 - Proof of meeting bonding requirements as per 9 C.F.R. 201 must be enclosed with the application.

How Do I Get a Quitclaim Deed - Allows for the quick conveyance of property rights with limited paperwork.

How to File for Divorce in Tennessee - Explores the options for serving divorce paperwork, including the differences between private service and service by publication.